Travel and expense management

Travel and expense management, simplified.

Discover expert insights into all of your questions about travel and expense management. Learn about the latest strategies to optimize and improve your bottom line, while ensuring financial success.

Definition

What is travel and expense management?

Travel and expense management refers to the process of handling and controlling business-related travel expenses incurred by employees. It involves managing various aspects of travel booking, such as booking flights, hotels, rental cars, and managing employee travel expenses related to meals, transportation, lodging, and other costs.

Travel and expense management aims to streamline the reimbursement process, ensure compliance with company policies and government regulations, reduce operational costs, and provide financial visibility and control over travel-related expenditures.

Emburse Travel Management FAQs

Frequently asked questions

The best travel expense management software can vary based on specific business needs and requirements.

When choosing the best travel expense management software, consider factors such as ease of use, scalability, integration capabilities, mobile accessibility, travel policy enforcement, reporting capabilities, and customer support.

Keeping track of every business expense can be made easier through various methods, including:

- Using the right expense management system: Implementing travel and expense management software can automate expense tracking, receipt scanning, expense data and categorization, and allocations. Maintaining a digital record: Keep digital copies of expense receipts, invoices, and expense-related documents using receipt scanner apps or document management systems.

- Using mileage trackers: Use mileage tracker apps to record and calculate mileage for corporate travel accurately.

- Implementing an expense policy: Establish clear expense policies that outline what business travel expense is reimbursable, the submission process, and if there is a spending limit.

- Regularly reconciling expenses: Review and reconcile expenses regularly to ensure accuracy and identify any discrepancies or potential areas for improvement.

- Organizing expense documentation: Maintain an organized system for storing and categorizing documents by expense category for easy retrieval and auditing.

For small business expense tracking, consider the following practices:

- Use expense management software: Implement an expense report management system that allows employees to record and submit expenses digitally, ensuring accuracy and efficiency in employee spending.

- Set up expense categories: Define expense categories relevant to your business and provide guidelines on how expenses should be allocated to each category.

- Require digital receipts: Encourage employees to collect and submit digital expense receipts for all business-related expenses.

- Regularly reconcile expenses: Conduct regular expense reconciliations to ensure that all expenses are properly recorded and accounted for.

- Implement spending limits: Set a spending limit to control expenses and prevent expense fraud or overspending.

- Educate employees: Provide training or guidelines to employees on the travel process, policy compliance, and the importance of accurate and timely reporting.

- Review and analyze expenses: Regularly review and analyze expense reports to identify cost-saving opportunities, ensure compliance, and make informed financial decisions for the business.

Expense reports are essential for several reasons:

- Financial visibility: Expense reports provide a comprehensive overview of business expenses, allowing businesses to analyze spending patterns, identify cost-saving opportunities, and make informed financial decisions.

- Policy compliance: Expense reports help ensure employees comply with company expense policies and guidelines, reducing the risk of unauthorized or non-compliant expenses.

- Audit and accountability: Expense reports serve as a record of expenses incurred, providing a trail of documentation for audits, tax purposes, and financial reporting.

- Reimbursement process: Expense reports facilitate reimbursement, ensuring that employees are appropriately reimbursed for eligible business expenses.

- Budgeting and forecasting: Expense reports provide valuable data for budgeting and forecasting purposes, helping businesses plan and allocate resources effectively.

To create an expense report easily, follow these steps:

- Collect and organize receipts: Gather all receipts and documentation related to your business expenses, ensuring you have digital or physical copies of each receipt.

- Categorize expenses: Group your expenses into appropriate categories, such as travel, meals, lodging, transportation, or specific project-related expenses.

- Enter expenses into a template or software: Use an expense report template or expense management software to enter the details of each expense, including the date, description, amount, and category.

- Attach supporting documentation: Attach digital or physical copies of receipts to the expense report, ensuring that each expense has proper documentation.

- Calculate totals: Sum up the expenses for each category and calculate the total amount to be reimbursed.

- Review and submit: Review the expense report for accuracy and completeness. Make any necessary adjustments or additions before submitting it to the designated approver or finance department.

- Follow up and track reimbursement: Keep track of the status of your expense report and follow up on the reimbursement process if needed.

To effectively manage each employee expense, consider the following approaches:

- Implement a corporate expense policy: Establish clear guidelines and policies outlining what expenses are reimbursable, spending limits, and expense submission procedures. Communicate these policies to all employees.

- Provide training and education: Educate employees on the expense management process, policy compliance, and the importance of accurate and timely expense reporting.

- Use expense management software: Adopt expense management software that allows employees to track, submit, and manage their expenses easily, streamlining the process and reducing errors.

- Regularly review expense reports: Review expense reports regularly to ensure compliance, accuracy and identify any anomalies or potential cost-saving opportunities.

- Enforce policy compliance: Regularly communicate and enforce expense policies to ensure employees adhere to the guidelines and do not exceed spending limits.

- Encourage digital documentation: Encourage employees to use digital methods for storing and submitting expense-related documents, such as receipts and invoices, to streamline the process and reduce paperwork.

- Provide timely reimbursement: Process reimbursements promptly to ensure that employees are reimbursed on time, maintaining employee satisfaction and motivation.

Employees can claim business travel expenses by following these steps:

- Keep track of expenses: Maintain a record of all business-related expenses incurred during the travel, including receipts, invoices, and any supporting documentation.

- Follow company policies: Familiarize yourself with your company's expense policies and guidelines to ensure compliance with reimbursement procedures.

- Complete an expense report: Fill out an expense report form or use expense management software provided by your company to document the details of each expense, such as date, description, amount, and category.

- Attach supporting documentation: Attach digital or physical copies of receipts, invoices, and any other relevant documents to the expense report as evidence of the expenses incurred.

- Submit the expense report: Submit the completed expense report to your organization's designated person or department responsible for expense reimbursement.

- Follow up on reimbursement: Keep track of the status of your expense report and follow up with the appropriate personnel if there are any delays or concerns regarding reimbursement.

Business expenses on a business trip typically include:

- Transportation: The travel cost associated with airfare, train tickets, rental cars, taxis, or rideshare services used for business purposes.

- Lodging: Expenses related to hotel stays during the business trip.

- Meals: Costs incurred for meals and refreshments consumed while on business travel.

- Entertainment: Expenses for client meetings, networking events, or other business-related activities.

- Communication: Charges for phone calls, internet usage, or other communication services necessary for conducting business while traveling.

- Incidentals: Miscellaneous expenses such as tips, parking fees, baggage fees, or visa fees that are directly related to the business trip.

- Other specific expenses: Expenses directly related to the purpose of the business trip, such as conference registration fees, equipment rentals, or business-related materials.

It is important to consult your company's expense policies and guidelines to determine the specific allowable expenses and any spending limits applicable to your business trip.

Corporate travel management refers to managing and coordinating business travel activities for employees within an organization. It involves various tasks, such as travel planning, booking flights and accommodations, arranging transportation, managing travel policies, and ensuring compliance with company guidelines and budgets. Corporate travel management aims to streamline the travel process, control costs, ensure employee safety and satisfaction, and optimize travel-related efficiency and productivity.

Billable travel expenses are costs incurred during a business trip that can be directly billed to a client or customer. These expenses are typically reimbursable by the client and may include travel fares, accommodation charges, or meals and entertainment expenses directly related to client meetings or projects.

Non-billable travel expenses are costs that cannot be directly charged to a client or customer. The company typically covers these expenses and may include internal team meetings, training sessions, or expenses incurred for non-client-related activities during the business trip.

It is important to consult your company's policies and guidelines to understand how billable and non-billable travel expenses are handled and what documentation is required for reimbursement or billing purposes.

The protocol for paying business trip expenses may vary depending on the company's policies and practices. Employees are required to pay for business trip expenses using personal funds or corporate credit cards. After the trip, employees submit expense reports and supporting documentation for reimbursement or direct payment. Reimbursement may be processed through payroll or a separate expense reimbursement system based on the company's reimbursement policies and spending limits in place.

It is important to familiarize yourself with your company's specific protocols and follow the guidelines for paying and reimbursing business trip expenses.

Here are some ways to save your company money on business travel:

- Plan: Book flights and accommodations well in advance to take advantage of lower fares and hotel rates.

- Encourage cost-conscious travel: Communicate to employees the importance of cost-consciousness when making travel arrangements, such as choosing economical flight options or staying at reasonably priced accommodations.

- Use travel rewards programs: Enroll in loyalty programs offered by airlines, hotels, and car rental companies to accumulate points or miles that can be redeemed for future business trips.

- Implement travel policies: Establish clear policies and guidelines that outline allowable expenses, spending limits, and preferred vendors or booking platforms.

- Encourage virtual meetings: Whenever feasible, consider using video conferencing or virtual meeting tools as an alternative to in-person travel, reducing travel costs and environmental impact.

- Seek negotiated rates: Negotiate corporate rates with preferred hotels, airlines, or car rental companies to secure discounted prices for business travel.

- Monitor and analyze expenses: Regularly review and analyze travel expenses to identify cost-saving opportunities, analyze spending patterns, and make informed decisions regarding travel budgets and policies.

By implementing these strategies, companies can effectively manage travel expenses and optimize cost savings without compromising the quality of business travel.

In startups, business travel typically follows similar principles to established companies but may have some unique aspects:

- Need-based travel: Startups often prioritize business travel based on specific needs, such as client meetings, investor pitches, industry conferences, or networking events.

- Budget-conscious approach: Startups may have limited financial resources, so cost-consciousness is crucial. Startups often emphasize finding affordable travel options while maintaining productivity and achieving business objectives.

- Flexible policies: Startups may have more flexible travel policies allowing employees to choose their accommodations or flights within budgetary constraints.

- Emphasis on ROI: Startups often focus on the return on investment (ROI) of business travel, ensuring that each trip aligns with strategic goals and contributes to the growth and success of the company.

- Startup culture integration: Business travel in startups may involve a close-knit team environment, where employees travel together, share accommodations, or collaborate closely during the trip.

Overall, business travel in startups combines the need for cost efficiency with pursuing business opportunities, networking, and building relationships necessary for the company's growth.

The best travel budget expense tracker depends on the specific needs and preferences of the user. Some popular travel budget expense tracker apps include:

- Emburse: Offers a fully automated T&E platform that reduces travel costs, mitigates risks, and generates real-time travel data insights.

- Expensify: Offers features for expense tracking, receipt scanning, and reporting.

- TripLog: Focuses on mileage tracking and expense logging for business travel.

- Trail Wallet: Designed specifically for travel expense tracking, users can set budgets, record expenses in different currencies, and generate reports.

- Splitwise: Useful for tracking shared expenses among travelers, making it ideal for business trips with colleagues.

- Mint: A comprehensive personal finance app that can be utilized to track travel expenses and manage budgets.

- XpenseTracker: Provides features for tracking expenses, recording mileage, and generating expense reports.

When selecting a travel budget expense tracker, consider factors such as ease of use, compatibility with your devices, reporting capabilities, integration with other tools or accounting software, and any specific features that cater to your business travel needs.

Corporate travel management software offers several benefits for businesses, including:

- Streamlined booking process: Travel management software simplifies the booking process by providing a centralized platform for employees to search and book flights, hotels, and rental cars, saving time and effort.

- Cost control: Using travel management software, companies can enforce travel policies, set spending limits, and access negotiated rates, ensuring cost control and compliance with budgetary restrictions.

- Policy enforcement: Travel management software enables companies to establish and enforce travel policies, ensuring employees adhere to guidelines and make compliant bookings.

- Expense tracking and reporting: Travel management software often integrates with expense management systems, allowing for seamless tracking of travel-related expenses and generating detailed reports for reimbursement and financial analysis.

- Improved visibility and transparency: Travel management software provides real-time visibility into travel bookings and expenses, allowing companies to monitor and manage travel-related activities effectively.

- Duty of care: Travel management software can assist in ensuring the safety of employees by providing access to travel alerts, emergency contact information, and traveler tracking features.

- Analytics and insights: Travel management software offers reporting and analytics capabilities, allowing companies to gain insights into travel patterns, expenses, and trends, facilitating better decision-making and cost optimization.

A travel management system (TMS) is a software solution designed to streamline and automate various aspects of travel management. It typically includes features for booking flights, accommodations, and rental cars, managing travel policies, generating reports, and facilitating communication between employees, travel managers, and travel agents.

A travel management system provides a centralized platform for managing all travel-related activities, allowing companies to enforce policies, control costs, improve efficiency, and ensure compliance with travel guidelines. It offers tools for travel booking, expense tracking, policy enforcement, reporting, and duty of care, among other functionalities, to simplify and optimize the travel management process.

To effectively manage travel expenses, consider the following steps:

- Define travel policies: Establish clear policies that outline allowable expenses, spending limits, preferred vendors or booking platforms, and any specific guidelines relevant to your organization.

- Communicate policies: Communicate the travel policies to all employees, ensuring they understand the guidelines, reimbursement procedures, and the importance of compliance.

- Implement expense management software: Adopt an expense management software solution that allows employees to track and submit travel expenses easily and enables each travel manager to review, approve, and process reimbursements efficiently.

- Provide training and support: Offer training sessions or resources to educate employees on using the expense management software, understanding the policies, and effectively managing their travel expenses.

- Monitor and review expenses: Regularly review travel expenses to identify any discrepancies, trends, or opportunities for cost savings. Use the data from expense reports to inform budgeting and decision-making processes.

- Enforce compliance: Enforce travel policies and expense guidelines consistently, ensuring employees adhere to the defined procedures and spending limits.

- Maintain communication: Foster open communication channels to address any questions or concerns about travel expenses, reimbursements, or policy compliance.

- Periodically evaluate and update policies: Review and update travel policies as needed to reflect changes in company needs, industry trends, or evolving regulations.

By following these steps, you can establish a structured and efficient process for managing travel expenses within your organization.

The cost of an average business trip can vary widely depending on several factors, such as destination, duration, purpose, industry, and company policies. According to various studies and industry reports, an average domestic business trip in the United States can range from $1,000 to $2,500 per traveler, including airfare, hotel accommodations, meals, ground transportation, and incidentals. International business trips tend to be more expensive, with costs averaging around $3,000 to $5,000 per traveler.

Customer success

What our customers love about us

“Working with Emburse feels like a true partnership where they really listen to our needs and care about our success and happiness, which is something we didn’t have with Concur.

”

Dawn Conway

Senior Business Analyst at BELFOR

“Emburse solutions humanize work by providing products and services that make it easier for people to do their jobs.

”

Craig Lundskog

at Great Basin Industrial

“Any company that is expecting growth needs to automate AP processes. Emburse will save you the cost of hiring additional AP staff and also give you time back for more innovative work to help your company grow.

”

Dan Sangeorge

at ALKU

“We now have happier users, and the streamlining of processes and workflows, combined with the improved spend visibility has delivered huge benefits for the firm worldwide.

”

Neil Ackley

at Latham & Watkins LLP

“Modern solutions like Emburse help support our mission and enable us to deliver educational programs to the world's most vulnerable communities.

”

Shari Freedman

at Room to Read

“Emburse is intuitive to use and easily integrates with our other finance systems and credit cards. The result is a 100% paperless expense reimbursement process.

”

Michael Sullivan

at PX Technology

About Emburse

Our growing technology ecosystem

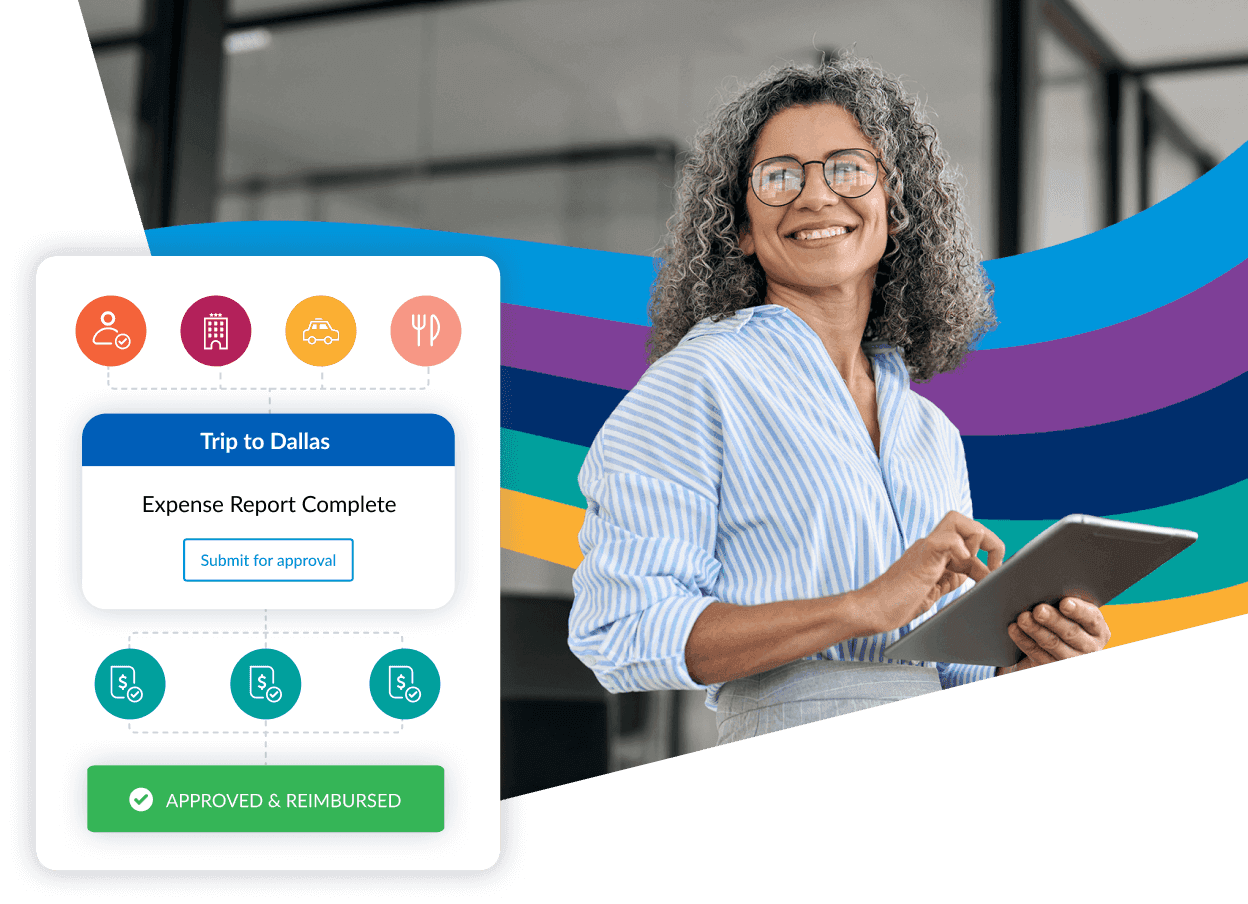

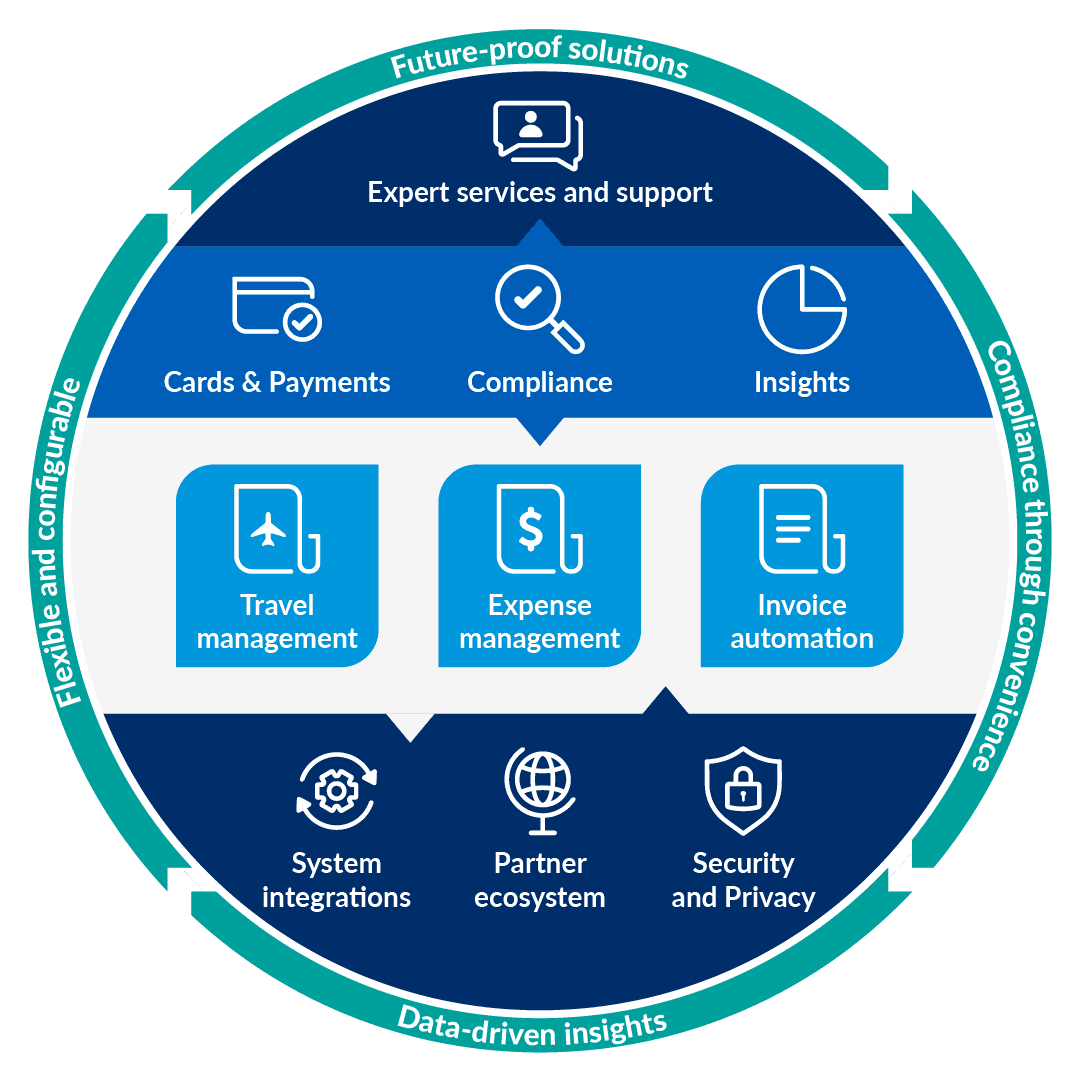

Emburse is the global leader in helping organizations simplify travel spend management. Our expense travel and expense management, purchasing, accounts payable, and payments solutions are trusted by over 12 million business professionals, including CFOs, finance teams, and travelers.

Emburse offers world-class expense and travel management solutions tailored to your organization’s unique needs. Whether you’re a Fortune 100 enterprise organization or a growing company, Emburse has what you need.

Ready to take your travel and expense management to the next step?

With Emburse, you can efficiently simplify your travel and expense management, reduce administrative tasks, and make informed financial decisions to drive business growth.