- solutions

- advanced analytics

Data Dive: How 2021 Priorities Can Be Guided By Leakage Data

Data Dive: How 2021 Priorities Can Be Guided By Leakage Data

As the new year approaches, many companies face a policy dilemma: Should travel programs be mandated to eliminate out-of-program bookings in the name of safety and duty of care, or should organizations provide individuals even greater choice of where and how they book to accommodate for heightened travel anxiety?

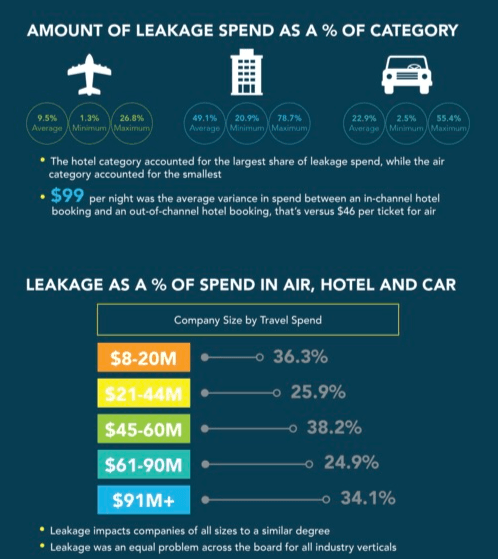

Examining amount of leakage spend as a % of category

31%

average leakage accounted for spend across air, hotel and car

49.1%

average leakage spend for hotel category, accounting for the greatest share of leakage spend

9.5%

average leakage spend for air category

26.8%

category high leakage spend for air category

58%

variance in nightly purchase between in-channel and out-of-channel hotel bookings

8%

variance in purchase for air

Want to access your history of leakage?

If you’re looking to get more visibility into your company’s historical program leakage or you’d like data-driven guidance on how to keep track of travelers and structure your travel policy in 2021, contact us today.

Get started with Emburse Analytics Pro Travel

Welcome to Emburse Analytics Pro Travel, where we turn our focus to a particular trend or industry development to let the data tell the story.