- solutions

What is AI audit?

AI Audit FAQ

What is AI audit?

All of your pressing questions answered to help you get the most out of audit technology.

FAQs

AI audit frequently asked questions

Machine learning will have a significant impact on the financial industry by improving data analysis, risk management, fraud detection, and decision-making. It enables financial institutions to process and analyze large volumes of data quickly, identify patterns, and make more accurate predictions. Machine learning algorithms can also enhance investment strategies, customer service, and regulatory compliance.

AI is revolutionizing accounting by automating repetitive tasks, increasing efficiency, and improving accuracy. AI systems can automate data entry, reconcile accounts, and generate financial reports, saving time and reducing human errors. Moreover, AI-powered software can analyze financial data in real-time, detect anomalies, and provide valuable insights for decision-making and financial planning.

AI in finance and accounting typically involves machine learning algorithms that learn from large sets of financial data. These algorithms can process unstructured data, such as invoices or receipts, extract relevant information, and make it usable for financial analysis. AI systems can also perform complex calculations, identify trends, and generate predictions based on historical data.

The advantages of AI in accounting include improved accuracy, increased efficiency, cost savings, enhanced data analysis, and better decision-making. AI can automate manual tasks, reducing the risk of human error and allowing accountants to focus on higher-value activities. It can also process and analyze large volumes of data quickly, providing real-time insights for strategic planning and financial forecasting.

Artificial intelligence is changing accounting by automating repetitive tasks, improving data accuracy, and transforming the role of accountants. AI can perform tasks such as data entry, reconciliation, and report generation more quickly and accurately than humans. This frees up accountants' time to focus on data analysis, interpretation, and providing strategic guidance to businesses.

Artificial intelligence is unlikely to replace auditors completely. While AI can automate certain aspects of auditing, such as data analysis and anomaly detection, auditors play a crucial role in applying professional judgment, assessing risks, and providing assurance. AI can enhance auditors' capabilities by improving efficiency and accuracy, but the human element of auditing, such as critical thinking and ethical considerations, remains essential.

Auditing is being transformed by automation, but it is unlikely to become fully automated. AI can automate routine and rule-based tasks in auditing, such as data processing and analysis. However, auditors will still be required to exercise professional judgment, evaluate complex situations, and provide subjective assessments. Automation allows auditors to focus on higher-level tasks and devote more time to areas that require human expertise and interpretation.

Customer success

What our customers love about us

“Working with Emburse feels like a true partnership where they really listen to our needs and care about our success and happiness, which is something we didn’t have with Concur.

”

Dawn Conway

Senior Business Analyst at BELFOR

“Emburse solutions humanize work by providing products and services that make it easier for people to do their jobs.

”

Craig Lundskog

at Great Basin Industrial

“Any company that is expecting growth needs to automate AP processes. Emburse will save you the cost of hiring additional AP staff and also give you time back for more innovative work to help your company grow.

”

Dan Sangeorge

at ALKU

“We now have happier users, and the streamlining of processes and workflows, combined with the improved spend visibility has delivered huge benefits for the firm worldwide.

”

Neil Ackley

at Latham & Watkins LLP

“Modern solutions like Emburse help support our mission and enable us to deliver educational programs to the world's most vulnerable communities.

”

Shari Freedman

at Room to Read

“Emburse is intuitive to use and easily integrates with our other finance systems and credit cards. The result is a 100% paperless expense reimbursement process.

”

Michael Sullivan

at PX Technology

About Emburse

Our growing technology ecosystem

Emburse can help you get the most out of audit technology.

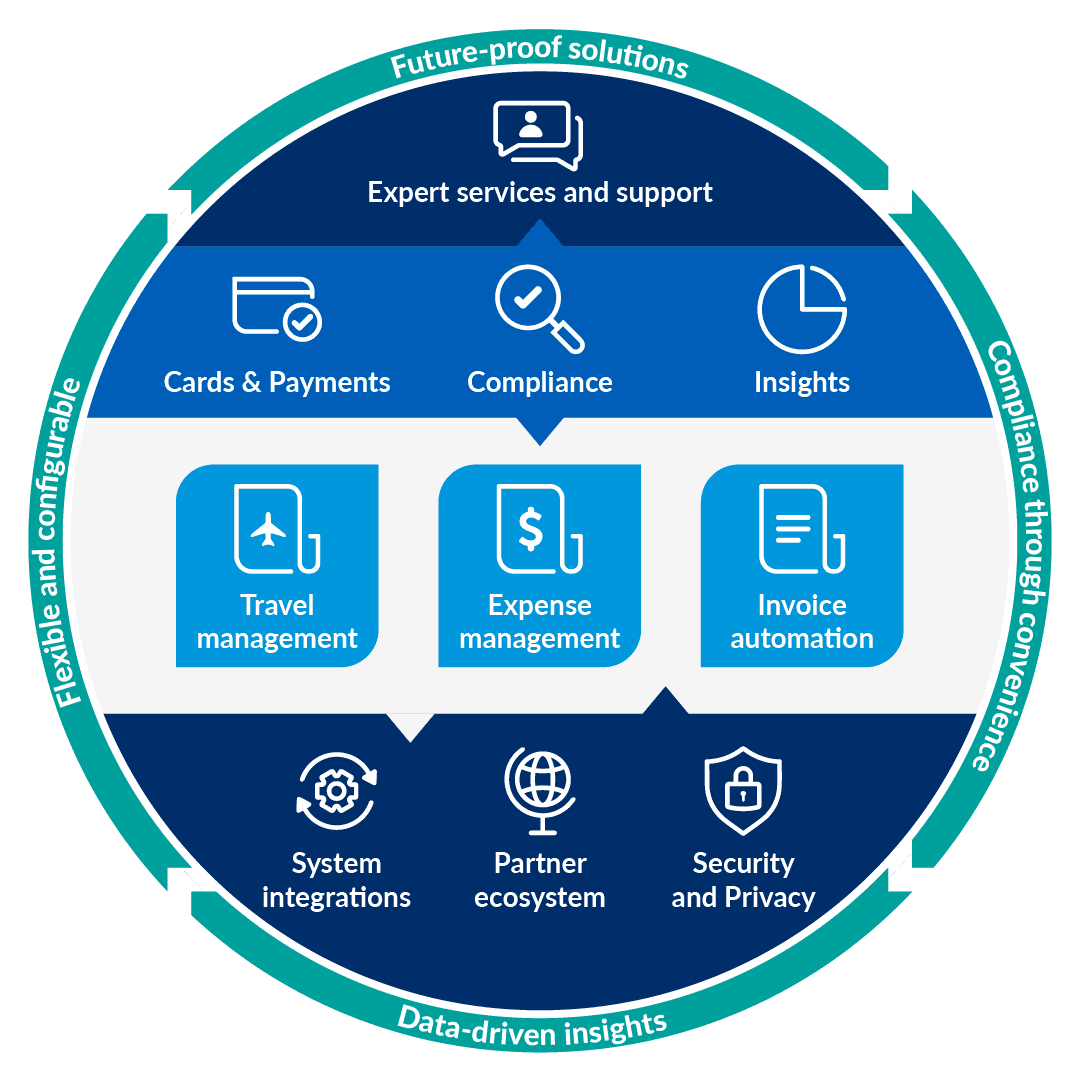

Emburse is the global leader in helping organizations simplify spend management. Our expense travel and expense management, purchasing, accounts payable, and payments solutions are trusted by over 12 million business professionals, including CFOs, finance teams, and travelers.

Ready to take your audit technology to the next step?

With Emburse, you can efficiently simplify your financial audit, reduce administrative tasks, and make informed financial decisions to drive business growth.