- solutions

Spend management guide

SPEND MANAGEMENT EXPLAINED

Spend management guide

Effective spend management involves strategically utilizing the right technology, automation, and data analysis to optimize financial stability and efficiency. Continue reading our comprehensive guide to discover the answers to your key questions and maximize your organization's spend management strategy.

Definition

What is spend management?

Spend management is the practice of monitoring, regulating, and enhancing an organization's spending behavior to drive cost savings, increase financial and operational efficiency, and acquire crucial spend data into expenditures. The spend management process involves managing and monitoring expenses across various categories, such as procurement, travel and entertainment, employee expenses and reimbursements, and other operational costs.

What are the key elements of spend management?

- Budgeting and planning

- Procurement and sourcing

- Vendor management

- Invoice, expense processing, and expense tracking

- Policy and compliance

- Reporting and analytics

Your spend management questions, answered.

How can you opt for the best corporate credit card?

To choose the best corporate credit card for your organization, consider the following factors:

Features and benefits:

Evaluate the card's rewards program, travel perks, expense management tools, and integration capabilities with financial software.

Credit limit and spending flexibility:

Determine the credit limit and whether it aligns with company spending needs. Also, consider if the card allows for individual spending limits for employee expenses.

Fees and interest rates:

Compare the annual fees, transaction fees, foreign exchange fees, and interest rates associated with the card.

Reporting and analytics:

Look for cards that offer detailed expense reports, real-time transaction tracking, and customizable spending controls.

Card acceptance:

Consider the card's global acceptance, supplier relationships, and merchant network to ensure your employees can use it for business expenses.

Customer support:

Assess the quality and availability of customer service and support the credit card issuer provides.

Integrations:

Check if the card can be easily integrated with your existing expense management software for streamlined processes.

What are business credit cards?

Business credit cards serve as invaluable financial tools for both business owners and employees, facilitating intelligent spend management within organizations. They provide a line of credit that allows businesses to make purchases and offer a management solution for expenses. They often include features tailored to business needs, such as rewards programs, expense tracking tools, employee spending controls, and customized reporting options. These card programs aid in the separation of personal and business expenses, promoting clarity and organizational efficiency in spend management.

What are the benefits of having a business credit card?

Having a business credit card offers several benefits, including:

Improved expense management:

Business credit cards provide a centralized management system to track and manage business expenses, simplifying record-keeping and reducing the administrative burden of unmanaged spend.

Enhanced financial visibility:

Detailed monthly statements and expense reports from corporate credit cards offer visibility into spending patterns, with access to spending data helping businesses analyze and optimize their spend management strategy.

Separation of personal and business expenses:

A dedicated business credit card helps organizations master data management by separating personal and business transactions, which simplifies accounting and tax reporting.

Reduction of reimbursement burden:

Allowing employees access to the organization’s funds reduces the need for employees to use their personal funds for expenses while enduring 30+ days for reimbursements.

Access to credit and working capital:

Business credit cards provide a revolving line of credit, offering businesses a convenient and flexible way to access funds for everyday purchases or unexpected expenses.

Rewards and perks:

Many business credit cards offer rewards programs tailored to business needs, such as cashback on business expenses, travel rewards, or discounts with partner merchants.

Employee spending control:

Business credit cards often allow business owners to set spending limits for individual employees, providing control and oversight over company spending.

Building business credit history:

Proper use of a business credit card can help establish and improve the business's credit profile, potentially leading to better financing opportunities in the future.

Can business credit cards be used for personal use?

Using business credit cards for business-related expenses is recommended to maintain proper separation between personal and business finances. Mixing personal and business expenses on a business credit card can complicate spend visibility for accounting, tax reporting, and expense tracking. Obtaining a personal credit card for personal expenses is advisable to ensure clear delineation between personal and business transactions.

What is spend management software?

Spend management software is a management tool that automates and streamlines the processes of managing an organization’s expenses. Spend management software typically offers features such as expense tracking, invoice management, budgeting, reporting, and analytics. Business spend management software empowers organizations to gain insights into their spending patterns, streamline expense processes, enforce spending policies, and leverage spend data for informed decision-making. Ultimately, optimizing spend management not only can improve cash flow and financial efficiency but can uncover a valuable savings opportunity.

EMBURSE SPEND MANAGEMENT

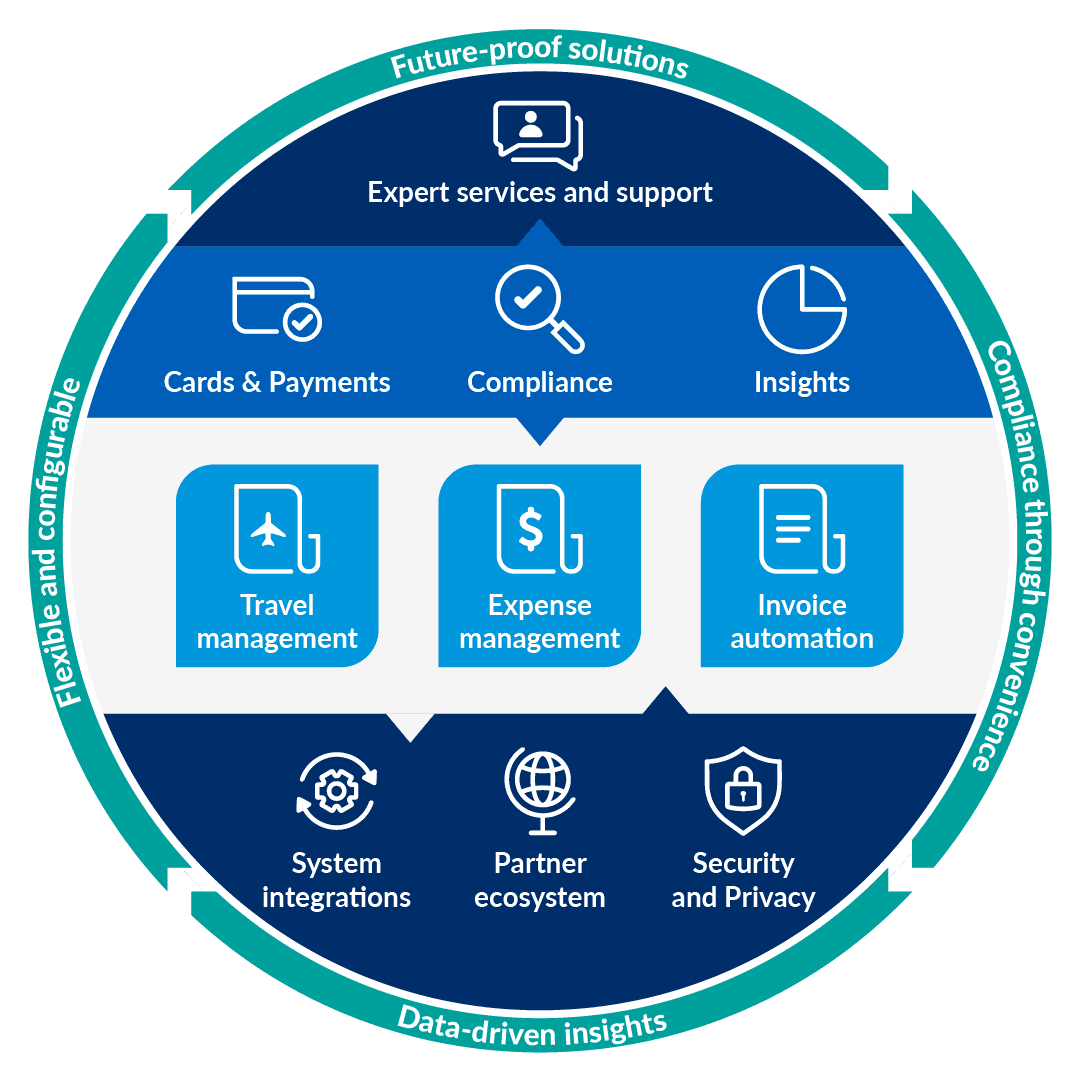

Our growing technology ecosystem

Emburse is the global leader in helping organizations simplify spend management. Our expense travel and expense management, purchasing, accounts payable, and payments solutions are trusted by over 12 million business professionals, including CFOs, finance teams, and travelers.

Emburse offers a full suite of world-class spend management solutions that can be tailored to your organization’s unique needs. Whether you’re a Fortune 100 enterprise organization or a growing company, Emburse has what you need.

Ready to take your spend management to the next step?

With Emburse, you can efficiently simplify your spend management, reduce administrative tasks, and make informed financial decisions to drive business growth.