Optimise company spending

Get started with spend optimisation

Spend Optimisation is an integrated approach to corporate spend for achieving frictionless finance. How? Using automation at scale, digital transformation, and data visibility. Expense, invoice, and travel management often operate in silos - limiting insight, risking fraud, and increasing overall costs. Spend Optimisation brings the six key areas of corporate spend together.

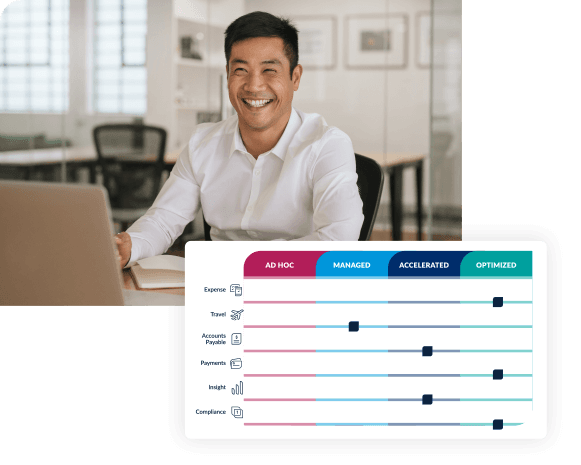

Emburse can help you identify your current optimization stage for each of the six key areas of corporate spend:

- Expense management

- Travel management

- Invoice automation

- Payments

- Insights and analytics

- Compliance and audit

benefits

What are the benefits of spend optimisation?

Spend optimisation creates measurable change throughout your organisation by enabling business leaders to meet their strategic goals.

Better balance spend and budgets to inform investments Reduce overall operating costs Improve spend visibility to make data-backed decisions Unify data sources to distill information easily

Get more done in less time Eliminate errors and late payments Enforce policy automatically while reducing fraud Improve visibility to help with strategic payment decisions

Capture claims and submit invoices while on-the-go Report spending accurately with less effort from a mobile device Introduce virtual/physical corporate cards Get reimbursed faster

Steps

Spend optimisation picks up right where spend management ends.

Where management focuses on processes to keep spend under control, optimisation involves creating a scalable, transparent, and strategic view of an organisation’s spend.

Ad hoc

Laborious manual processes reduce productivity and don’t provide insight into spend data.

Managed

Automation begins to drive down operational costs and reduce chaos.

Accelerated

Spend visibility and control improves as technology is implemented.

Optimised

Digitally-evolved solution stack makes meeting strategic goals easier.

94% of surveyed CFOs say digital transformation is critical to their organisation's future success.

Are you on the path to optimised spend? Find out for free.

Three reasons to schedule your assessment, today

Chat with us for insight into how your organization’s current expense management, travel, AP, and more could evolve to deliver future success.

Together, we’ll identify:

- The current level(s) of your organization’s spend maturity

- Which unique challenges impede organizational success

- What your desired future state looks like—and how to get there

Emburse products

Seamless integration with the Emburse Ecosystem

Expense

- Global expense management

- Fast, fluid, mobile interface

- Business rules engine ensures spend compliance

- Smooth implementations and expert support

- Streamline reconciliation and reduce reimbursement times

- Automatically enforce compliance with built-in policy controls

- Gain company-wide visibility into spend

Tell us what you need and we'll help find the best solution for your business.

contact usPlan your digital transformation

Contact Emburse to schedule your free assessment. Our experts will walk through a series of questions with you to provide your custom output.