- products

- emburse cards

Why Emburse Cards?

Why Emburse Cards?

The convenience you need with the control you require.

Features

Customized features for every business

Emburse Cards have all the features you want in an expense management solution. They're easy to set up, customize, and provide full control over your business and employee expenses.

Role-based permissions

With restricted and admin level views, you have the ability to set roles for your employees

Granular spending rules

Automate rules for where, when and how much an employee can spend.

Preapprovals

Allow employees to instantly request funds on the go.

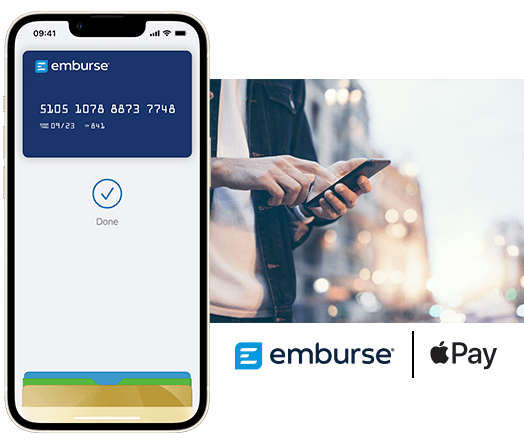

Pay in a safe, fast way using Emburse Cards with Apple Pay.

Enjoy all the benefits of Emburse Cards using Apple Pay. It’s the easy, secure and, private way to pay.

Features that make a difference

Rapid registration and approval

Register for an Emburse account in minutes. Receive approval notification and start issuing cards within one business day.

Virtual and physical cards

Emburse gives you the ability to issue an unlimited amount of physical and virtual credit cards.

Accounting integrations

Connect card data through other Emburse solutions, as well as your favorite ERP.

Mobile receipt capture

Instantly receive prompts to upload receipts seconds after a purchase is made.

Single sign-on (Okta)

Easily add, track, and remove members from your Emburse account through our Okta SSO integration.

Preapprovals

Employee running low on their limit? They can request additional funds that go instantly to the manager for approval.

Expense categorizations

Emburse helps automatically categorize recurring transactions and can detect the type of merchant.

Enforce expense policies

Set restrictions such as date, place, merchant, and budgets to control spending.

Fraud protection

Our fraud detection engine automatically identifies and blocks unauthorized purchases.

Overdue task enforcement

For tasks that aren’t completed, restrict or disable spending until the task is done.

Global acceptance

Add security and fraud protection to each transaction by verifying the purchaser including support for 3DS by Mastercard.

Take control of business expenses

The more visibility companies have into their expenditures, the easier it is to curb fraud and abuse.

Emburse lets you limit not only how much employees can spend, but when and where purchases can be made. Which provides greater oversight and control to your daily processing.

Get started with Emburse Cards

If Emburse Cards sound like the right solution for your company, schedule a demo.

Cards are issued by Celtic Bank, a Utah-Chartered Industrial Bank (Member FDIC) Recognized by