Executive summary

AI has become the budgeting loophole of 2025.

CFOs are being advised to tighten spending, consolidate vendors, and demonstrate ROI—all while accelerating AI adoption to remain competitive. Gartner® notes that while overall IT budgets are stricter, worldwide IT spend is still expected to reach $5.43 trillion in 2025, driven largely by AI-related infrastructure rather than net-new investment 1.

Our proprietary survey of 1,500 finance, IT, and business leaders across the U.S. and U.K. shows how sharply this tension is playing out in today’s organizations.

Three key themes define this shifting software landscape:

1. AI hype has outpaced governance

Cost discipline is rising, yet AI purchases continue to bypass scrutiny. Nearly two-thirds of leaders have been told to cut spend, vendors, or both, yet AI-related tools remain the easiest to approve. In fact, many teams have intentionally labeled a purchase as an “AI initiative” to fast-track sign-off. AI is accelerating spend, but only 25% of organizations have mature AI governance—underscoring the gap between awareness and accountability.

2. Finance is becoming the command center for innovation

As unchecked AI enthusiasm gives way to scrutiny, innovation no longer falls solely in the domains of IT and Procurement. Over two-thirds of leaders say software decisions are now made collaboratively across Finance, IT, and Procurement. Finance increasingly anchors this model: IDC predicts that by 2027, CFOs will lead 65% of AI operations, driven by the need for financial oversight, data governance, and cross-functional alignment 2.

3. Spend intelligence is now a competitive advantage

The organizations pushing ahead are not spending more; they’re evaluating more effectively. Leaders need more than automation hype—they need intelligence. The ability to link spend, usage, risk, and ROI into a single source of truth that guides every renewal, approval, and investment is a gamechanger. When vendor or feature preferences override performance, organizations lose their ability to objectively assess whether a tool is necessary, effective, or aligned with strategy.

A New Mandate for Clarity and Control

The path forward requires a shift from AI enthusiasm towards evidence-led governance. Leaders need structured ways to operationalize how they evaluate AI-enabled software, grounding innovation in accountability and measurable ROI.

This report draws on a proprietary Emburse survey of 1,500 finance and IT leaders in the U.S. and U.K., alongside insights from Gartner and IDC, to assess whether AI-readiness is driving smarter consolidation or unintentionally creating new inefficiencies.

When leaders govern innovation with intelligence, progress is not by chance. It becomes predictable, measurable, and a force multiplier that’s impossible to ignore.

Marne Martin

CEO

Emburse

Methodology

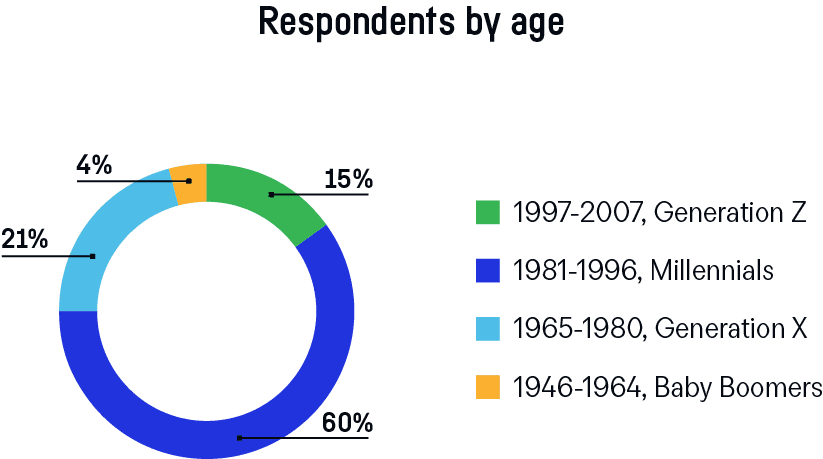

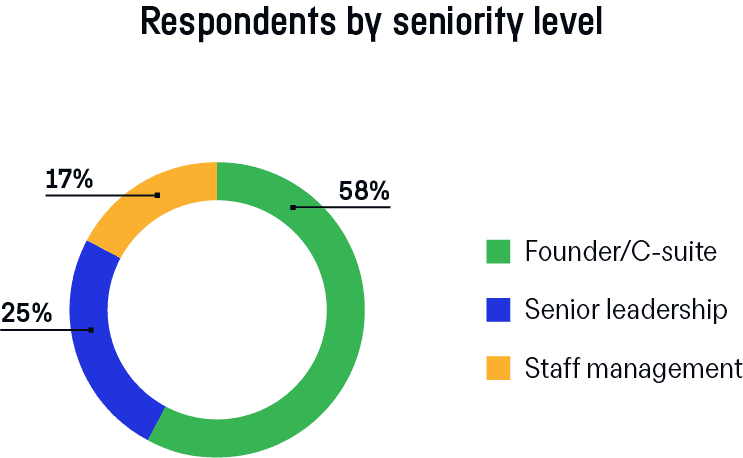

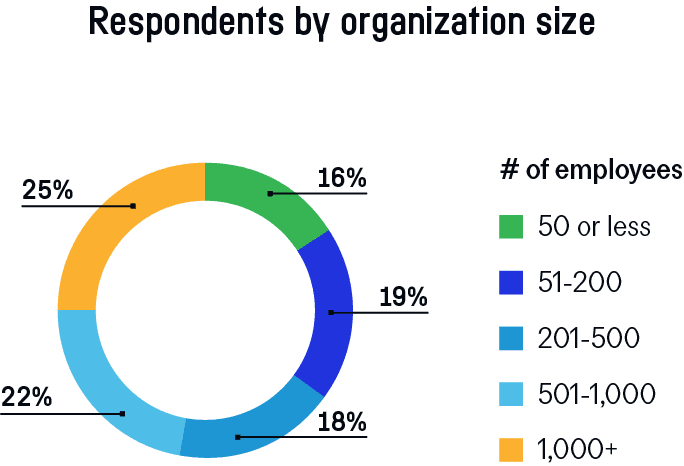

Our findings are based on a quantitative survey of 1,500 corporate decision-makers conducted by Talker Research between September 30 and October 9, 2025.

Respondents included 1,000 U.S. and 500 U.K. professionals across Finance, HR, Sales/Revenue, and IT, with a minimum of 150 respondents per function and company size segment, which ranges from fewer than 50 employees to more than 1,000.

The random, double opt-in survey was carried out under the Market Research Society (MRS) and the European Society for Opinion and Marketing Research (ESOMAR) standards to ensure data integrity and transparency.

The State Of SaaS In 2025: Shrinking Tech Stacks, Rising Expectations

65% of organizations have been told to cut costs or reduce vendors

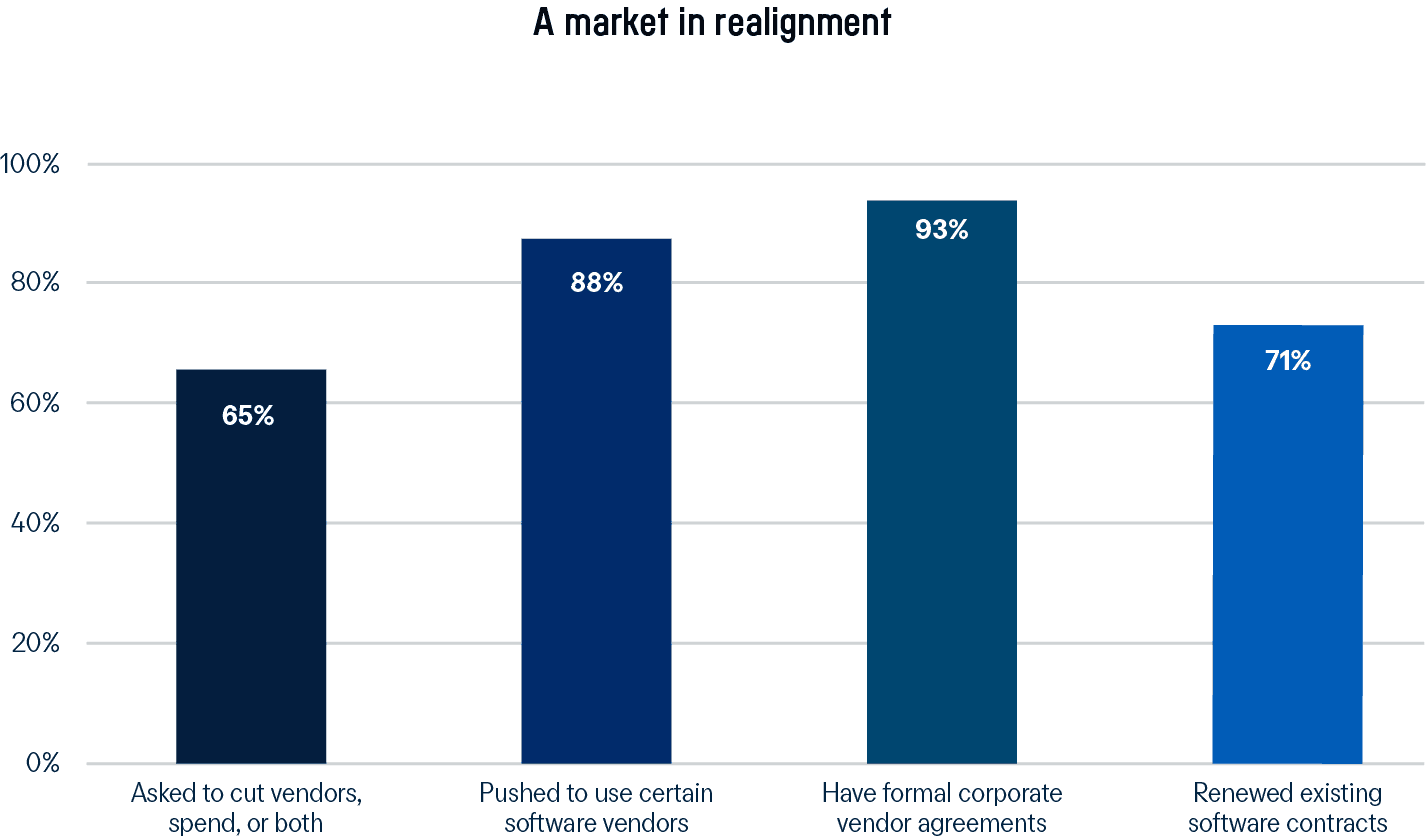

After two years of accelerated growth in AI, 2025 marks a strategic pivot toward financial discipline. Across industries, organizations are pruning tech stacks, renegotiating contracts, and asking deeper questions about real business value—but restraint has yet to translate into a cohesive strategy. Much of today’s consolidation efforts focus on reducing exposure to financial and operational risk rather than improving performance.

Following years of adding new tools to address every workflow, use case, or AI promise, our survey shows that organizations are now prioritizing vendor consolidation, with 65% being told to cut costs or reduce the number of vendors.

Findings from MIT’s “The GenAI Divide: State of AI in Business 2025” show that buyers increasingly favor familiar, “safe” vendors, relying on peer recommendations and existing relationships rather than objective evaluations. Our research data supports this trend: 71% of organizations prefer renewing existing software contracts over adding new ones, 93% have formal corporate vendor agreements, and 88% are encouraged by leadership or IT to use preferred suppliers. In regulated industries, this instinct is even stronger: companies would rather wait for an established partner to release an AI-enhanced version of existing tools rather than consider more capable or cost-effective alternatives.

Familiarity lowers perceived risk, but can also limit progress and innovation. Preferred vendors and corporate contracts often create a governance “comfort zone”, where spend appears compliant but investments are rarely evaluated against usage, performance, or ROI. Consolidation without insight leads to a leaner vendor list, but not necessarily a more effective tech stack.

A real-world case shows why alignment matters as much as selection:

EMBURSE CASE STUDY

Faced with user resistance and misaligned workflows after implementing a new finance software, SPIN, a non-profit healthcare organization, invested in a change management service to customize the system, retrain teams, and refine approvals. Adoption surged, processes improved, and the organization built a more effective solution by optimizing its tech stack.

Because SPIN tracked usage and adoption closely, they quickly saw that the problem wasn’t the software but the rollout. Clear insight prevented an unnecessary cancellation and allowed them to refine the system through targeted change management—an outcome many teams miss when they lack visibility.

This tension between efficiency and insight is the real turning point: the tech stack is smaller, but few teams have a clear view of whether remaining tools actually deliver value. Without that visibility, consolidation becomes risk reduction, not business strategy.

The evolution begins when Finance and IT move beyond enforcing policy to understanding whether software is used, useful, and aligned with business goals. Effective governance requires linking every contract and transaction to performance, policy fit, and ROI—and then operationalizing those insights so they actively shape future decisions.

The AI Trojan Horse: When Innovation Overrides Discipline

The Hidden Costs of AI Spending

Leaders push for consolidation to restore control, but AI has rewritten the rules. In boardrooms everywhere, projects stamped with “AI” are moving through approvals faster than the financial oversight designed to contain them in the first place.

AI has become the fastest path to a “Yes”. More than half of business leaders (58%) say AI-related purchases are easier to approve than any other category of software, and 62% admit to linking at least one software purchase to an AI initiative to secure budget approval.

As AI becomes an assumed marker of innovation, 55% of leaders now consider AI capabilities a key criterion in vendor selection. This accelerates spend decisions without the discipline that typically protects budgets. What begins as an attempt to stay competitive often results in overlapping pilots, unplanned licenses, and the emergence of shadow systems.

Shadow systems are unofficial tools, workflows, or datasets created outside IT’s governance. When an AI tool is purchased quickly but doesn’t fit how teams work, employees turn to their own AI assistants, browser extensions, and free-tier apps to fill the gaps. These tools operate outside standard approval and security processes, storing data in locations that neither Finance nor IT monitors.

EMBURSE CASE STUDY

BELFOR, a worldwide leader in property restoration and disaster recovery, found that its previous expense management solution was difficult to navigate and lacked user-friendly mobile features.

This led the organization’s finance team to adapt workarounds outside the system. Despite having three dedicated accountants, expenses could take up to three weeks to be reimbursed. With Emburse, they now achieve 67% faster reimbursements.

At the same time, AI-branded purchases rarely address end-to-end needs, fueling software sprawl. This is when a tool is approved for its AI features, only to have teams discover that it lacks core functionality— so they add another system. Both end up partially used, each carrying its own configuration, data standards, permissions, and integration maintenance. Having multiple platforms also results in duplicate work, which wastes both time and resources.

As these patterns persist, oversight becomes increasingly challenging. No single team has a complete view of which tools are active, where data resides, or how their combined footprint impacts budgets. The organization then invests in more software while gaining less operational coherence, eroding the very efficiency that AI is intended to deliver.

IDC expects organizations to address this AI governance gap at scale, predicting that “by 2028, 100% of Global 100 and 50% of Global 1000 will spend at least $2 million a year on unified AI governance software that includes security, ethics, and privacy, as a requirement for innovation 3.” AI promises massive transformation, but few today can prove it. Findings from Boston Consulting Group’s 2025 Center for CFO Excellence survey showed that the median reported ROI for AI/GenAI in finance is just 10%, with nearly one-third of finance leaders seeing limited or no gain.

Taken together, these findings suggest that AI hype is reshaping budgets more rapidly than it improves outcomes. To break the cycle, finance leaders must shift their focus from “What’s AI-enabled?” to “What’s value-enabled?”

The real risk isn’t overspending on AI; it’s mistaking activity for impact. Finance has to be the value filter that transforms noise into strategy.

Owen Newman

Chief Financial Officer

Emburse

The New Decision-Making Power Center

Finance, IT, and Procurement: The Emerging Command Center for Spend Intelligence

Budget pressure and accelerated AI adoption have exposed the limits of siloed spend decisions. Effective governance now demands shared visibility, shared data, and shared accountability across Finance, IT, and Procurement.

More than three-quarters of organizations (77%) say purchase decisions are now jointly made by senior leaders across Finance, IT, and Procurement. Leading organizations approach these three functions as a single command center, replacing sequential approvals with collaborative alignment.

Each potential investment is assessed through a shared lens that considers financial impact, security requirements, workflow relevance, and long-term scalability. This framework shift is essential as AI tools intersect with data, architecture, compliance, and operational processes in ways no single function can govern alone.

The change is also redefining the role of Finance. The center of gravity for spending has moved from passive approval to active architecture. CFOs are shaping where innovation should occur, how it scales, and which investments deliver measurable impact. IDC expects this evolution to accelerate, predicting that “by 2027, digital transformation, regulatory shifts, risk, globalization, and talent gaps will drive 80% of CFOs to become strategy architects, integrating finance, tech, tax, and HR 2.

We’re seeing finance leaders move from reacting to spend, to architecting it.

Consolidation is no longer about cost; it’s about control, data fluency, and enabling AI to work across a cleaner, unified tech stack.

Kevin Permenter

Senior Director, Enterprise Applications

IDC

The emerging command center of Finance, IT, and Procurement enables organizations to create coherence in their technology strategy and ensure that innovation delivers measurable outcomes. However, collaboration does not eliminate friction. Leaders still face barriers to faster decision-making, including different vendor preferences (24%), conflicting priorities (23%), and disagreements over budget allocation (15%).

Even more worrying is that more than a third (36%) of leaders have chosen not to grow their AI stack due to alignment challenges on which AI tools to adopt. This puts organizations at risk of falling behind and missing the full transformational benefits that AI can deliver across the business.

These pressures make one point clear: cross-functional decision-making can only scale when every stakeholder uses the same criteria to assess risk, value, and strategic fit. Frameworks, such as the SaaS Survivability Scorecard presented in this report, provide teams with a common foundation, ensuring that technology investments support the organization’s long-term financial, operational, and security goals.

Cross-functional spend governance is the new power center. It’s where speed, clarity, and accountability can finally work in the same direction.

Michele Shepard

Chief Revenue Officer

Emburse

The Criteria That Matter Now: From AI-First to ROI-First: How Finance Leaders Redefine Value

In a market where every vendor claims to be “AI-powered,” leaders are shifting from what looks innovative to what delivers measurable value.

Despite the range of tools available, our survey data shows that organizations apply a consistent decision model across software renewals, purchases, and cancellations.

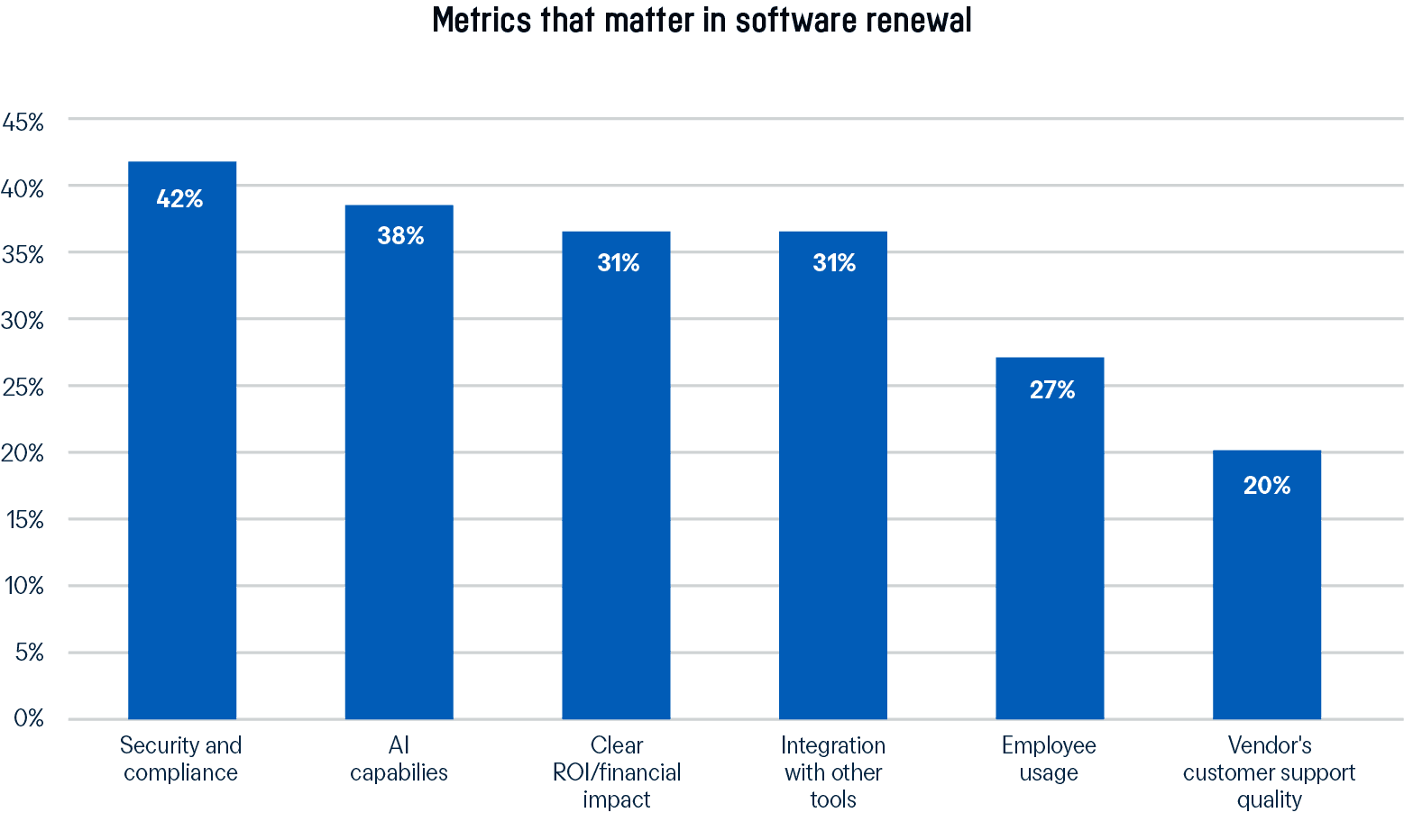

For renewal decisions, leaders prioritize security and compliance (42%), followed by AI capabilities (38%), clear ROI (31%), and integration with existing tools (31%).

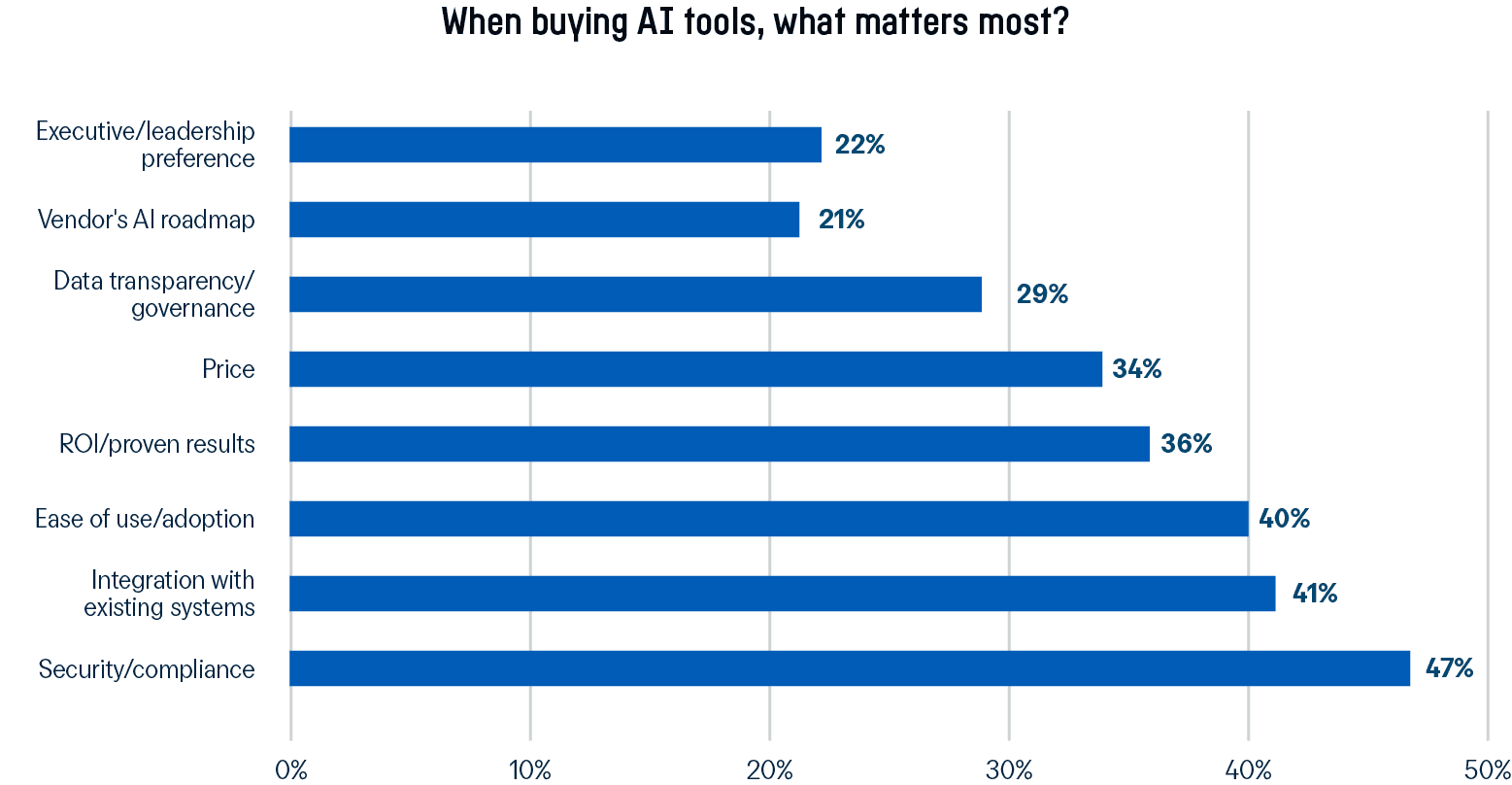

The same priorities shape new AI purchases. Security and compliance (47%) again top the list, followed closely by integration (41%) and ease of adoption (40%).

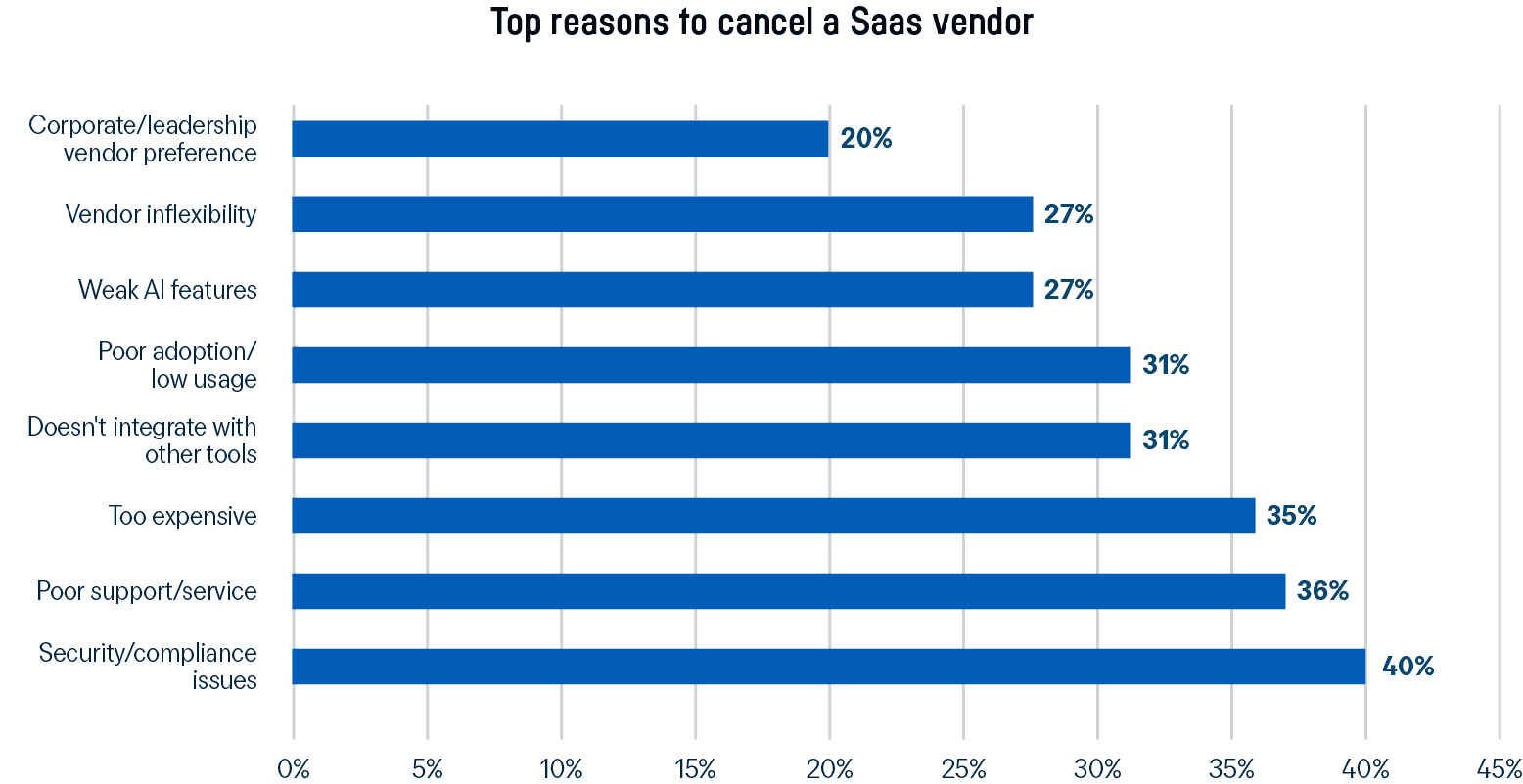

Cancellation data mirrors these patterns: security or compliance gaps (40%), poor integration (31%), weak AI features (27%), and low usage (31%) are the most common reasons vendors are replaced.

Across all three stages, four criteria now define value in the AI era:

Security and Compliance

Security is the first value filter through which every tool must pass. AI tools handle sensitive data that often connect with ERP, HRIS, travel, and payment systems. Any uncertainty around data processing, access controls, or regulatory alignment outweighs even the strongest features and compromises the integrity of your broader stack.

Integration

Disconnected tools lead to manual reconciliation, inconsistent reporting, and duplicate spending. As AI touches more cross-functional workflows, integration determines whether insights can be used across Finance, IT, and Procurement.

EMBURSE CASE STUDY

Dealer Tire, a leading national distributor of tires and automotive parts, eliminated lost invoices, manual reconciliations, and inconsistent approvals by selecting Emburse software that integrated with its ERP, HR, and card systems.

The result: 40 hours saved per month, 100% approval compliance, and real-time visibility for every employee.

Ease of Adoption

AI features alone cannot compensate for tools that don’t fit day-to-day workflows. When adoption falters, employees resort to their own workarounds, creating inconsistent shadow systems and unmanaged data paths. Usage is the true test of whether an AI investment becomes operational or remains a stalled initiative.

EMBURSE CASE STUDY

Employees at Elevance Health, a national health insurer, bypassed their corporate T&E system in favor of more intuitive consumer travel booking sites, creating compliance and visibility issues.

Switching to Emburse’s intuitive, mobile-first platform dramatically improved adoption, restored policy adherence, and delivered clearer spend insights.

Clear ROI

AI capabilities matter, but only when paired with evidence that they deliver results. With increasing pressure to justify spend, leaders should prioritize tools that

demonstrate measurable outcomes—time saved, risk reduced, accuracy improved, or compliance strengthened.

This ROI-first, evidence-based mindset means organizations can no longer rely on legacy purchasing habits such as familiarity, preference, or feature-led decisions. Once decisions are based on comparable, structured criteria, the next step is to automate the procurement workflow itself.

IDC projects that “by 2028, 70% of enterprise application buyers will use AI agents to optimize pricing and contracting, resulting in greater market share for vendors with AI-readable pricing 4.” This shift indicates that intelligence will influence not only what organizations purchase, but also how they make their purchases. As organizations strengthen their evaluation discipline, they become better positioned to adopt procurement models that use AI agents to analyze pricing, contract terms, and value alignment at scale.

In this environment, competitive advantage will depend on having the systems and governance to compare tools objectively, measure outcomes consistently, and feed those insights into increasingly automated workflows.

‘AI-powered’ is meaningless without measurable impact. Technology earns trust when it is securely integrated and can prove real ROI for the organization.

Kevin Permenter

Senior Director, Enterprise Applications

IDC

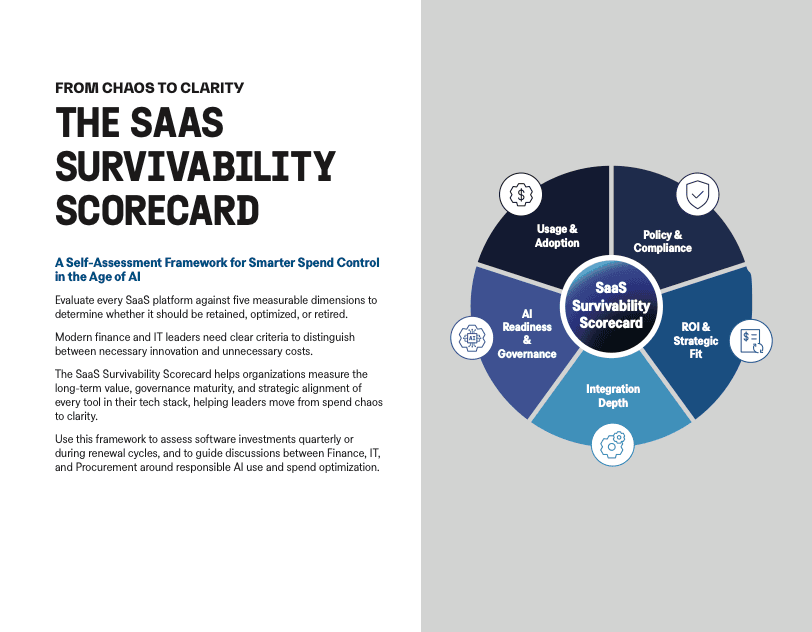

The SaaS Survivability Scorecard: A Self-Assessment Framework for Smarter Spend Control in the Age of AI

As AI reshapes buying behaviors, software renewals, and vendor strategies, leaders need a consistent, data-driven approach to determine what stays, what scales, and what should be retired. The SaaS Survivability Scorecard offers a clear, objective way to evaluate whether a software tool deserves to be in your tech stack.

In a landscape where AI hype can easily overshadow business performance, the SaaS Survivability Scorecard enables Finance, IT, and Procurement to work from a shared evaluation model rooted in clear, measurable outcomes.

The Scorecard distills the criteria surfaced throughout this report into five dimensions that reflect how value is evaluated across an organization:

Usage & Adoption Rate

Examining how often employees log into a software application, which features are being utilized, and the percentage of active licensed users will reveal whether the software is widely adopted. Low usage often reveals a poor fit, redundancy, or a lack of clear business purpose. This mirrors a core principle of any software deployment: teams must understand why a tool exists and how it improves their work. When the purpose is clear—saving time, improving accuracy, enabling higher-value analysis—user engagement rises.

Integration Depth

Effective software adoption only occurs when tools seamlessly connect with existing systems, data flows, and processes. Integration depth reflects not just technical fit, but the tool’s capacity to support intentional, scalable AI-driven workflows. Before investing in a new platform, find out how well it integrates with Finance, IT, and HR systems, how data syncs across workflows, and whether the tool streamlines processes or creates additional manual workarounds.

AI Readiness & Governance

Leaders have admitted to using the AI label to expedite approvals without demonstrating its value. This dimension addresses the problem by evaluating whether AI features are auditable, secure, transparent, and aligned to risk, ethics, and policy. Governance then ensures that AI augments the organization, rather than introducing hidden risks, aligning directly with the need for responsible automation and continuous output validation.

Policy Alignment & Compliance Maturity

Tools that automate compliance —rather than manual processes—reduce operational burden, improve audit-readiness, and limit financial and reputational risk. Assessing the tool’s security certifications, regulatory compliance, and policy fit will help determine whether the organization is ahead of compliance demands.

ROI & Strategic Fit

A tool that cannot demonstrate financial impact is not sustainable in a tech stack under cost pressure. Strategic fit helps leaders determine whether software should be scaled, replaced, or retired to ensure that every investment continuously advances strategic business outcomes. A tool that once served a purpose may become misaligned as business needs evolve. The cost-to-value ratio, renewal ROI, and strategic alignment are key indicators of whether a tool demonstrates financial impact and how well it aligns with the company’s strategic direction.

SaaS Survivability Scorecard

Use this framework to assess software investments quarterly or during vendor renewal cycles, and to guide

discussions between Finance, IT, and Procurement around responsible AI use and spend optimization.

The Road Ahead: How Finance Will Lead the Next Era of Technology Decisions

The shift toward evidence-based evaluation marks a deeper transformation in how Finance—and the enterprise more broadly—will operate in the years ahead. The next decade won’t be defined by how much companies spend but by how intelligently they spend it.

The future belongs to leaders who orchestrate spend as organizational strategy. When every dollar moves with clarity and precision, AI stops being hype—and becomes a real competitive advantage.

Marne Martin

CEO

Emburse

As organizations mature their approach to AI-enabled technology, the center of gravity in decision-making will continue to move toward Finance. What began as better governance will evolve into a more strategic model, one where Finance orchestrates data, validates outcomes, and sets the conditions under which innovation succeeds.

The first shift is architectural. Simplifying tech stacks and tightening governance have revealed a deeper need for a unified financial core. IDC anticipates that by 2030, ERP systems will function less as workflow engines and more as Finance’s data warehouse and system of record, with specialized financial platforms carrying out up to 80% of the work historically performed by the CFO’s office 2. The future points toward a reliable financial backbone supported by flexible, purpose-built platforms that deliver analytics, controls, and intelligence with far greater precision.

Moreover, as evaluation becomes more structured and outcome-led, traditional measures of success will give way to outcomes that can be quantified over time. IDC predicts this change will reshape the definition of value itself, as “outcome-based pricing ties vendor compensation directly to customer success, strengthening loyalty and differentiation 5.” In this scenario, Finance becomes responsible not only for authorizing investments but also for verifying that they deliver a measurable impact.

Operationally, decision-making will become more integrated and dynamic. Finance, IT, and Procurement will increasingly rely on real-time signals—consumption-based usage, performance, cost patterns, workflow fit—to guide decisions as they happen. Automation will continue to expand, but the real differentiator will be the intelligence layer underpinning it: AI-driven systems that connect spend, usage, and performance into a continuous cycle of evaluation, capable of influencing decisions in real-time.

For CFOs, these developments expand the remit of financial leadership. Finance moves from monitoring spend to architecting value, shaping how investments scale and what they deliver. In the decade ahead, the most effective finance teams will be those that combine unified data, clearer evaluation criteria, and real-time intelligence into a coherent model for decision-making.

From Hype to Control: Priorities for Smarter Spending

The findings point to a decisive next step: leaders must move from observing the AI spending paradox to proactively managing it. The next phase requires stronger governance, clearer value criteria, and shared frameworks that turn spend signals into action.

After years of unchecked expansion and AI hype, business leaders now have both the data and the imperative to make spending smarter—more measurable, disciplined, and sustainable.

Here are three priorities that help organizations transition from reactive oversight to intelligent control:

1. Turn fragmented oversight into unified visibility

Disconnected data limits insight. Integrating expense, travel, card, and vendor data creates the foundation for true spend control across the organization.

Next steps:

- Integrate all spend data into a single intelligence platform.

- Establish a cross-functional Finance–IT–Procurement governance council to oversee the organization’s technology stack.

- Standardize dashboards that link compliance, cost, and utilization metrics.

- Replace static audits with continuous monitoring and real-time alerts to catch issues before they escalate.

EMBURSE CASE STUDY

Processing 80,000 expense reports annually across 13 disparate systems left Jotun, a leading manufacturing MNC, without global spend visibility. Consolidating expense data onto a single platform standardized policy enforcement and created real-time transparency for the MNC’s finance team and approvers.

Within the first year, the firm achieved ROI and significantly reduced out-of- policy and duplicate expenses.

2. Focus on measuring ROI instead of chasing innovation

Innovation without accountability creates confusion and noise. Every initiative must prove its impact and success through measurable results.

Next steps:

- Require ROI projections and time-to-value milestones before approving new investments.

- Conduct quarterly value-realization reviews to assess adoption, usage, and cost savings.

- Link AI or technology funding renewals to verified business outcomes, rather than proofs of concept.

- Embed ROI accountability directly into leadership and departmental KPIs to reinforce measurable performance.

EMBURSE CASE STUDY

International Services, Inc., a national HR consulting firm, already had an expense

system in place, but due to limited reporting depth and manual analysis, they couldn’t quantify the value of their T&E.

Implementing advanced analytics revealed hidden spend leakage, recovered over $500K, and tripled the speed of expense reporting. Once they could measure value, the platform became a strategic asset. Using the data, the firm plans to negotiate better vendor terms and foster a more responsible spending culture among employees.

3. Shift from AI Hype to AI Governance

Responsible automation is the next leading competitive advantage. Clear governance ensures AI enhances control, transparency, and compliance rather than complicating it.

Next steps:

- Define formal approval criteria for AI-related purchases that include risk, security, and ROI thresholds.

- Apply frameworks such as the SaaS Survivability Scorecard to evaluate AI tools for transparency, ethics, and operational performance.

- Map all AI deployments to corporate risk management and data governance frameworks to ensure alignment and compliance.

- Recognize and reward teams that deliver positive outcomes through responsible, compliant AI use.

EMBURSE CASE STUDY

Seeking a more efficient and user-friendly alternative to its manual expense reporting system, Allianz Partners, a global leader in consumer specialty insurance, evaluated several expense management providers by systematically scoring them on 10 key criteria, including cost, reporting capabilities, mobility, and customer support.

Emburse was the highest- scoring expense management solution and reduced expense report processing time by 90%, improved compliance, and enhanced the user experience for both approvers and travelers.

1

Gartner Press Release, Gartner Forecasts Worldwide IT Spending to Grow 7.9% in 2025, July 15, 2025, https://www.gartner.com/en/newsroom/press-releases/2025-07-15-gartner forecasts-worldwide-it-spending-to-grow-7-point-9-percent-in-2025. GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

2

IDC, IDC FutureScape: Worldwide CFO Tech Agenda 2026 Predictions, #US53859125, October 2025, https://my.idc.com/getdoc.jsp?containerId=US53859125

3

IDC, IDC FutureScape: Worldwide AI and Automation 2026 Predictions, #US5385812, October 2025, https://my.idc.com/getdoc.jsp?containerId=US53858125

4

IDC, IDC FutureScape: Worldwide AI-Enabled Enterprise Applications and Agents 2026 Predictions, #US53855925, October 2025, https://my.idc.com/getdoc.

jsp?containerId=US53855925

Lead with Intelligence: Turn AI Insight Into Intelligent Spend with Emburse

Clearer Decisions. Smarter Spend. Unified Intelligence.

The AI spending paradox is becoming a defining challenge for modern finance teams. Familiar vendors and surface-level innovation aren’t enough to guide technology decisions anymore. Value now depends on knowing what your tools are doing, how they perform, and whether they move the needle on financial outcomes.

Finance is stepping into the center of these decisions, responsible not just for monitoring spend, but for ensuring that every investment delivers ROI. To lead effectively, teams need systems that reduce complexity and orchestrate data from across the business into a single, reliable view of spend.

Emburse Expense Intelligence brings together the data, insight, and governance capabilities that modern finance teams rely on to drive measurable impact:

• Unified visibility across expense, travel, card, vendor, and AP with real-time, bidirectional data sync

• Predictive insights into spend, usage, and compliance trends for identifying savings to keep budgets in check

• Embedded controls that apply your policies in real-time, protecting spend integrity and strengthening organizational trust

• Continuous monitoring and early alerts to surface anomalies before they become cost or risk exposures

If your organization is preparing for more intelligence-led financial operations, explore what becomes possible when your spend data, systems, and decisions finally work in sync.