- resources

Future-proof your T&E strategy

How to prepare your business for what’s next in travel and expense

We can’t predict the future of the travel and expense (T&E) landscape. We don’t know if the return-to-office push will boost business travel, or if high commercial real estate interest rates will shutter office spaces and force more meetings online. The economy might cool down, and the much-anticipated recession could finally land. Maybe big investments in generative AI-powered travel products will burst like the dot-com bubble. Or maybe not.

We can’t predict the future of T&E, but we can see what’s around the corner. We know the forces driving change today, and we can harness them to prepare for the future, whatever it holds.

We know, for example, that employees are demanding more autonomy and simplicity at every stage of the spending experience. Concerned about rising travel costs, businesses are tapping into innovations like NDC (New Distribution Capability) to access better rates. Finance departments are looking to wrangle employee spending, kerb spend leakage and enable real-time reporting for deeper insights into spend.

We know organisations are worried about their ability to control employee spend from all angles. They’re watching external factors like inflation and rising business travel costs. Thankfully, other areas remain within the realm of their control—like growing employee autonomy in making purchase decisions, increased expense fraud, and cloud costs.

All of these forces point to the same urgent conclusion: organisations need to modernise their T&E function, transforming it from a financial gatekeeper to a business accelerator. Why? Organisations that treat T&E as a strategic asset and implement the right infrastructure, processes, and systems to support it see a notable difference in their bottom line.

Our research reveals a strong correlation between a business’s financial performance and its T&E processes. The more confident a company is in its ability to ensure T&E policy compliance and control travel costs and other types of employee spend, the more likely it is to be ahead of its financial targets.

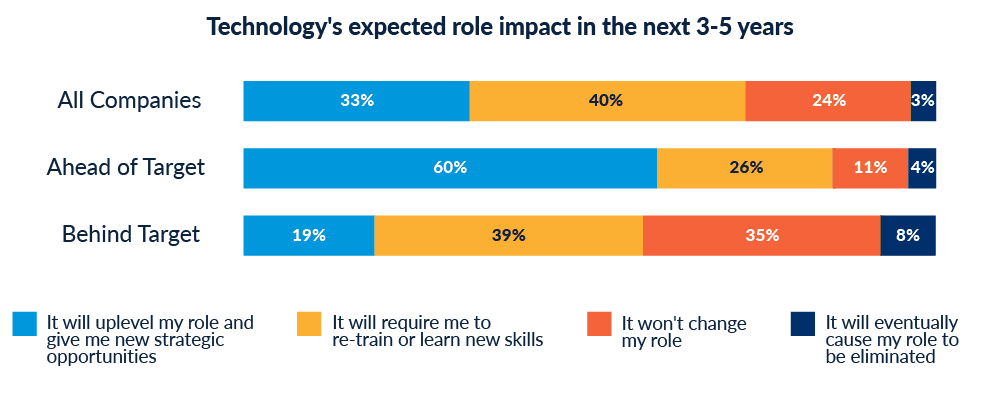

The reported high-performing companies have much greater confidence in their T&E analysis capabilities, bigger plans for T&E investments, and are likely to be working with a T&E vendor that they feel is ahead of the curve. Employees working for such companies feel more optimistic about how technology will uplevel their roles.

Tackle T&E head-on, your financial performance will reflect that. The reverse is also true.

Making T&E a competitive advantage for your organisation involves future-proofing the entire function—systems, policies, and processes—not just adopting the right technology. This report serves as a guide to help prepare your T&E function to meet the demands and pressures of the modern workplace. It captures the most pressing fears, expectations, and plans reshaping today’s business travel and employee spend landscape, supported by survey data and soundbites from industry experts. Concluding with three benchmarks to help T&E managers implement solutions that meet their performance goals, you’ll learn how to future-proof your T&E department so it fully supports the business into the next decade.

Methodology

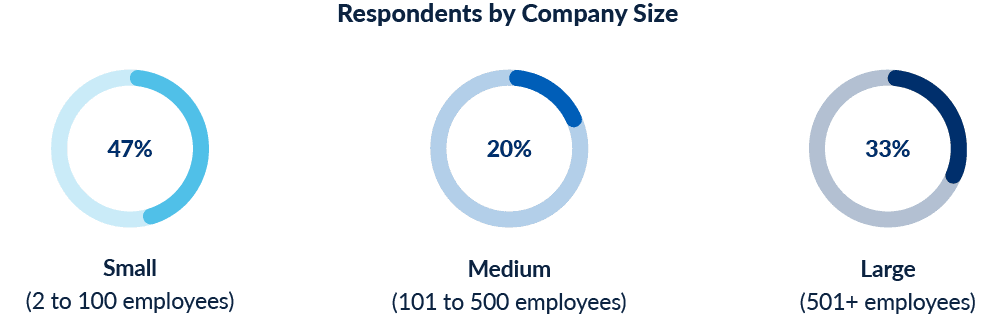

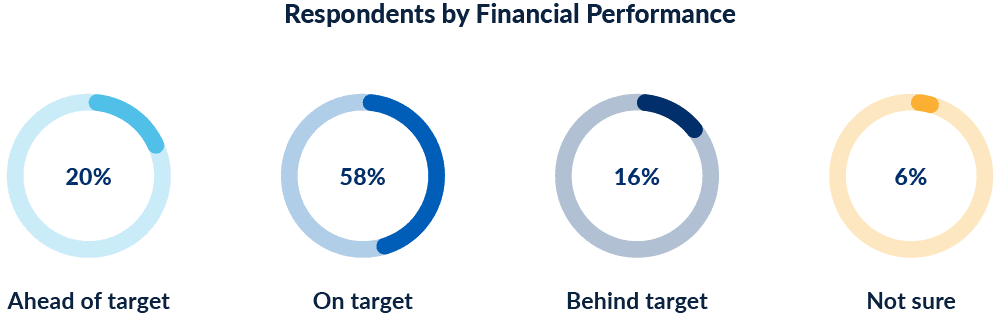

All figures, unless otherwise stated, are from YouGov Plc. The total sample size was 509 adults employed in HR, finance, travel, or operations. Fieldwork was undertaken between the 27th and 29th of June, 2024. The survey was carried out online.

Survey demographics

Financial performance not based on actual metrics. Respondents were asked to describe their workplace's financial performance this year (EOY 2024).

The four forces reshaping T&E

Force 1: The employee easy button

Employee-driven spending is a critical business catalyst, allowing employees to get their jobs done effectively and drive the business forward. But the T&E process is often littered with checkpoints designed to clamp down on employee spending: like limiting access to corporate cards or requiring manual expense entries. Too much friction at these checkpoints hinders productivity and performance.

Employees shouldn’t have to worry about how, where, and what they’re allowed to buy to perform their jobs effectively.

Nowhere is this problem worse than at the enterprise level. At large, established companies, billions of pounds in employee spending flow through clunky, archaic T&E platforms.

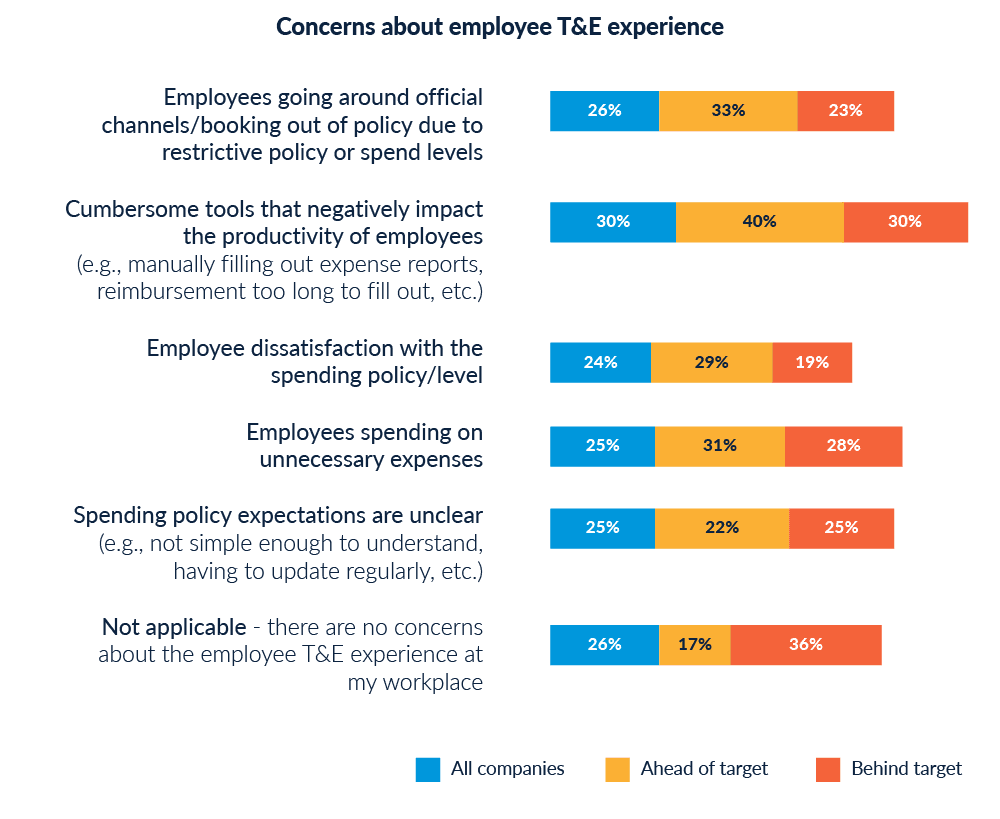

Those in large companies are more likely than those in small companies to be concerned about cumbersome tools negatively impacting employee productivity (37% vs 25%) and employees spending on unnecessary expenses (34% vs 23%). Large companies seem to be aware of issues with their T&E processes. Compared to small companies, they’re far less likely to say that there are “no concerns about the employee T&E experience at my workplace” (20% vs 35%).

Removing this friction doesn’t have to mean easing control of employee spending. Instead of limiting expenses at all costs, high-performing companies are learning to trust tools to enable employee spending while keeping it within budget.

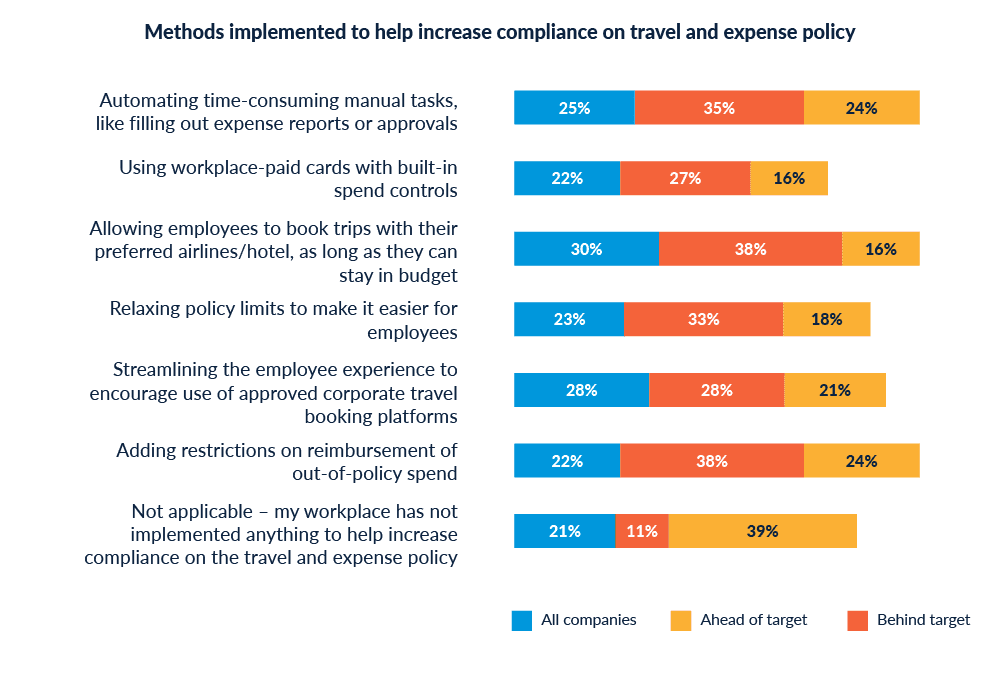

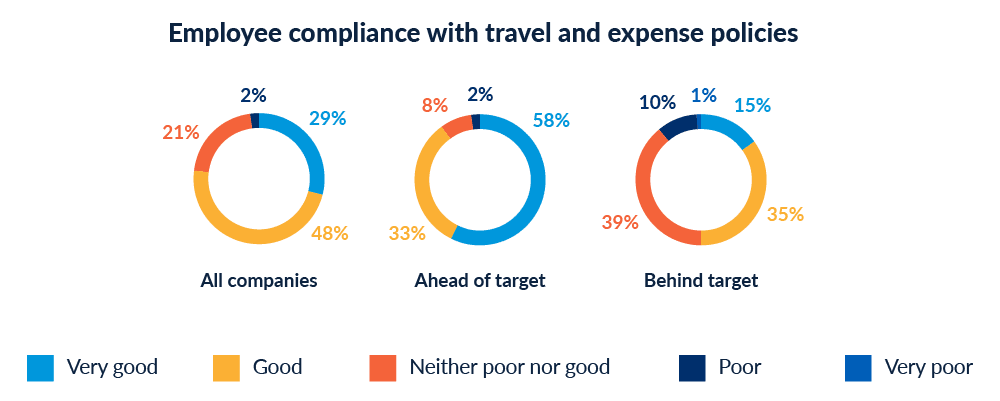

89% of respondents working for companies that are reportedly ahead of their financial targets have implemented measures to help increase compliance with T&E policies. Many of these measures may be working to usher more employee spending within policy by simplifying and enhancing the user experience. This includes automating time-consuming manual tasks, like filling out expense reports or approvals (35% of ahead-of-target companies do this compared to 24% of behind-target ones), using workplace-paid cards with built-in spend controls (27% vs. 16%), and relaxing policy limits to make [compliance] easier for employees (33% vs. 18%).

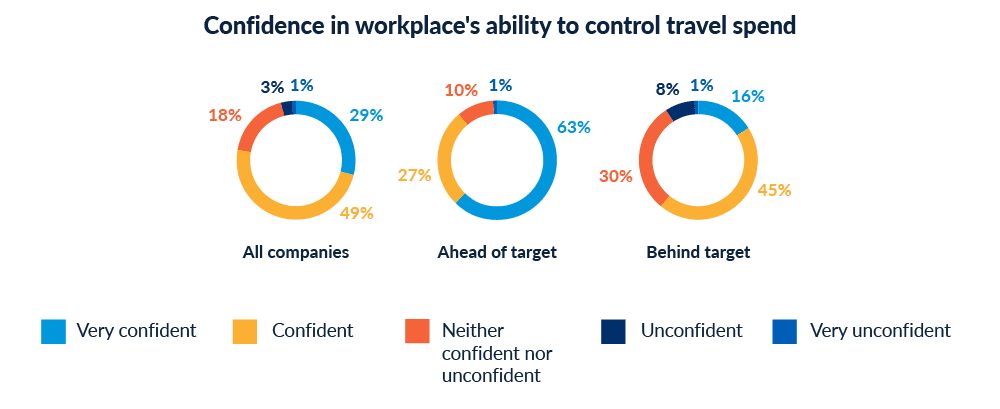

These actions pay off. 58% of ahead-of-target companies characterised employee compliance with T&E policies at their workplaces as “very good.” Only 15% of behind-target companies gave the same response. Similarly, 63% of ahead-of-target companies said they were “very confident” in their workplace’s ability to control travel spend, compared to 16% of behind-target companies.

When companies invest in creating frictionless T&E experiences, they reap the benefits in compliance. Spending should be as simple and straightforward as hitting an “easy” button.

By using AI to reduce the effort and shorten the time required to capture, process, analyse and summarise expenses, executives and managers can have greater control while reducing administrative burdens placed on workers.

Advice from an expert

Rob Kugel

Executive Director, Business Research

ISG

Force 2: Best deal certainty

The pressure’s on to secure the best deals in corporate travel, and it’s getting intense. Traditionally, companies have saved money by enforcing the use of assigned booking tools sourcing content from their suppliers. However, what employees consider to be the "best deals" often diverge from the cheapest contracted rates. For employees, the best deal might mean a flight with their preferred airline, or departing at 10 a.m. instead of 6 a.m. Just as we expect the best prices in our consumer lives and know how to shop for them, employees expect the same convenience in their professional lives. Forcing employees to use managed travel platforms with confusing or overly restrictive interfaces can lead many of them to circumvent the company’s T&E policy.

25% of Americans who work in travel, finance, HR or operations said “Growing employee autonomy in purchase decisions” was a top factor negatively impacting their ability to control employee spending over the next year. And when asked for their concerns about the employee T&E experience at their workplace, 26% selected “Employees going around official channels/booking out of policy due to restrictive policy or spend levels.”

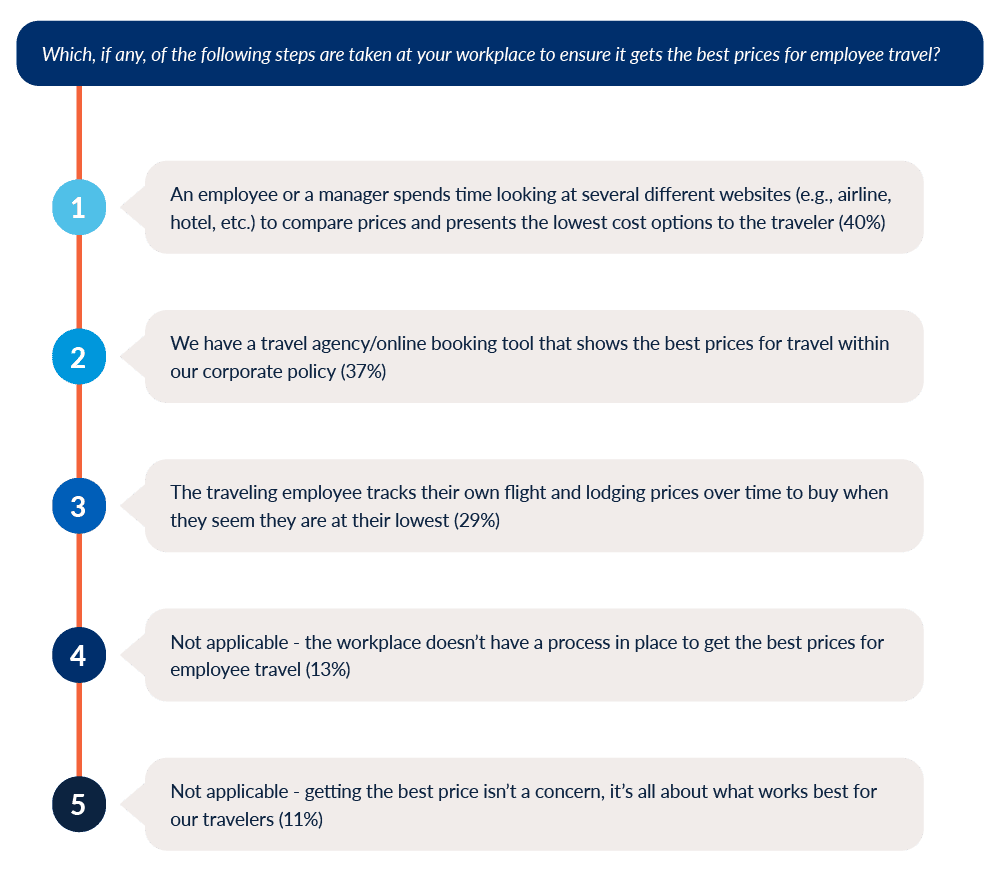

So, what steps do companies take to ensure they’re getting the best deals on employee travel? The majority of companies ask employees or managers to manually compare prices from different airline and hotel websites and present the lowest cost option to the traveller.

Travelers who engage in comparison shopping may find lower fares directly with airlines outside of their online booking tool and travel management company and question why they cannot book directly, believing they are saving the company money. If certain inventory or lower fares are restricted from EDIFACT (Electronic Data Interchange for Administration, Commerce, and Transport), the price difference can be significant, particularly for specific hubs. However, these travelers often lack awareness of contracted rates and the obligations tied to them. They may not realize that booking outside approved channels means the agency cannot assist them, and it also results in the loss of critical booking data, which compromises the integrity of T&E analytics. This well-intentioned cost-saving can ultimately increase expenses, impact policy decisions, and complicate budget control.

In cases where policies are extremely strict (e.g. entire carriers are blacklisted during shopping), travelers may assume their booking tool simply isn’t working and take matters into their own hands. Instead of hiding certain carriers entirely, travel managers should flag them as prohibited so the traveler understands. This transparency promotes more trust in the platform and thus, better adoption.

Curtis Socha

VP, Product Development, Travel Division

Emburse

Which, if any, of the following steps are taken at your workplace to ensure it gets the best prices for employee travel?

Consistently getting the best prices on business travel requires precise tools, not blunt forces. By adopting more intuitive booking systems and granting employees more autonomy, companies can access the best prices without wasting time shopping around or forcing employees to use outdated, restrictive booking platforms. In an era where every dollar counts, companies need to rely more heavily on sophisticated T&E technologies, rather than rigid policies, to secure the best deals for air and hotels and improve budget predictability.

Businesses have more dynamic pricing tools at their disposal than ever before. With innovations like NDC, they get access to real-time, optimised airline pricing. Hotel and airfare rebooking tools can automatically hook them up with the best rates. Automated auditing can check reservations against policy, supplier contracts, and market rates. Companies need to take advantage of these tools to secure the best deals—according to employee’s standards and their own. If they don’t, they’ll have to watch their competitors attend more conferences, hold more company all-hands, and meet with more prospects in person, all while they’re still figuring out how to afford it.

Travel managers' perception of policy is disconnected from reality. OBTs (online booking tools) are typically configured to warn travellers, not stop them from booking non-compliant air and hotel. The more a company tightens the options down, the more travellers simply book direct to get the options they want. I’m not saying there’s no use for T&E policies, but they can be creatively applied, like auditing bookings pre-trip and using consolidated travel, expense and card data to detect fraud in expense reports.

Steve Reynolds

Chief Strategy Officer

Emburse

Force 3: Quiet recentralisation

The explosion of remote and hybrid work has driven up the volume of employee T&E spend, but it’s also created a new category of decentralised expenses that fall outside finance’s control. Decentralised expenses include items like software subscriptions, training courses, and office equipment that employees can purchase directly from vendors.

According to respondents, the top factors negatively impacting their ability to control employee spending over the next year were external: inflation and rising prices (49%) and increased volume/cost of business travel (32%). But other factors were cultural and within an organisation's control. These include:

- Growing employee autonomy in purchase decisions (25%)

- Increasing reliance on the cloud (software subscriptions and hosting costs) (23%)

- Rise in expense fraud and non-compliance (23%)

- Increased employee spending related to remote work and return-to-office (22%)

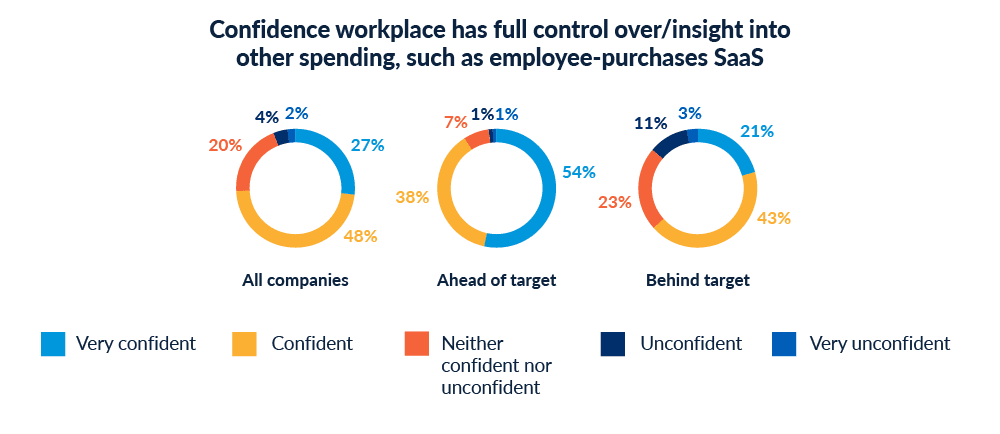

Confidence around controlling cloud spend varies significantly between those at companies performing ahead of their financial targets for the year and those falling behind. Compared to 21% of behind-target companies, 54% of ahead-of-target companies were “very confident” that their workplace has full control over/insight into other spending purchased by employees, such as subscriptions and SaaS.

Enabling employees to buy subscription services from vendors directly helps them work unencumbered by approval requests so projects flow smoothly. But finance departments struggle to track these decentralized expenses, categorize them correctly, and reconcile them with the appropriate budget allocations.

In the shift to quiet recentralisation, employees can still initiate and manage mission-critical purchases, but automation will channel this spending through a centralized control point. For example, companies can equip employees with virtual cards that automatically implement spend controls. When issuing virtual cards, managers set usage limits to prevent out-of-policy expenses and overspending at the point of purchase or point of request. Virtual card purchases are automatically recorded into ERP systems—effectively recentralising spend without any added effort from the finance team at month-end close. With automation, we'll see finance gain more control of decentralized spend and real-time visibility, while employees won’t necessarily notice a difference.

Everything is disparate right now. You get data from various solutions, but how do you harness it? Bringing all that data into a data warehouse with reporting tools allows us to harness the astounding amount of data from T&E platforms. Imagine pressing a button and everything’s connected, showing you where you're overspending and suggesting better options.

Adriana Carpenter

CFO

Emburse

Force 4: Real-time finance

Finance teams have always been under pressure to meet reporting deadlines and close the books as soon as possible. As automation promises to speed up the process, shorter cycles will become inevitable. What’s more, the level of detail expected is becoming greater. Over the next few years, companies will feel growing pressure to accurately and properly report expenses with more granularity. And not just because leadership demands it. In June 2024, the Financial Accounting Standards Board voted to require U.S. public companies to disclose their distributing, marketing, and selling expenses on a quarterly basis.

Finance departments will increasingly turn to automation to eliminate the classic expense backlog that slows closing. By adding transactions at the point of sale, companies will transition from traditional reporting periods to real-time systems. Real-time, AI-powered data collection will allow finance teams to instantly tie expenses to specific projects and perform detailed profitability analyses in a timely manner.

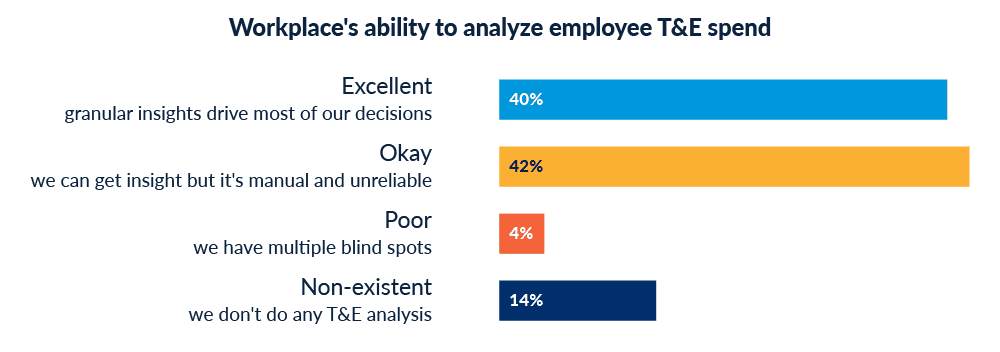

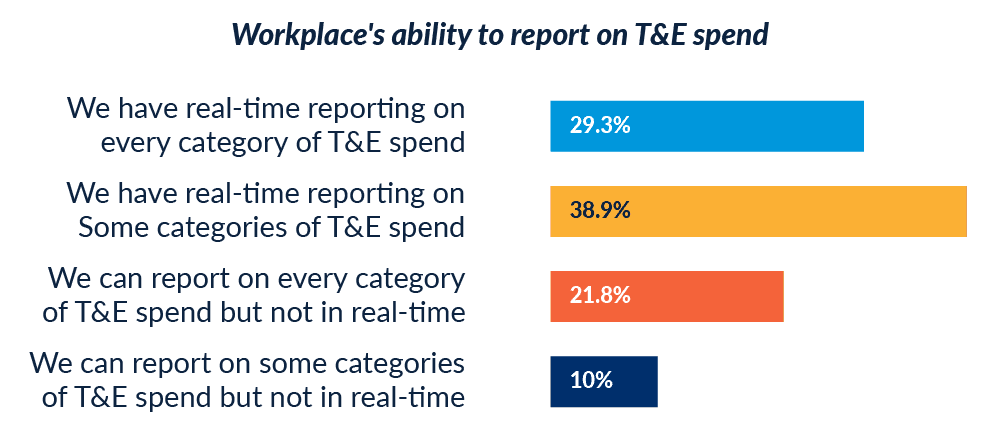

The survey data suggests that most organisations are not prepared for this shift to real-time and will therefore miss out on the competitive advantage to be gained from such granular and timely insights. Currently, 42% describe their workplace’s ability to analyze employee T&E spend as “okay,” in that they can get insights but it’s manual and unreliable, and 4% say it’s “poor”, having multiple blind spots. Almost 4 in 10 (39%) have real-time reporting on “some” but not all categories of T&E spend.

We’re moving away from fixed schedules like quarterly earnings and monthly closes because everything can be done faster. With decentralised, employee-initiated spending combined with immediate visibility, finance teams can almost close daily. The spend is already tagged and processed the minute it’s requested, making transaction recording and reporting nearly instantaneous. However, this requires consistent data entry points. Without consistent data, daily closing is impossible.

Adriana Carpenter

CFO

Emburse

Framework for the future of T&E

You recognize that strategic T&E can be an asset for your organisation. You’re ready to scale your operation to meet the demands of modern business. Now you have to prepare your T&E function to maintain control in the face of rising costs while balancing employee expectations for convenience and increased autonomy.

Use the three benchmarks below to evaluate your organisational readiness and determine where you might need to integrate new capabilities. You’ll be able to see how your current T&E vendors, future investments, and talent approach stack up against the average survey respondent, as well as respondents working for high- and low-performing companies.

T&E vendor readiness

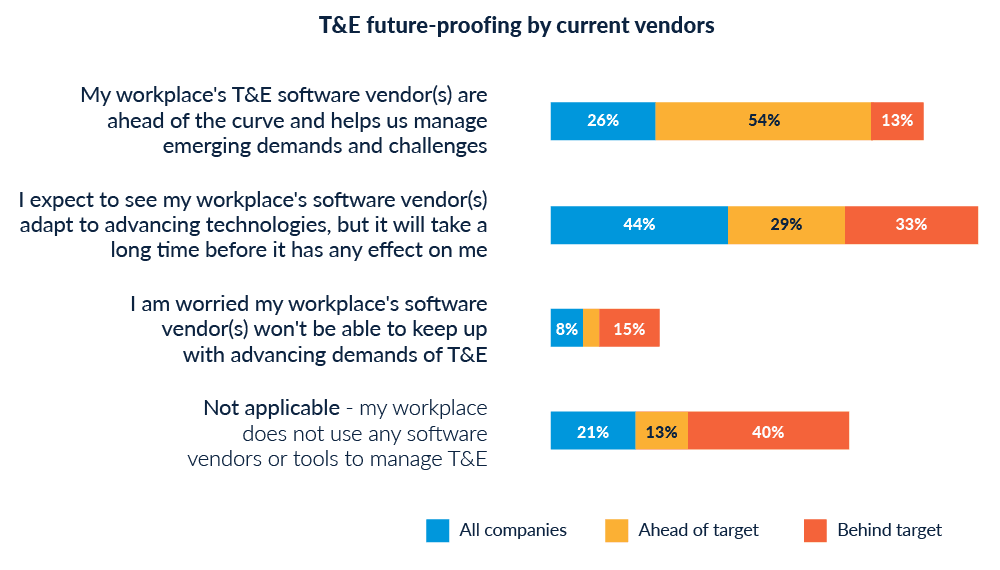

Those at ahead-of-target companies are much more likely than those at companies behind target to be working with a T&E software vendor that they feel is "ahead of the curve” for helping them manage emerging demands and challenges compared to behind-target companies (54% vs. 13%).

With compliance and control top of mind for every company today, it’s worth re-noting that ahead-of-target companies are more likely to have implemented measures to increase T&E compliance (89% vs 61%) and rated employee policy compliance as “very good” (58% vs 15%). As you assess the capabilities of your current and future T&E vendors, remember that employee convenience can drive compliance and operational efficiency. Look to adopt employee-centric tools that enhance user experiences and simplify compliance on their behalf.

If an employee needs to go buy something, they should be able to go to one app and be directed to make the purchase correctly, whether they’re buying software or booking travel. As a CFO, I want you to be compliant, and as an employee, you want to be compliant. Technology can govern that compliance across the board.

Adriana Carpenter

CFO

Emburse

Planned investments

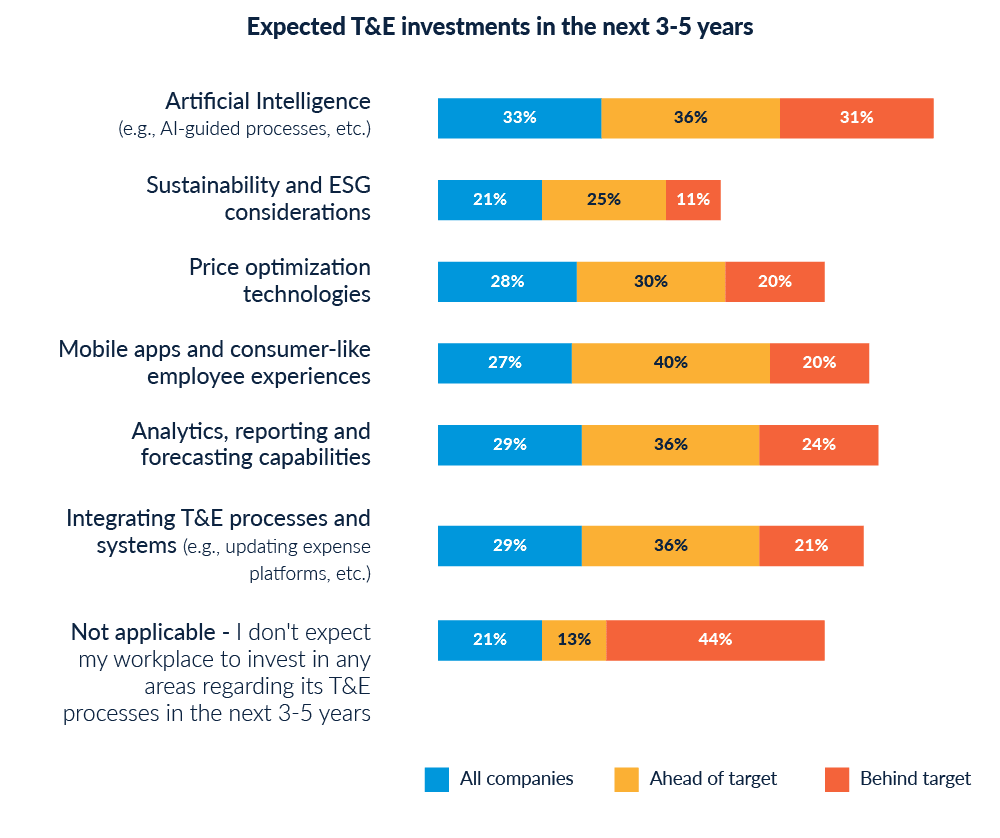

While these numbers reflect the sprint towards AI (33%), respondents also expect their companies to invest in: integrating T&E processes and systems (29%); analytics, reporting and forecasting capabilities (29%), price optimisation technology (28%), and mobile apps and consumer-like employee experiences (27%) in the next 3-5 years.

The breadth of investments serves as a reminder to avoid the pressure to adopt AI for AI’s sake. Figure out your business goals first, and make sure you’re implementing the right solutions (AI or otherwise) to meet that goal.

The quickest impact a company can see from AI is applying it to improve receipt scanning and accuracy. The next is fraud detection, improving the automated approval of an expense report beyond the rules engine in place today. The last realistic AI application coming down the pipeline today might be the application of a Large Language Model (LLM) to entire travel and expense datasets to establish benchmarks for comparing against a client’s travel spend. Example: compare my average airfare by market to the average for all other companies of a similar size and vertical.

Steve Reynolds

Chief Strategy Officer

Emburse

Talent approach

As businesses future-proof their T&E functions, individuals working for these companies also have the opportunity to future-proof their own roles. Automating expense management and recentralising all spend data into a single platform will enable real-time reporting and strategic decision-making—setting up travel managers and finance leaders to focus more on business outcomes.

Finance is no longer about how well you can run Excel. You have to understand business functions, how the functions should work together, and what each function’s financial outcome should be. For instance, evaluating whether spending $1 million on 20 engineers will generate a $10 million return, or if $750k elsewhere could yield higher returns. Finance professionals need to understand the ‘why’ and ‘what’ of financial outcomes and measure them consistently to make informed investment decisions.

Adriana Carpenter

CFO

Emburse

Conclusion

This report offers a roadmap for future-proofing your T&E operations, providing actionable benchmarks and expert insights to help you meet the evolving demands of business travel and employee spending. Our survey reveals that high-performing companies are using automation to simplify expenses and ensure compliance. Automation also allows finance teams to regain much-needed control over decentralised spend without compromising employee autonomy. By adopting dynamic pricing standards like NDC, companies can secure the best travel rates, and by investing in frictionless T&E experiences, they improve policy compliance. These are the forces reshaping T&E—but only you can shift it into a growth engine.