What is a p-card?

If given a choice between complete expense automation, where employee purchases flow seamlessly into your expense management software, and comprehensive spend controls, where you have power over every step in the purchasing process, which would you choose?

Many companies approach expense management as an all-or-nothing decision between efficiency and control, a trade-off that doesn’t serve anyone. End users want to make essential purchases without the red tape of approvals and reimbursements. Procurement and AP teams want to regulate where, why, and how employees spend corporate funds.

But you don’t need to sacrifice proper oversight to facilitate effortless employee-vendor transactions. There’s a special kind of corporate card explicitly built for procurement purposes — no convoluted procurement process needed.

P-cards, also called purchasing cards or procurement cards, empower end users to make business-critical purchases while automatically enforcing budget and vendor limits. P-cards are like corporate credit cards that contain an extra level of controls to prevent overspending, such as restricting card use to a specific timeframe or budget per transaction. Using modern card management software, companies can issue p-cards as physical and virtual cards.

Is a purchasing card a credit card?

You’re right in wondering if there’s an overlap between p-cards and traditional corporate credit cards. What’s the difference between purchasing cards vs. corporate cards, and when should companies use what?

The primary difference between p-cards and corporate cards is that p-cards are solely intended for vendor purchases, while corporate cards can also be used for travel and expense (T&E) funds. With the right expense management technology backbone, both cards allow companies to proactively manage employee spend, automate reconciliation, and simplify month-end close.

How do p-cards work?

At the point-of-sale, p-cards work like any other credit or debit card. As virtual cards, they function as restricted-use card numbers that can be set up for one-time purchases, specific time periods, or recurring transactions. Where the magic happens is at the card issuance, reimbursement, and financial reporting stages.

Here’s how p-cards work:

- Admin issues a p-card or approves an employee’s purchase request

- Admin sets p-card usage limits, such as approved vendors, purchase categories, budget, and time period

- Employee uses the p-card online or in-person, and usage limits are enforced automatically

- In-policy purchases are auto-approved

- Transaction details, including invoices and receipts, are effortlessly submitted to the ERP system

Within a few hours, a vendor purchase can be requested, qualified, completed, and recorded in the books. Processing transactions at this speed and level of involvement is undoubtedly a revolution for procurement. Compare that to the traditional processes, where employees have to float the company’s expenses for weeks as they wait for reimbursement, leading to cash flow uncertainty for the organization and their own financial strain.

P-card benefits

By now, you understand that p-cards aren’t any old corporate cards — they’re critical tools for streamlining and gaining control over the procurement process. Let's dive deeper into the transformational advantages of p-cards.

P-cards provide additional controls

Traditional corporate credit cards often need to catch up when it comes to financial controls. They were designed for employees making T&E purchases, not big-ticket or recurring vendor payments. Traditional cards lack proactive budget control, meaning companies only discover unwanted spend after it’s processed.

P-cards provide complete control over the end user’s ability to spend corporate funds. Admins can set comprehensive vendor restrictions tailored to the organization’s needs. For example, they can establish a monthly SaaS budget and specify the approved vendors. Employees can quickly make critical purchases with confidence that their spend is within budget and policy.

P-cards eliminate expense reports

The traditional system of submitting expense reports, matching receipts, and issuing reimbursements creates a lot of unnecessary admin work — and that’s when everyone follows the process and policy correctly.

Because p-cards are issued with built-in spending restrictions, they eliminate the need to review expense reports for possible violations. Admins can rest assured knowing that every purchase has been pre-approved. And because they capture purchase details and receipts at the point of transaction, p-cards actually eliminate the need for expense reports altogether. This simplifies employees' lives, streamlines accounting and bill pay, and reduces operational costs.

P-cards save admin time through automation

Consider the time-consuming process of paying invoices and hunting for purchase order receipts. Now consider repeating that process for dozens of small nuisance transactions, like recurring SaaS subscriptions and office expenses. Compared to traditional payment methods like ACH, checks, and wire transfers, which offer little to no efficiency in employee-driven corporate spending, p-cards are a game changer for streamlining the procurement process.

By setting up p-cards with spend controls, admins and managers prevent out-of-policy purchases at the point of purchase or request. Automated spending limits make manual review for high-volume, low-value payments a thing of the past. Instead, finance teams can focus their attention on strategic decisions.

That’s one of the most significant benefits of embracing p-cards: the shift in how finance teams allocate their time. Rather than drowning in paperwork — reconciling expenses, chasing down receipts — they invest their hours in higher level planning, analysis, and decision-making.

What software should you use to manage your purchasing card program?

There are three main methods for managing p-card expenses: through spreadsheets or pen and paper (manually), traditional expense reports, or expense management software. While p-cards are powerful tools for simplifying the procurement process, using an inefficient management method may offset their time-saving benefits.

Managing p-card transactions manually (paper or spreadsheets)

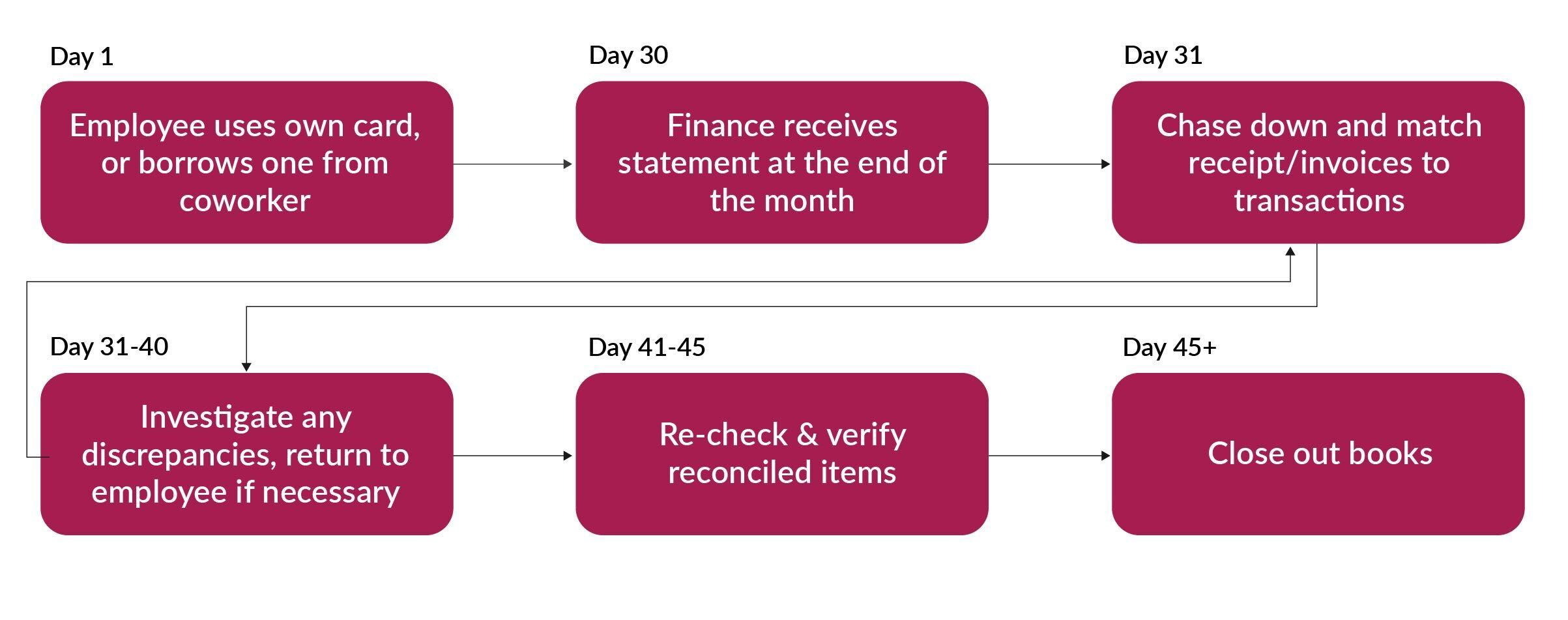

In the manual method, an employee uses their p-card to pay for vendor expenses. At the end of the month-long billing cycle, finance begins the arduous process of reconciling the transaction. They have to investigate discrepancies, match receipts and invoices against the transaction, and verify balances. In the best-case scenario, finance teams are able to reconcile the transaction a staggering 45 days after it occurred.

Managing p-card transactions in traditional expense reports

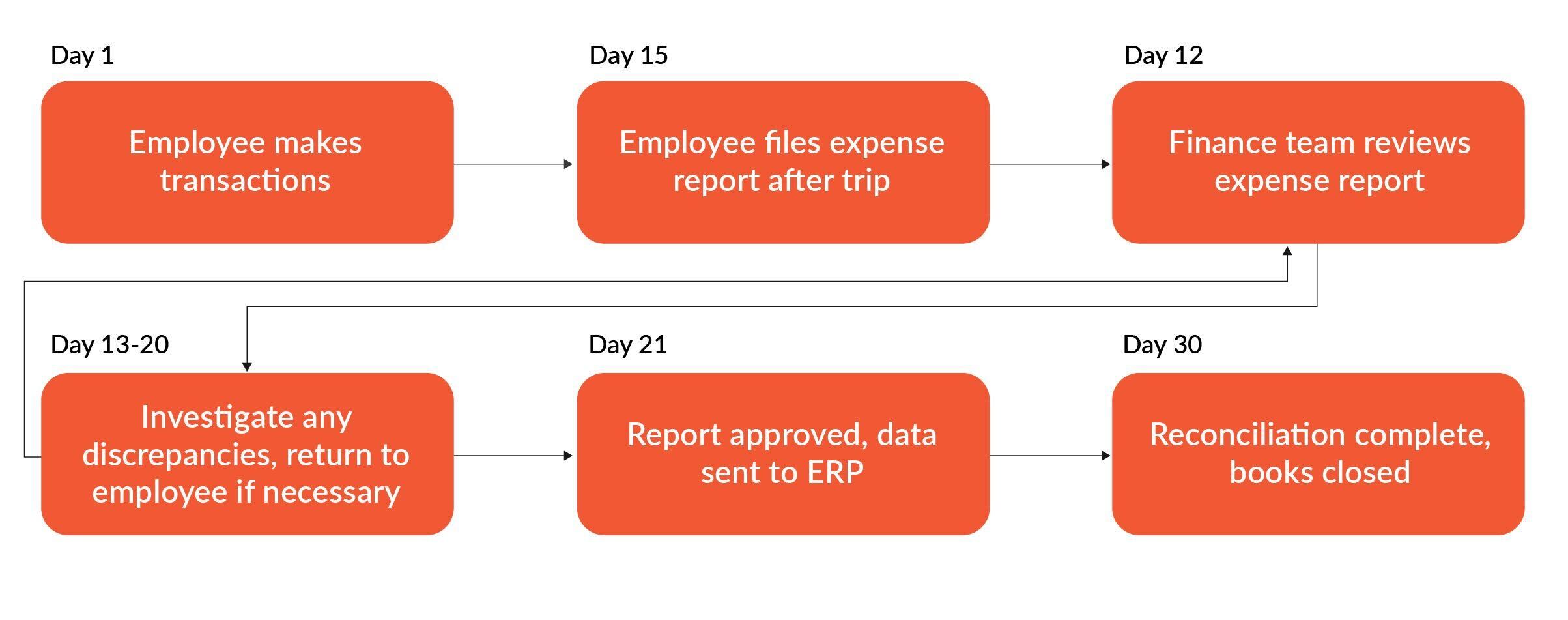

Handling p-card transactions alongside traditional T&E expenses is more efficient than dealing with them manually. However, it can still be a 30 day process depending on whether employees submit their expense reports manually right after the purchase(s), or if employees wait for the software to submit it automatically at the end of the reporting cycle (typically, two weeks). Bundling vendor purchases with T&E expenses can create extra work for the finance team at book closing, as they have to review a few weeks’ worth of transactions at a time.

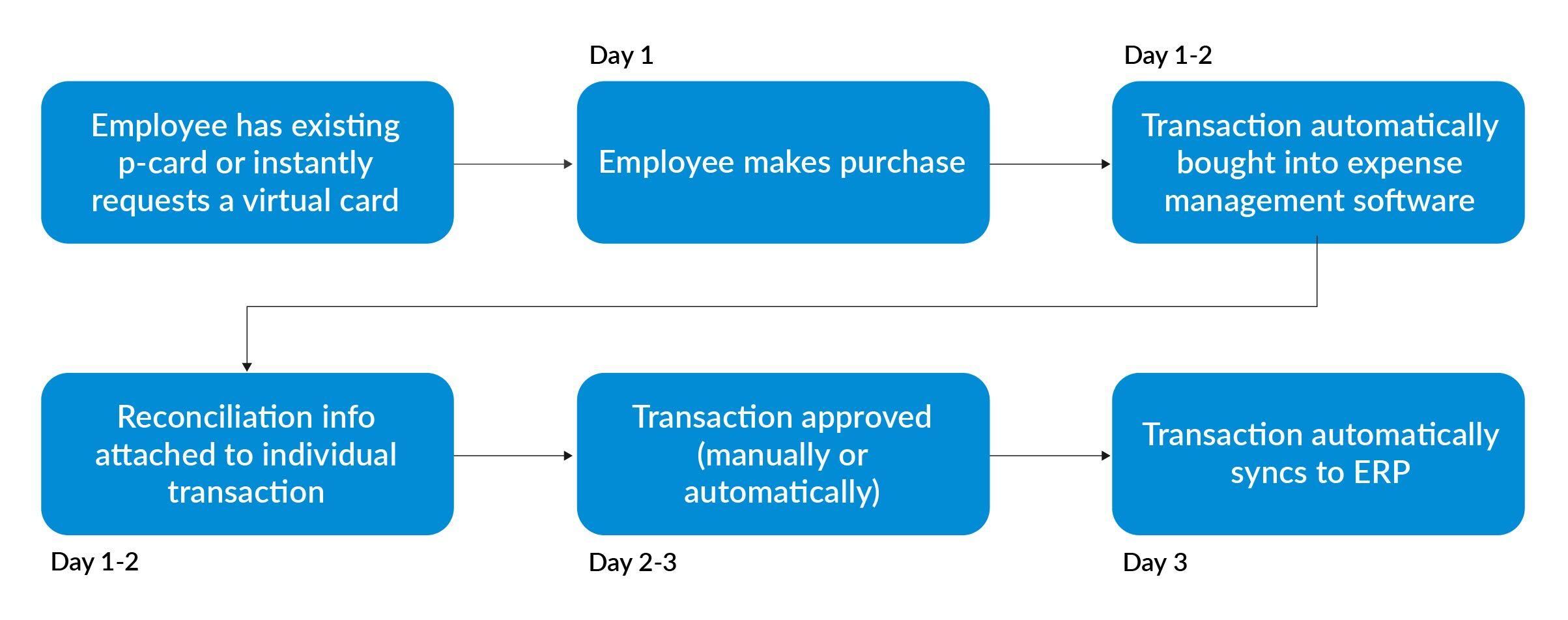

Managing p-card transactions in expense management software

When funneling p-card purchases into expense management software, transactions are managed individually, in real time. This approach ensures that each expense is tracked and controlled as it happens, instead of processed in bulk at the end of the month — as it would be if handled like a traditional expense report.

At first glance, dealing with transactions individually might sound like more work. In reality, the opposite is true, thanks to automation. Modern expense management platforms can capture purchase details and receipt at the point-of-sale, categorize the purchase for manual review or auto-approval if it meets set spending rules, and sync the transaction to the ERP system. That’s the real advantage of using an expense management platform to run your p-card program: automation significantly reduces the administrative burden on finance teams.

Set up a p-card program today

The strategic advantages of p-cards are clear. With p-cards supported by modern expense management software, you can enforce budget and vendor limits automatically, ensuring that spending stays in check. This eliminates the need for expense reports and simplifies accounting and bill payment. P-cards also save valuable administrative time through automation, allowing your finance team to focus on important decisions instead of mundane paperwork.

Consider adopting p-cards as part of your corporate card program if your finance team spends considerable time reconciling expense reports or lacks control over company spend. If those pain points are familiar, it's time to free your finance teams and end users from the burden of manual payment methods and introduce a more efficient procurement process.

Achieving long-term financial wellness often requires making several smart software investments. P-cards offer the automated rules you need to facilitate employee spend while managing it effectively. If streamlining procurement processes, gaining spend control, and empowering end users is your goal, that’s your sign to implement p-cards as part of your corporate card program, supported by robust expense management software.

See how modernizing your p-card program can help you gain proactive control over company spend. With insights from helping over 16,000 companies simplify expense management, T&E, and accounts payable processes, we've identified the key process areas that might be holding you back from major savings. Use our five-minute spend ROI calculator to see how your current spending practices are affecting your cash flow.