- products

- emburse cards

- why cards

Marketing expenses

Marketing expenses

Emburse lets your marketing team instantly request and use virtual cards to pay for online ads, removing the need to pass around a corporate card while ensuring accurate reconciliation.

Why use virtual cards for marketing or ad spend?

Buy ad placements for campaigns on a large scale by creating different cards for different advertising platforms.

Set hard limit budgets and use our 1-click On/Off feature to deactivate cards. Plus there’s no need to reconcile.

Customized features for every business

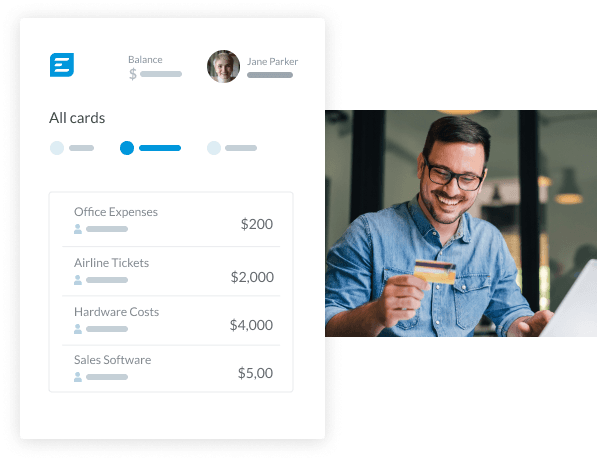

All the features you want in an expense management platform. Easy to set up and customize, Emburse gives you full control over your business and employee expenses.

Set personalized budgets and limits

Set time & category restrictions

Transfer funds instantly

Capture receipts automatically

Enable and disable cards with just one click

Issue virtual credit cards

No risk of theft

Attach distinct cards to separate campaigns

Set hard budgets for each, or combine a total budget for all. Turn off any existing cards at the touch of a button. These are some of the many ways Emburse is using virtual cards to help streamline the work of marketers.

Benefits

Benefits of using Emburse Cards for marketing buys

Virtual cards

Virtual cards can be issued within seconds and immediately used; cards can be assigned to specific websites/platforms/clients and instantly deactivated if compromised.

Automatic deactivation

Cards can be set to automatically self-suspend after a certain date, ensuring that card usage ends when your campaign does.

Automated transaction reconciliation

Transactions immediately appear in Emburse, and can be reviewed and exported to your accounting software directly from the web app.

Preapproval

Your employees can instantly request a new virtual card or budgetary increase when making larger-than-expected purchases, and requests can be approved or denied with one click.

Track and control spending

If Emburse Cards sound like the right solution for your company, schedule a demo with our team to learn more.

Cards are issued by Celtic Bank, a Utah-Chartered Industrial Bank (Member FDIC) Recognized by