Emburse is proud to announce the launch of Emburse Cards for Abacus. Emburse Cards allow companies to issue virtual and physical cards to their employees right from within Abacus, giving companies real-time control over expenses from the point of sale through reconciliation.

How Emburse Cards for Abacus Work

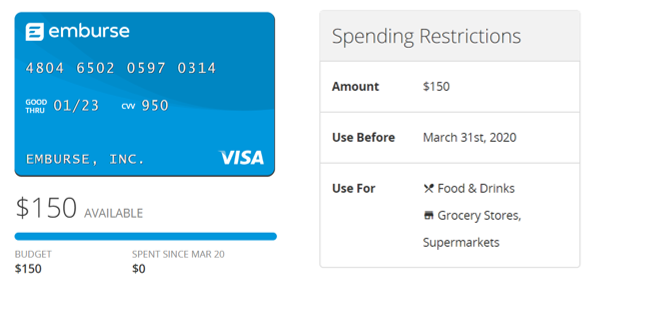

Emburse Cards is a card issuing tool that lives within Abacus. Businesses are able to instantly issue a virtual or physical card to their employees that draws from company funds. Administrators set granular spending rules for where, when and how much an employee can spend, preventing purchases at the point of sale that do not meet the policy.

Employees no longer need to make out-of-pocket purchases and layout their own money to then be reimbursed days or weeks later. In addition, traditionally, companies had to enforce the policy after a purchase was already made. So, if your employee spent $1,000 on a flight when your policy said the limit was $700, the company either needed to swallow the additional $300 or otherwise deny the additional expense.

With Emburse Cards for Abacus, companies can automate expense reconciliation immediately after a card is swiped. A notification is sent to the employee prompting them to add a receipt and submit the expense. By using custom routing and auto-approval rules, the expense is reconciled in real time.

Additional Card Features

Comprehensive Fraud Protection. With real-time fraud detection, administrators of Abacus will get a notification immediately if something doesn’t look right.

Real-Time Insights. Employees’ spend will be visible to administrators as soon as the card is swiped, providing the advantage of real time visibility to adjust budgets and spending rules accordingly.

Access from Mobile Wallet. Employees can add both virtual and physical Emburse Cards to Google or Apple mobile wallets for easy payments.

Direct Accounting Sync. Continuously sync expenses in either cash or accrual method directly into QuickBooks, Intacct, NetSuite, or Xero.

Improved Employee Experience. Give employees flexible options for their expenses with Emburse Cards or fast reimbursements.

Get Cash Back. Receive a percentage of cash back based on eligible transaction volume.

Abacus has always been focused on real-time expense reporting allowing admins to have more control and visibility into their company spend. With the addition of Emburse Cards for Abacus, we are now able to make the expense reporting process even more efficient from the point of sale through reconciliation.

One of the big differentiators for Abacus from day one has been the focus on real-time expense reporting. While other expense management solutions can dramatically cut down the reimbursement time for employees, there was still often a few days’ lag to reconciliation, due to the posting delays in corporate card transactions, multi-tier approvals, and payment cycles. Abacus cuts this down significantly by automating most approval workflows based on the organization’s predetermined expense policy.

Even with this level of automation and speed of reimbursement, there were still areas for improvement for both end-users and the finance team. The travelers still needed to make the purchases out of their own funds and then be reimbursed. Asking an employee to spend $1,000 out of pocket on an international flight can be a burden, and in addition, companies had to enforce the policy AFTER the purchase was made. So, if your employee spent $1,000 on that flight, when your policy said the limit was $700, the organization either needs to swallow the additional $300, or otherwise deny the additional expense. Neither of these is a great solution, nor simple to enforce.

We’ve found a way to eliminate both of these challenges with Emburse Cards for Abacus. Emburse cards are employer-paid cards which have the organization’s expense policy automatically configured, so that policy violations can be prevented at the point of sale, not during the reimbursement process. So the employee never needs to pay for items out of pocket, and the finance team never has to have that awkward conversation about excessive expenses.

Emburse cards can be easily deployed by an Abacus administrator from within the solution, so that employees can receive a virtual card in real time, and a plastic one in a couple of days. Administrators can configure the policy at a granular level based on a number of parameters, such as by vendor, merchant category code, or transaction amount. As Emburse cards can be configured with a pre-set expiration date, they’re also perfect for non-employees such as traveling job candidates.

By incorporating Emburse Cards into Abacus, organizations can also make card reconciliation available to the user in real time with a single workflow. As soon as a transaction occurs, users receive a notification with the transaction details, prompting them to upload a photo of the receipt and complete the additional items relative to the expense based on real-time policy enforcement. Once they hit submit, they never need to return to the transaction again, and it will immediately route for approval and reconciliation. It’s possibly the most employee- and company-friendly expense solution out there.

You can find more information on Emburse Cards for Abacus here. Click here to schedule a demo.