EMBURSE EXPENSE INTELLIGENCE REPORT 2025

What $1.42 billion in meal spend signals about how work actually happens.

Introduction

Meal expenses rarely draw attention. Individually, they are small, routine, and typically compliant. At scale, they form one of the richest behavioral datasets in expense data, reflecting how work happens across locations, schedules, and roles. Because meal spend touches nearly every workflow, it reveals patterns that other categories often obscure.

This report examines $1.42B in meal spend across 14.9M expense transactions submitted through Emburse solutions in 2025. The data reflects how meals appear inside finance systems today. It has not been cleaned, idealized, or reshaped to fit policy assumptions. This is intentional. That perspective enables this report to reveal where meal dollars go, which vendors matter most, and where visibility breaks down.

When finance teams rely on totals and after-the-fact review, these signals arrive too late. Reading meal data as intelligence rather than reimbursement gives teams earlier insight into behavior, policy effectiveness, and where spend control must evolve to keep pace with modern work.

About the data

The insights in this report come from an aggregated analysis of corporate meal expenses incurred in North America (the United States & Canada) and submitted through Emburse solutions over a 12-month period, from November 2024 through December 2025.

All data is anonymized and normalized to support accuracy, consistency, and comparability across industries, company sizes, and regions. Individual organizations and employees are not identifiable in this dataset.

Meal Spend Is Surging, but Visibility Isn’t Keeping Up

The #1 “vendor” in the entire dataset wasn’t Uber Eats or Starbucks. It was “Vendor Not Defined,” which alone captured $391M in spend and 3.75M transactions. Other vague entries, such as “Food” (~$11.3M), “Dinner” (~$8.6M), and location-defaulted labels like “Greensboro” (~$9.5M), also rank among the most common vendors.

In total, corporate meal spend increased to $1.42B across 14.9M expenses during this period. Yet nearly 70% of those dollars arrived with unclear or incomplete vendor information. At that level of ambiguity, benchmarking performance, negotiating with strategic partners, and shaping effective spend policies become increasingly complex.

Expense Explained:

This data reflects what meal spend still looks like in many programs today: lots of volume, rapid growth, and a long tail of poorly defined merchants. The dollars are visible. The underlying behavior often is not.

That means many organizations can answer “How much did we spend on meals?”, but struggle with more operationally useful ones, such as:

- Which chains and platforms receive most of our meal spend?

- How much of our budget supports travel versus office culture?

- Where is policy drift or category crossover emerging?

The size of “Vendor Not Defined” underscores why finance teams are prioritizing cleaner merchant data and better categorization. Without structure, meal spend cannot be reliably compared across vendors, time periods, or programs. These patterns inform how Emburse continues to evolve Emburse Expense Intelligence, powered by Emburse AI and supported by capabilities such as Emburse Assurance, to orchestrate spend with clarity that holds over time for both finance teams and employees.

Emburse At Work

Emburse AI accelerates ledger visibility by up to ~90%, enabling near real-time insight.

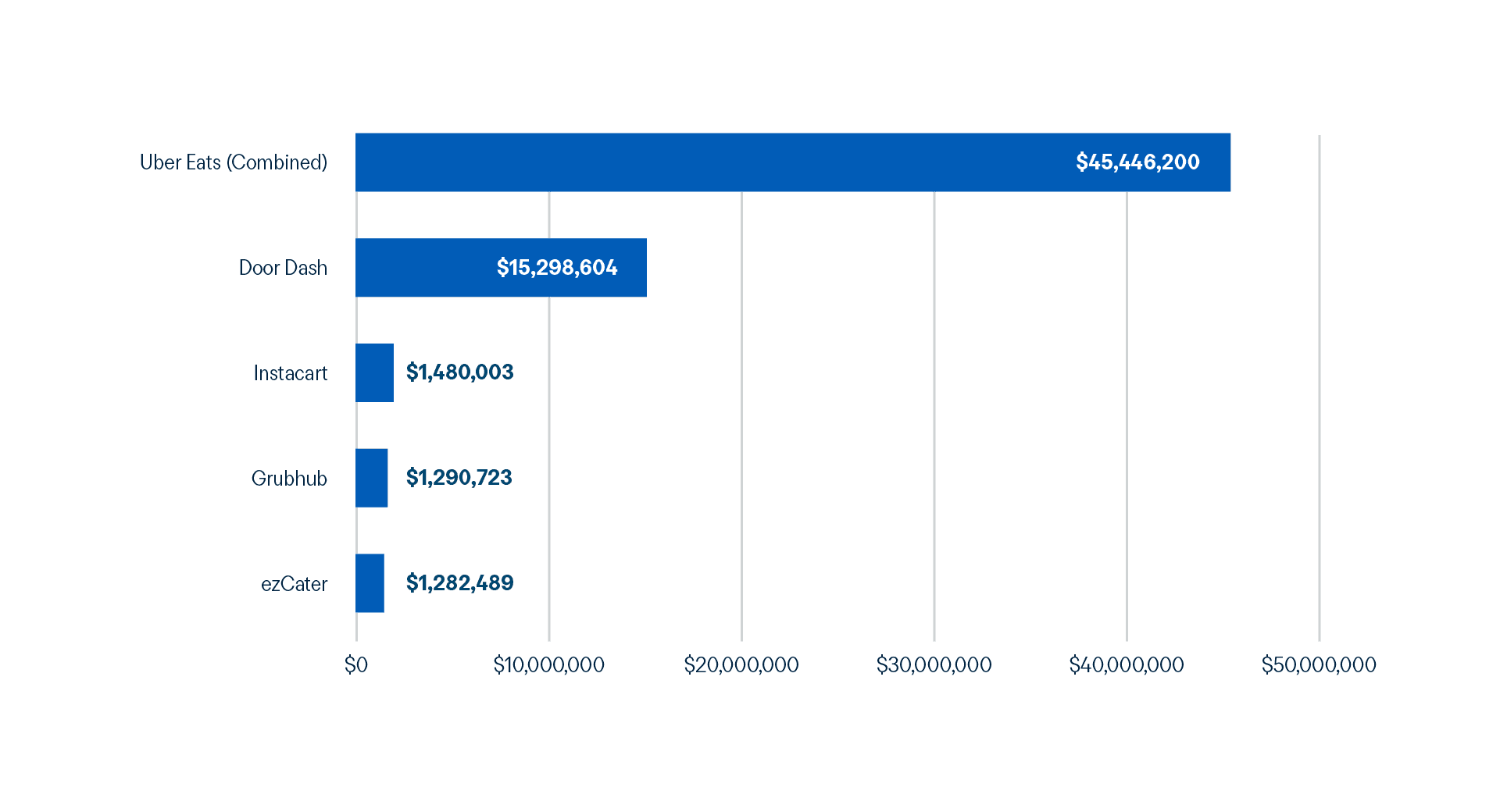

On-Demand Platforms Have Become Core Meal Vendors

Online ordering platforms have shifted from occasional conveniences to major meal partners. They now shape employee expectations, introduce new compliance considerations, and concentrate a growing share of meal spend within a small set of intermediaries.

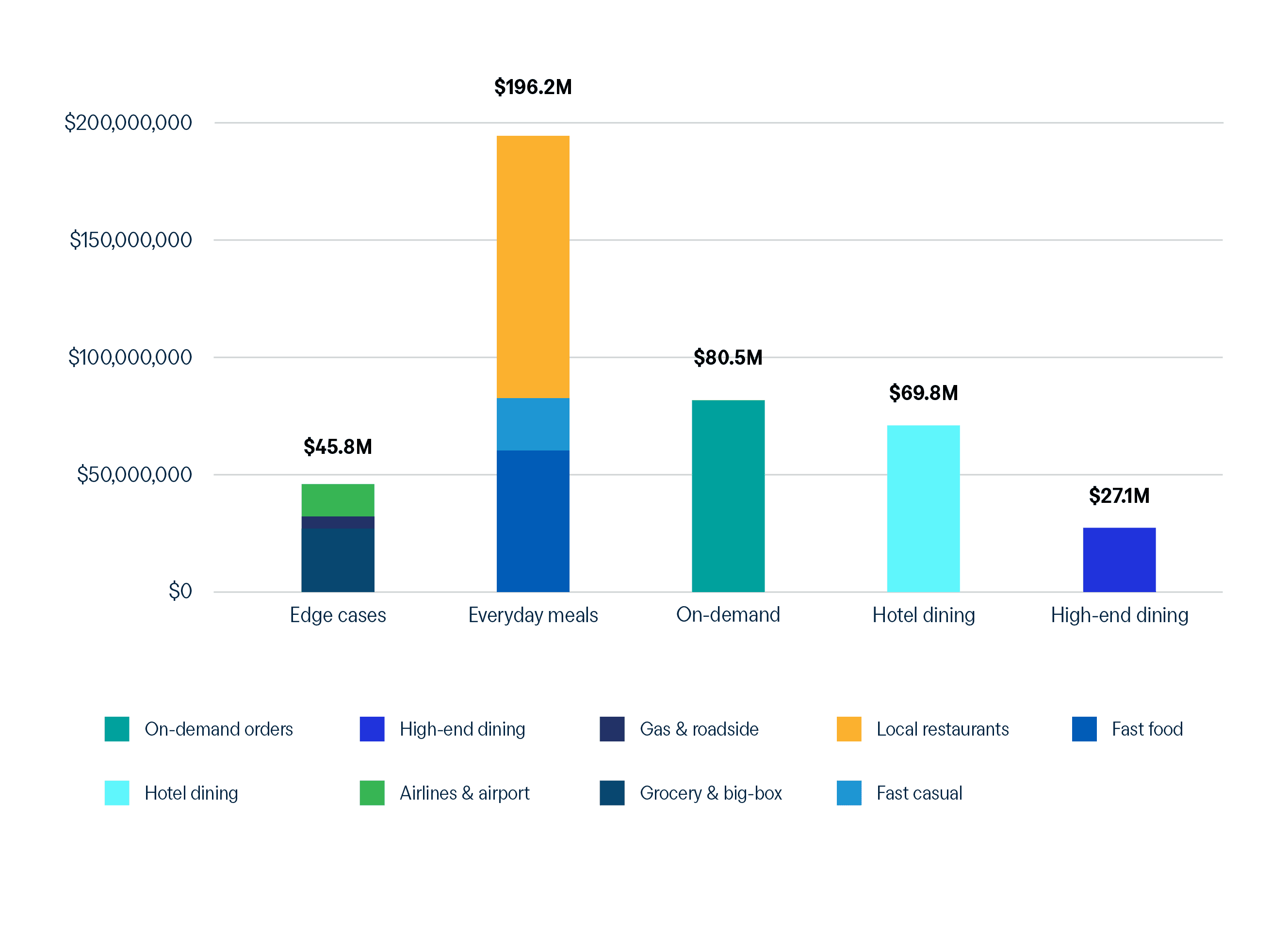

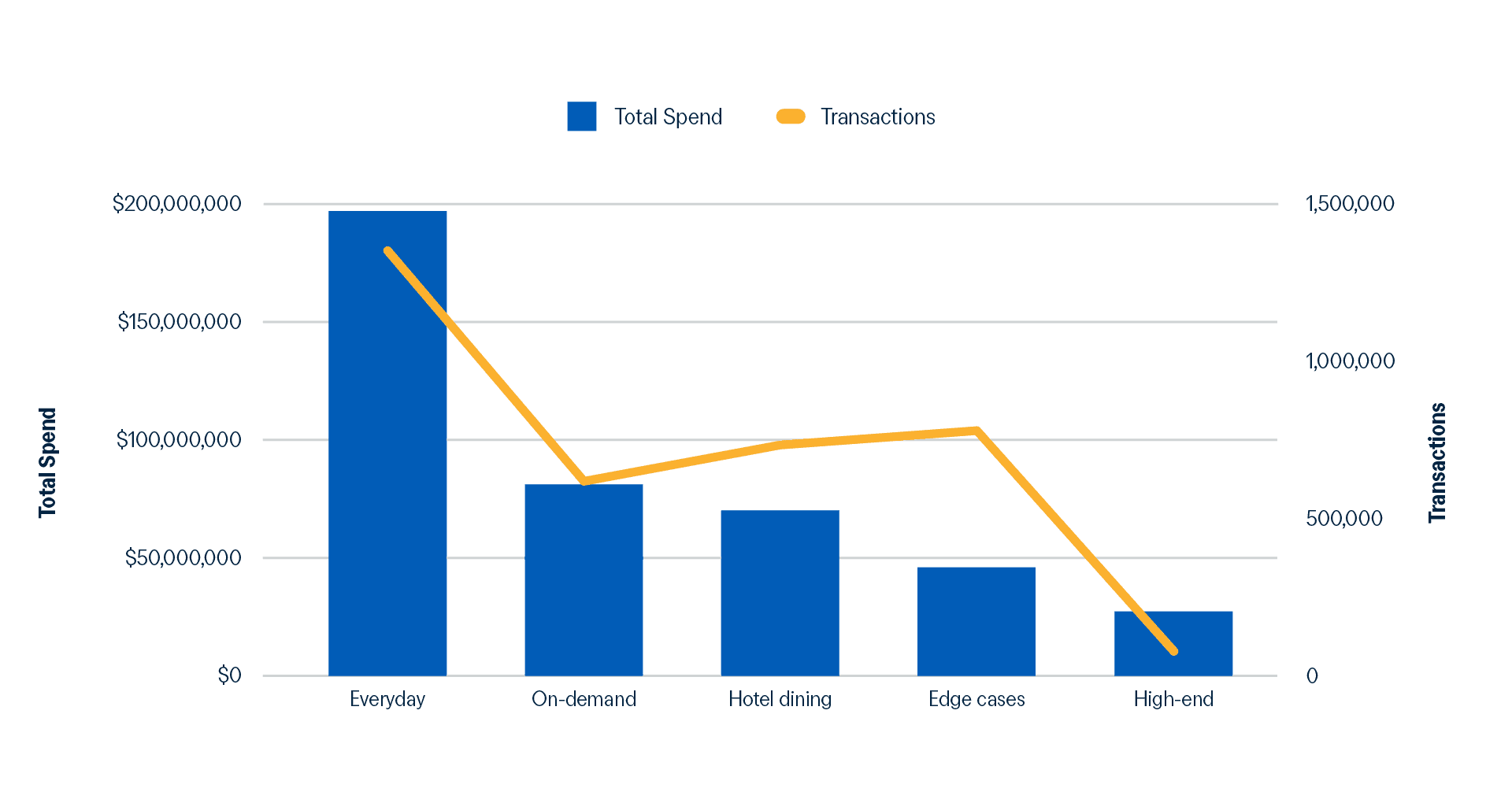

When we combine vendors labeled “Uber” and “Uber Eats” (as we should), Uber Eats becomes the largest identifiable meal vendor in the dataset, with $45.5M+ in annual spend across ~618K transactions—more than 3% of all meal dollars. And Uber Eats isn’t an outlier. Platforms such as DoorDash, Instacart, Grubhub, and ezCater add millions more, bringing on-demand meal spend to $80.5M, or 5.7% of all meal spend.

Expense Explained:

On-demand platforms add a new intermediary layer to corporate meal spend, consolidating volume in ways that rival traditional restaurant chains. Platform ordering can blur personal and business use, particularly during remote or hybrid workdays. It also lowers friction around frequency, making multiple-meal days easier to justify and harder to detect with static policy thresholds.

For finance teams, this creates two clear pressures:

- On-demand meal spend requires the same level of visibility and policy intent as traditional dining

- Vendor strategy must expand beyond restaurant brands to include platforms

This concentration of spend is a clear marker of how meal behavior is evolving. Emburse Expense Intelligence provides the infrastructure organizations can use to detect and contextualize platform-driven shifts in non-payroll spend—helping finance and travel leaders understand how meal spend is changing, not just where it occurs.

Emburse At Work

Finance teams reclaim hundreds of hours each month with Emburse’s intelligent analytics automation.

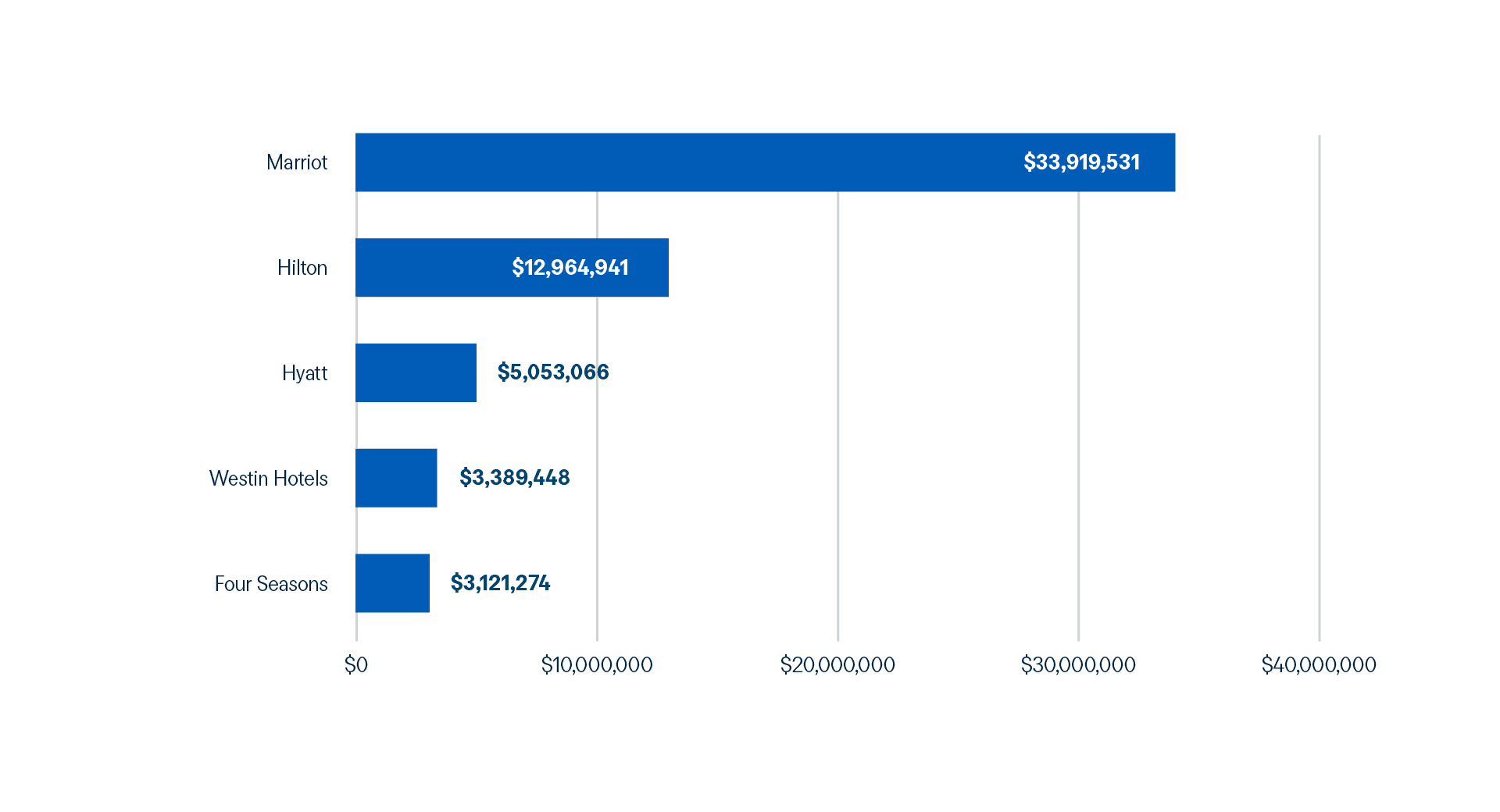

Hotel Dining Is Visible in Spend, Not in Detail

Business travel has returned, and hotel meal spend has followed. In this dataset, hotels captured approximately $69.8M in dining spend across ~728K transactions.

Much of that spend appears in hotel folios or is bundled with room charges and other incidentals. Marriott accounts for ~$33M in dining alone, with Hilton (~$13M), Hyatt (~$5M), Westin (~$3.4M), and Four Seasons (~$3.1M) also near the top of the list.

Expense Explained:

Meals now travel with the traveler. When meals are absorbed into folio charges, it becomes more challenging to separate dining activity from broader travel expenses. That narrows visibility into:

- How much meal spend is driven by travel

- Where policy exceptions are most common

- Which hotel groups may warrant structured agreements or clearer guidelines

Programs that can reliably separate lodging from dining gain a clearer view of total travel costs, more consistent guardrails, and greater leverage in vendor conversations. In these scenarios, an Emburse solution is essential for extracting meal-level detail from folios and applying the right policies at the right level of granularity.

Emburse At Work

With Emburse AI, approval and reimbursement cycles move ~50% faster.

Fast Food, Fast Casual & Local Spots Define the Everyday Corporate Diet

The majority of identifiable meal spend still comes from everyday meals: quick bites between meetings, lunches with colleagues, and regular spots near offices and client sites.

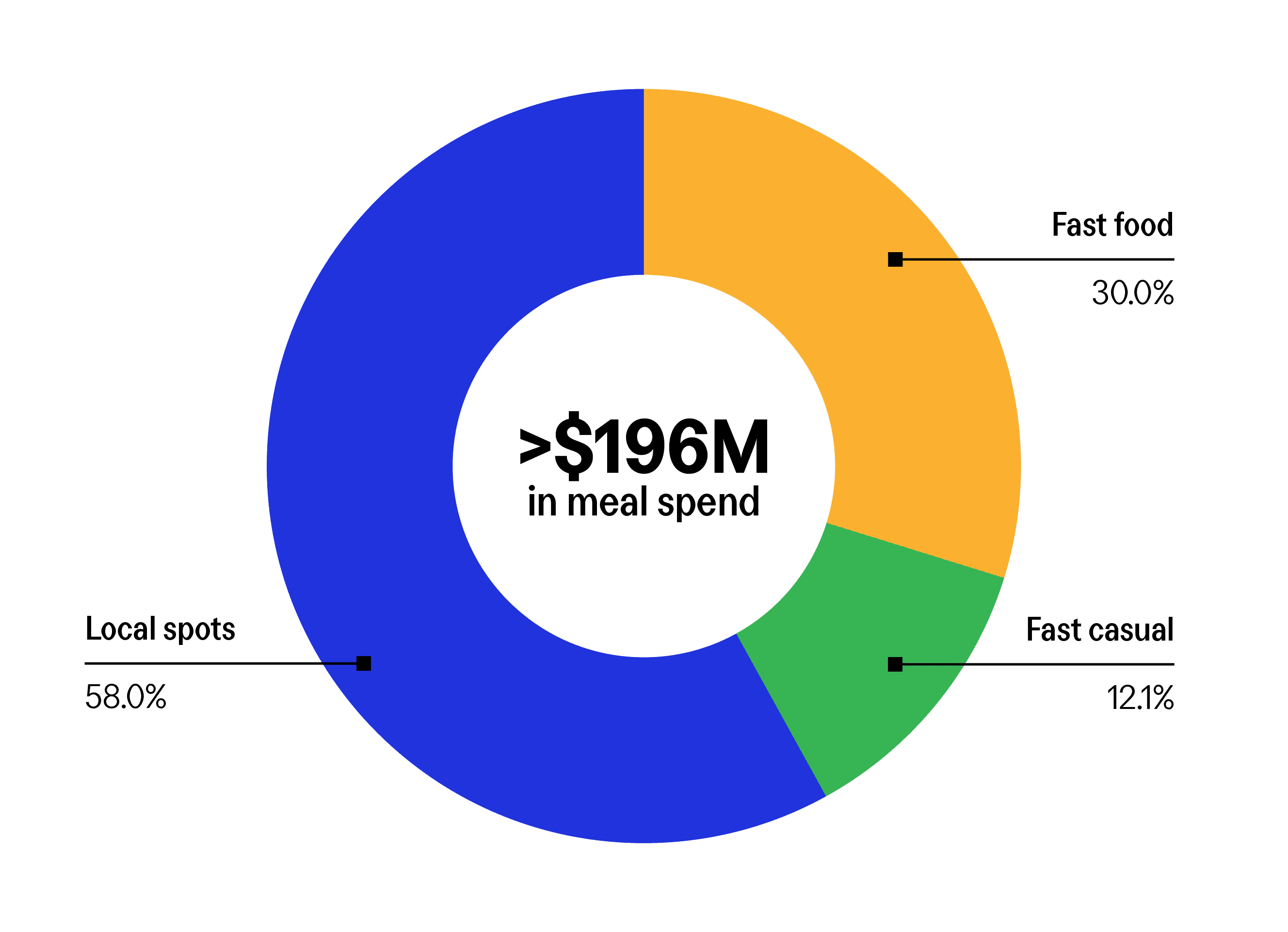

Across fast food, fast casual, and independent local restaurants, employees expensed more than $196M this year. These categories differ in price point and purpose, but together they reveal that most corporate dining is driven by convenience, familiarity, and proximity rather than premium or planned experiences.

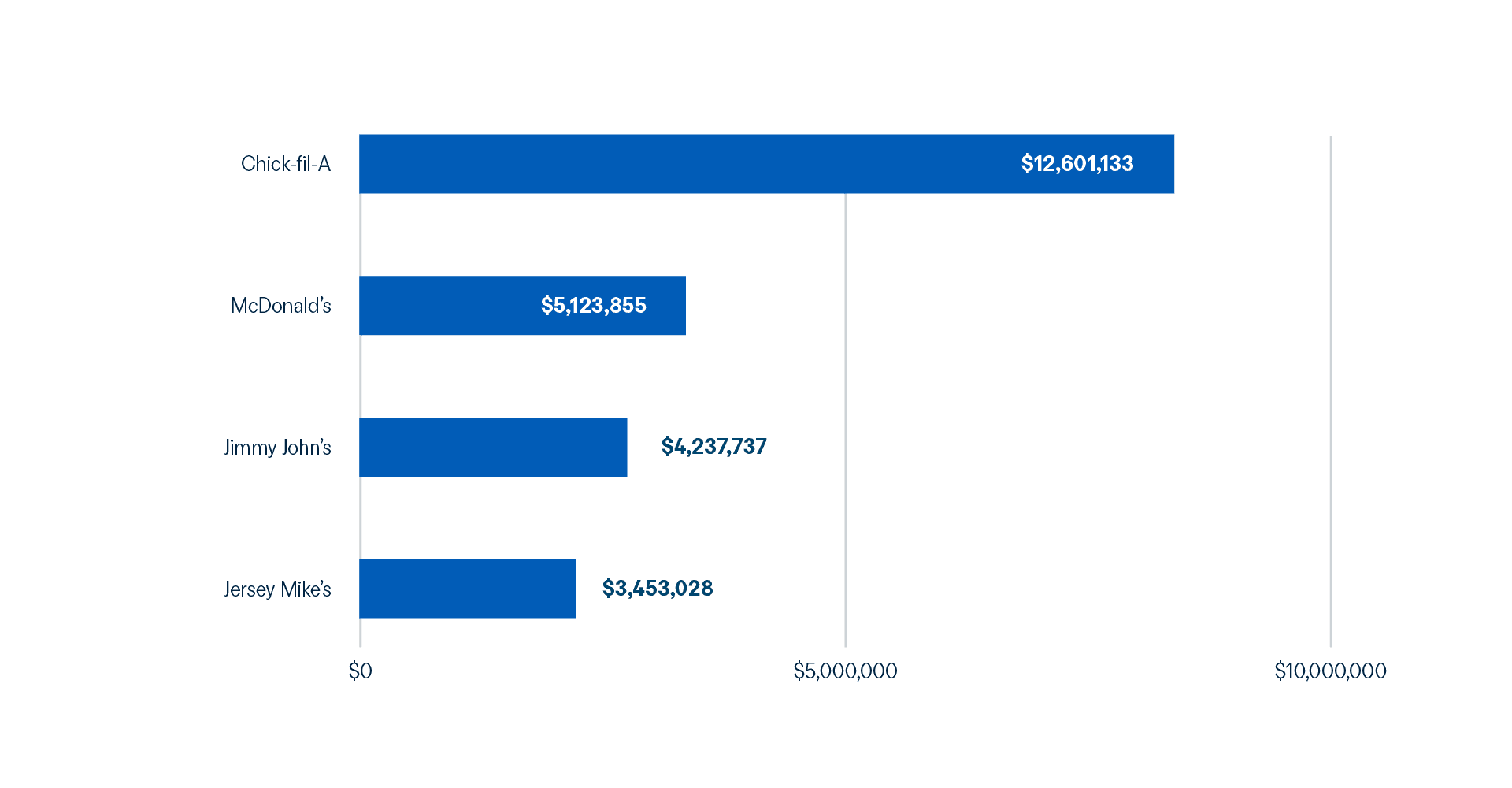

Fast food

Fast food continues to account for the highest meal volume in the dataset, particularly among field teams and travelers who prioritize speed, consistency, and availability. A small group of national chains captures a large share of this activity, led by Chick-fil-A (~$12.6M), McDonald’s (~$5.1M), Jimmy John’s (~$4.2M), and Jersey Mike’s (~$3.5M).

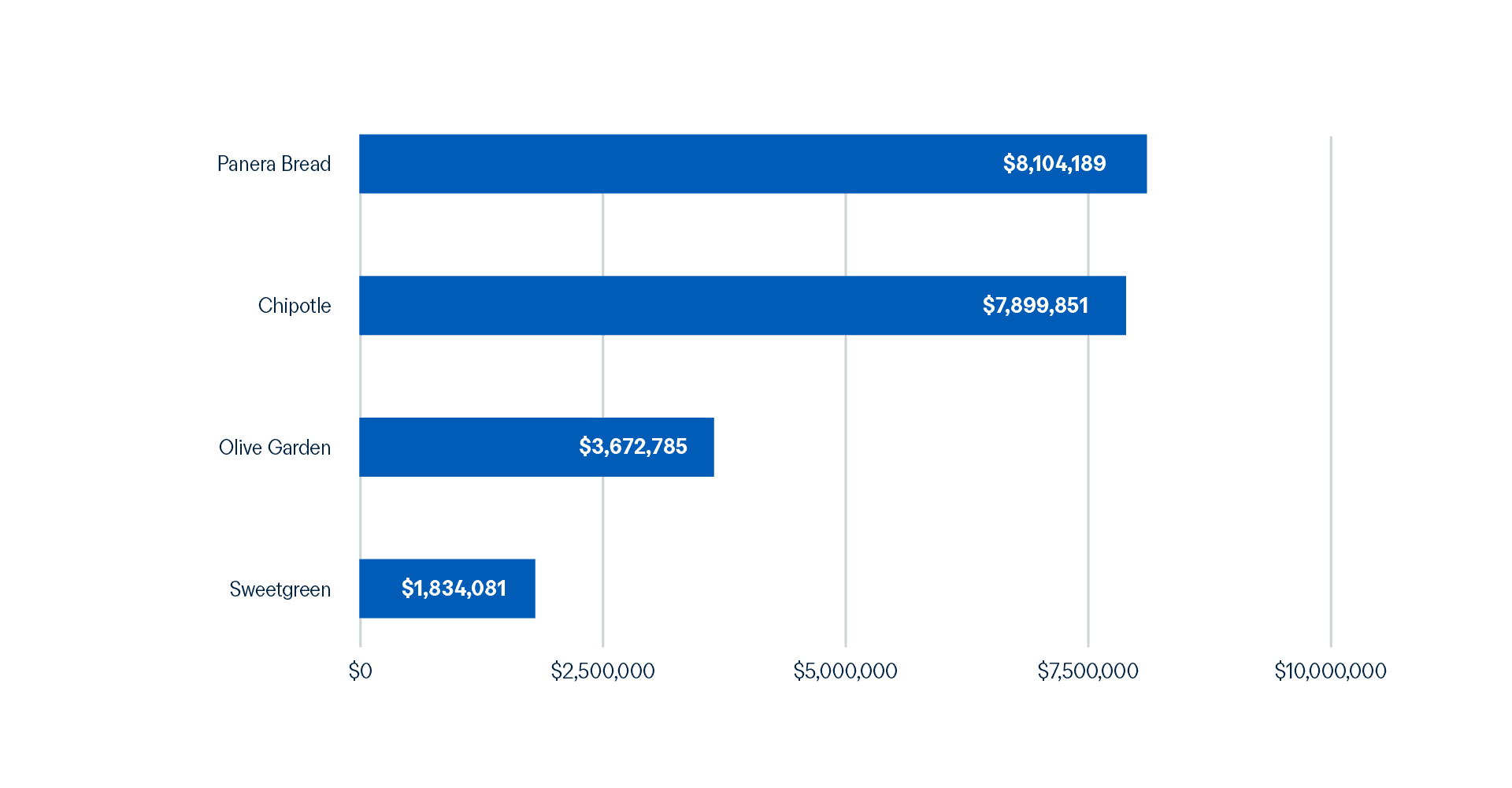

Fast casual

Fast casual occupies the “everyday but elevated” middle ground. Spend in this category often reflects team lunches, office meetings, and hybrid work patterns, especially in urban centers where these brands are densely concentrated. Leading brands include Panera Bread (~$8.1M), Chipotle (~$7.9M), Olive Garden (~$3.7M), and Sweetgreen (~$1.8M).

Local Restaurants

The most diverse and culturally meaningful segment of everyday meal spend, local dining is where relationship-building, community ties, and team connection tend to occur. These venues range from small cafés to regional favorites and single-location establishments.

That diversity, however, also creates operational friction. Inconsistent naming conventions across independent restaurants contribute to a long tail of merchants that are harder to reliably categorize and compare.

Expense Explained:

Fast food delivers volume and predictability. Fast casual reflects hybrid and office-based rhythms. Local restaurants carry the most relational value and exhibit the greatest variability in merchant data. Together, these categories form the “everyday rhythm” of corporate meal spend—frequent, largely within policy, and operationally repeatable.

That rhythm suggests a practical approach for finance and T&E leaders:

- Treat routine, low-risk, in-policy meals as candidates for stronger automation

- Use more nuanced review and oversight for exceptions and high-impact receipts

- Keep everyday spend clean and comparable at scale by normalizing merchant data

By continuously structuring merchant data and learning how meal spend behaves across volume, category, and ticket, Emburse Expense Intelligence enables finance teams to eliminate busywork without sacrificing comparability or control. Routine meals continue to move quickly, exceptions surface with clearer context, and spend signals remain interpretable over time.

Programs that apply intelligence at this level can reduce review bottlenecks, improve employee experience, and maintain consistent control even as meal volume scales.

Emburse At Work

Emburse Expense Intelligence helps teams save thousands of hours monthly—often a 40–50% reduction in manual effort.

High-End Dining Carries More Than a Price Tag

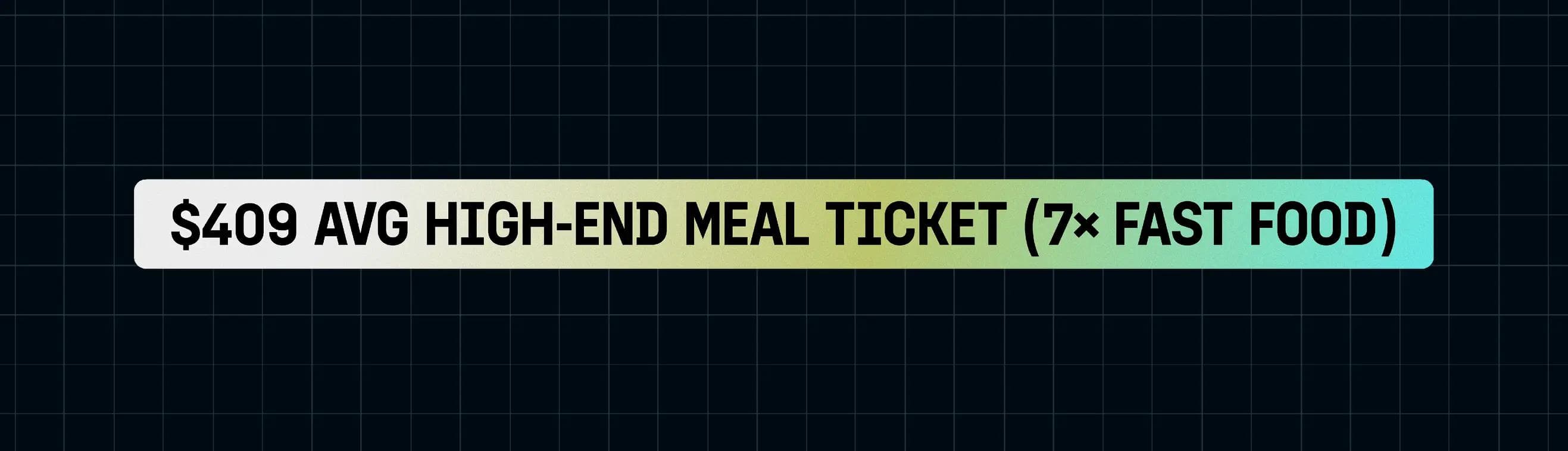

High-end restaurants account for a small share of total meal volume, yet they carry an outsized share of strategic significance. These are the places where client deals take shape, executives host partners, and critical relationships are advanced over premium menus.

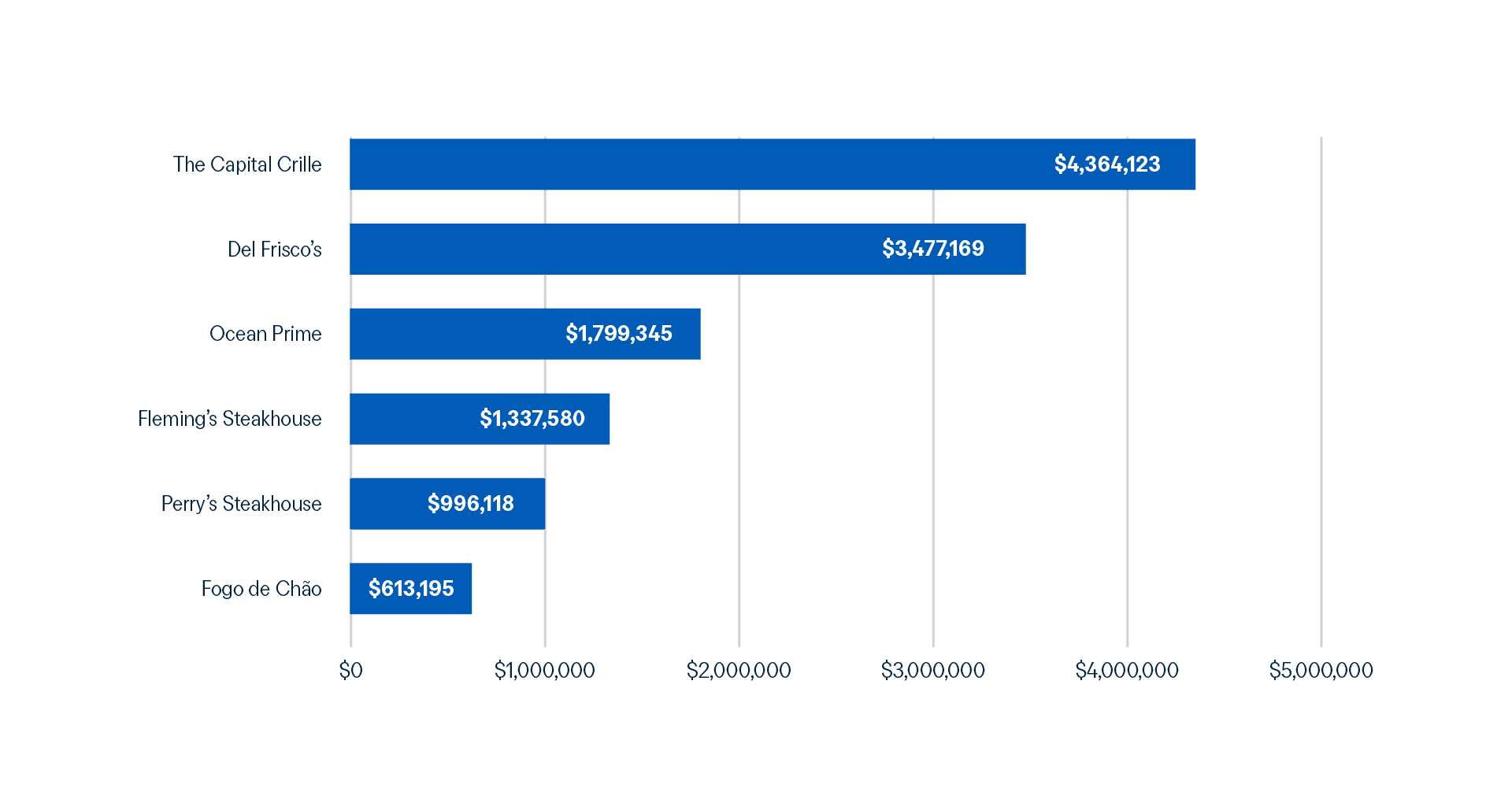

Across upscale steakhouses, fine-dining concepts, and corporate-favorite premium chains, employees expensed $27.1M in high-end meals this year—on just 66K transactions. The Capital Grille leads with roughly $4.4M, followed by Del Frisco’s (~$3.5M) and Ocean Prime (~$1.8M). Fleming’s Steakhouse, Perry’s Steakhouse, and Fogo de Chão follow closely behind.

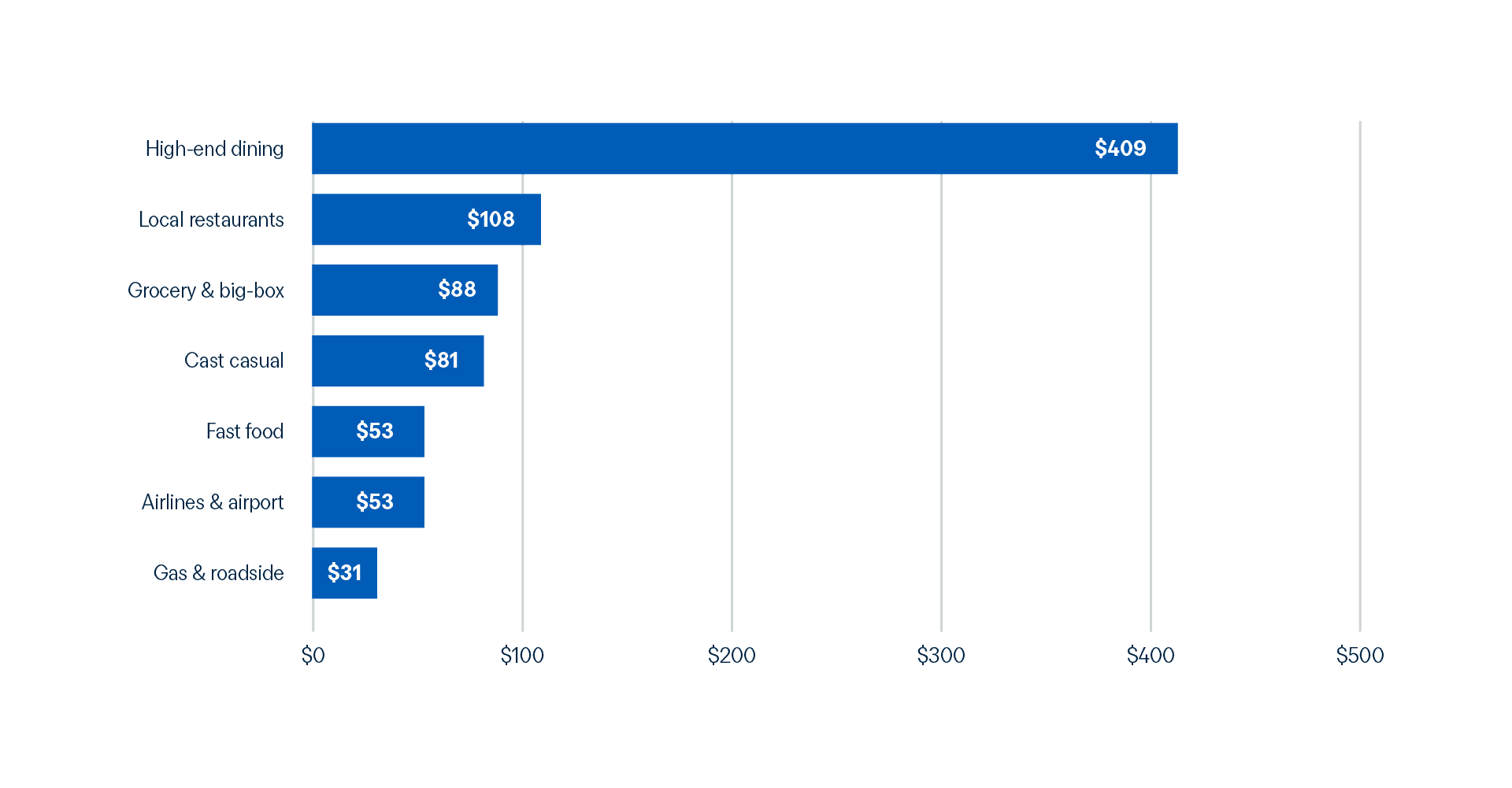

That volume represents less than 0.5% of all meal receipts. Yet with an average ticket of $409 per meal, high-end dining stands apart as one of the most consequential categories in the dataset.

Expense Explained:

High-end dining sits at the intersection of financial oversight and relationship value. These meals are often legitimate business investments, but their higher ticket sizes increase sensitivity around policy, risk, and perception.

That is why upscale dining warrants a different lens than fast food or coffee runs. Simple, one-size-fits-all rules often miss the nuance of:

- Who attended and why

- Which deals, relationships, or initiatives the spend supports

- Where policy should flex and where it should not

When interpreted correctly, high-end dining becomes a signal, rather than an exception, for highlighting moments of strategic engagement, such as client milestones, leadership alignment, talent acquisition, and investor activity.

Systems that distinguish between big-ticket dining and everyday meals are better positioned to apply appropriate context, set clear expectations, and maintain alignment between financial controls and relationship-driven spending. Emburse solutions support this by applying enhanced rule checks, context-aware alerts, and anomaly detection, which bring higher-risk patterns into focus without slowing down legitimate business activity.

Emburse At Work

Powered by Emburse AI, organizations complete expense reports ~50% faster.

Grocery, Gas, & Airport Dining Form the Hidden Edges of Meal Spend

In 2025, employees expensed more than $45M across grocery, gas, and airport vendors combined. These transactions are easy to overlook, but together they reveal how work actually unfolds across hybrid schedules, travel recovery, and frontline operations.

Grocery & Big-Box Retail

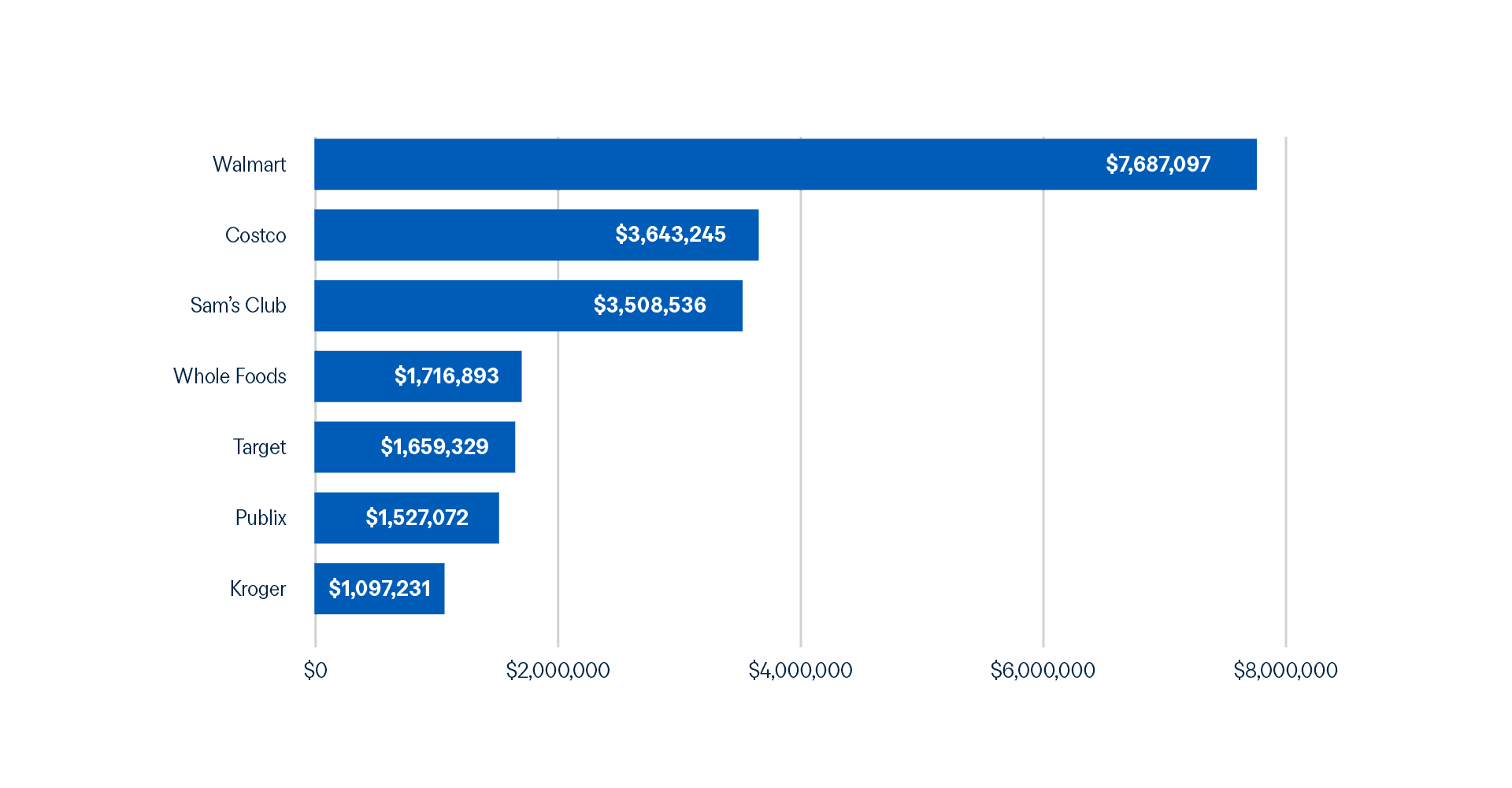

As the largest “edge” category in the dataset, spend concentrates among vendors such as Walmart (~$7.7M), Costco (~$3.6M), and Sam’s Club (~$3.5M), trailed by Whole Foods, Target, Kroger, and Publix. These purchases often fuel team off-sites, office lunches, community events, employee appreciation programs, or field operations. They’re also commonly used to stock shared kitchens in hybrid workplaces, where allocating costs per person is difficult, and receipts lack item-level clarity.

Airlines & Airport Dining

Airport and in-flight meal spend appears across a mix of airline brands, airport retail groups, and terminal-specific food and beverage operators. These meals typically occur during layovers, between connecting flights, or onboard when food is charged separately from airfare. As vendor names are frequently generic or abbreviated, airport dining often arrives with less descriptive merchant data, despite being closely tied to travel timing and itinerary structure.

Gas Stations & Roadside Stops

Gas and roadside vendors represent the smallest spend category and appear most frequently in transit transactions. Meals purchased here tend to be inexpensive, informal, and consumed on the move, reflecting the needs of technicians, drivers, sales representatives, and field service teams. Spend concentrates among national fuel and convenience brands, including ExxonMobil, Shell, Wawa, Love’s, Speedway, Circle K, and Chevron.

Expense Explained:

Not all business meals reflect preference. Some occur because time, location, or logistics leave no alternative. Grocery stores, gas stations, and airport terminals capture these moments, which explains why these categories are highly predictable in behavior yet consistently messy in data.

Sitting at the edges of traditional meal reporting, these transactions say a great deal about how work actually gets done. They highlight:

- The intensity and pattern of travel and field work

- How teams are supported on long days away from home or the office

- Where policy needs to adapt to on-the-ground reality

These signals are difficult to interpret through static rules alone. Edge-case transactions are often inconsistently labeled and bundled with non-meal items, obscuring intent at the individual receipt level. Emburse Expense Intelligence helps finance teams read these categories as patterns rather than anomalies, providing clearer context for forecasting, policy design, and oversight.

Emburse At Work

Emburse Expense Intelligence reduces policy and audit exceptions by ~35%.

Key Takeaways for Finance Teams

A full year of meal data points to a clear conclusion: Knowing how much was spent is no longer enough. Finance teams need visibility, context, and control that starts before a meal is expensed and continues through the reconciliation process.

Here are four action areas these findings can reinforce.

1. Fix the visibility gap with merchant normalization & AI-powered categorization

Large volumes of meal spend still arrive without reliable merchant details. In this dataset alone, “Vendor Not Defined” accounts for $391M across 3.75M transactions, obscuring who actually receives spend and how categories behave.

This level of ambiguity makes it difficult to:

- See which vendors truly drive meal budgets

- Negotiate volume-based agreements with confidence

- Understand how much spend supports travel, culture, or client work

Teams that invest in cleaner merchant data and smarter categorization will gain a clearer picture of vendor relationships and category dynamics over time. That is a foundation for better forecasting, stronger policy decisions, and more effective sourcing conversations.

2. Automate the routine and focus human attention on high-impact spend

Fast food, coffee, and roadside meals create millions of low-value, low-risk transactions each year. Meanwhile, a smaller subset—high-end dining, bulk purchases, and certain platform-driven patterns—carries disproportionate financial and reputational weight.

The data points to a clear operating model:

- High-volume, in-policy meals should move with minimal resistance

- Context-heavy or high-impact spend should receive proportionate scrutiny

Separating rhythm spend from high-impact spend gives finance and T&E teams room to reduce bottlenecks while keeping focus on the receipts that matter most for risk, reputation, and relationships.

3. Treat on-demand platforms and hotels as strategic vendors

On-demand platforms and hotel groups now function as primary distribution channels for meal spend. Together, they account for meaningful concentration:

- $80.5M through on-demand platforms, with Uber Eats as the largest identifiable vendor

- $69.8M in hotel-linked dining, led by Marriott at approximately $23M

This concentration creates leverage when these entities are managed as strategic vendors rather than incidental line items. That includes:

- Bringing platform and hotel data into vendor reviews

- Designing policies that are specific to these channels

- Monitoring usage patterns across regions, roles, and time of day

4. Read meals as a workforce signal, not just a cost line

Meal behavior reflects much more than taste. It shows where teams travel, how often they collaborate in person, and how workdays are shaped by mobility and time pressure across roles. Across this dataset:

- Roadside and airport meals map to time on the road

- Local restaurants reflect office proximity and client interaction

- High-end dining aligns with sales cycles and executive engagement

Finance leaders who treat meal data as a workforce signal can:

- Allocate budgets more accurately by region, role, or business unit

- Tailor per diems and policies to actual behavior

- Separate structural overspend from isolated exceptions

Viewed through this lens, meal data becomes an early indicator of both financial and organizational change.

Regain Control of Your Bottom Line

The meal category is more than a stack of receipts. It is a map of how work gets done.

Every coffee, cart, and client dinner leaves a trace of where teams travel, how often they meet customers, and what it takes to keep people moving. When that map is fragmented, finance teams are left to react after the fact. When it is clear, they can guide spend while decisions are being made.

With a more intelligent approach to meal data, organizations can shift from:

- High-level totals to vendor and category level insight

- Blanket rules to targeted, behavior-aware policies

- After-the-fact clean up to earlier, better-informed decisions

That is the spirit behind Emburse’s approach to Expense Intelligence. The goal is to help organizations move beyond reconciliation and toward real-time financial control that supports both the business and the people doing the work.

If you see your own organization in these findings and want to explore this perspective further, learn more about how Emburse Expense Intelligence can provide you with modern spend control.

Get ready for what’s next

When you're ready to shift from reactive cost tracking to strategic spend control, this is where your Emburse Expense Intelligence journey begins.

Emburse Expense Intelligence transforms reactive expense management into infrastructure for strategic growth. Powered by Emburse AI, it orchestrates corporate spend across travel booking, reimbursements, AP, and payments, embedding dynamic policy controls and predictive insights directly into workflows. This real-time approach empowers organizations to adapt quickly, reduce risk, and guide spend before money leaves the business.

Trusted globally by more than 12 million finance leaders, travel managers, and professionals, Emburse serves over 20,000 organizations in 200 countries—including Global 2000 enterprises, SMBs, public sector agencies, and nonprofits.

By proactively managing and accurately validating spend, Emburse ensures robust financial governance, enhanced compliance, and unsurpassed visibility into spend behaviors - all while dramatically streamlining the process for every employee.

Our Expense Intelligence is more than a feature; it’s a framework for transformation, reshaping the role of finance teams from administrators to strategic drivers of organizational success. To learn more about Emburse, visit www.emburse.com and check out our social channels @emburse