IRS rules for expense reporting

The IRS has laid out rules for what qualifies as a business expense, what constitutes a complete record, how to keep records, and what can be deducted on your taxes. You can reference the IRS Publication 535 to get started, but, due to the volume of information, we recommend consulting with a certified accounting and finance professional.

According to IRS Publication 535, a deductible expense is a business expense that is both ordinary and necessary.

These are defined as:

- Ordinary:

a common and accepted expense in your industry - Necessary:

a helpful and appropriate expense for your trade or business

Reimbursing employees is discretional; however, the benefit to reimbursing employees is that you can generally deduct all or a part of the expense if it is reimbursed to the employee.

General business expense rules

Some of the most important IRS rules for employee expenses to take note of are:

Expenses over $75 should always have a receipt.

Never reimburse an employee for a ticket, summons, or other expense incurred as a result of illegal activity.

Employees need to provide contextual information about the expense, such as amount, date, merchant, and what it was for to be considered a complete record.

Expenses should be submitted within 60 days of the expense being incurred.

Deducting mileage expenses

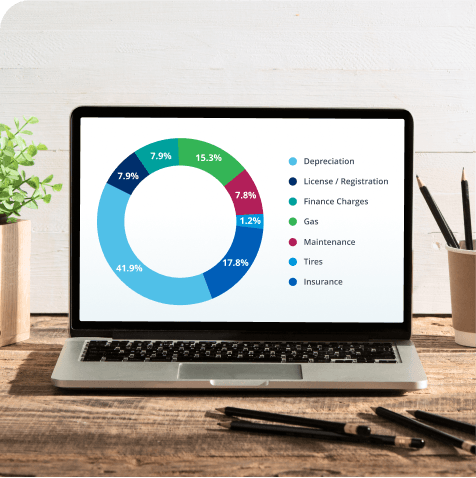

The standard IRS mileage rate is calculated based on the average cost of owning and operating a vehicle compared to the average number of miles driven, and is recalculated each year. Best practice is to use the IRS standard mileage rate for auto expense reimbursement, since the cost of gas, repairs and insurance has already been taken into account. However, the company should still reimburse employees for tolls and parking. If you decide to use an amount other than the IRS standard rate, know that there may be tax deduction consequences or penalties. It’s best to consult a tax professional before implementing a different reimbursement rate.

While the IRS does not share its exact calculations, AAA completes annual research and surveys to estimate the cost per mile of owning and operating a vehicle. Using those numbers, you can assume the breakdown of the mileage rate calculation probably looks something like the picture featured here.

Creating your expense policy

Emburse Spend helps customers of all sizes evolve their manual workflows into efficient, reliable, data-rich processes. You’ll be supported every step of the way with personal care.

What to include in your policy

Your policy should clearly outline rules, policies, and expectations. However, you should also highlight the intent of your policy; whether it’s to always ask questions before expensing or to spend as little as possible, the intent will help set the overall tone.

Rules and requirements

Include limits for categories, per diems, and receipt requirements. Clearly list what can and cannot be submitted, especially for common expenses and categories. Be explicit about any timeframes for submitting an expense, as well as anything else that may be specific to the company.

Exceptions and discretionary circumstances

Cover rules for tips and gratuities, and what to do if they need to do something that falls outside of the policy.

Expectations for submissions and reimbursements

Set expectations for how expenses should be submitted (whether you use expense management software or a specific form) and when and how employees should expect reimbursements.

Processes to follow

Outline the process for submitting expenses, whether directly to finance or to a manager. Also, if they still have questions, how and whom to ask.

Keep your policy clear

Be sure to use language in your policy and expense management process that anyone can understand. Specifically, use easy-to-interpret categories that maps to your chart of accounts, especially if you use accounting jargon or naming conventions. Making them easy for someone outside of finance to understand will result in less “guesswork” on behalf of the employee.

Expense per diems

If you decide to use per diems in your expense policy, there is a full breakdown by state on per diems for federal employees.

There are pros and cons to per diems versus actual expenses that you should take into consideration when developing your policy. Per diems can help set expectations around spending and encourage taking cost into consideration during the buying process. However, per diems can also become unrealistic depending on location and may require constant exceptions to the rule.

Make your expense policy accessible

Use an internal website or an expense management tool to make sure that everyone has quick and easy access to the policy. It will improve policy compliance if employees can access the policy before or as they are incurring an expense. Make sure that employees also have easy access to any software or forms necessary to submit expenses.

The more specific your rules are, the less confusion there will be. However, the more rules you have to follow, the more complicated it will be for the employee, increasing the risk of error. It should be a balance of what is most important to note and what should be held in the intent of the policy.

Reimbursable expenses over $X should always have a receipt.

Client meals should not exceed $X.

Any expense must have a note.

Billable expenses should have a client associated with them.

Expenses must be submitted within 60 days of the transaction date.

All expenses should have a category.

Reimbursable expenses do not include: mini-bar, spa usage, in-room entertainment, and other hotel amenities.

Managing expenses

How you manage employee expenses can have a big impact on your financial reporting, taxes, and the bottom line. Make sure that you are keeping proper records, the data is complete, and that it is within your policy and IRS rules.

How to keep expense records

A collection of properly kept records will be one of your biggest allies in the event of an audit. Be proactive — do not wait until the IRS comes calling to find out how you should be keeping records. Consult with an accountant on the front-end to determine how your expense records should be documented and archived. Ideally, you would look for an accountant or accounting firm that has experience working with your type of business or industry.The IRS only requires you keep your records for three years if you’ve been correctly filing your taxes. However, it is best practice to keep your records for seven years in case there is an issue of which you are unaware. If you keep your records electronically, be sure to have a duplicate copy in a separate place, whether in hard copy or a separate, secure electronic location. If you use an expense management system to store your records, be sure that you will have unhindered access to them for the seven years and that they have a backup of all of your records.Also make sure that your records are properly secured from theft, accidents, and human error, whether in hard or electronic copy.The IRS record keeping schedule is as follows:

Keep records for a minimum of three years.

Keep records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return.

Keep records for seven years if you file a claim for a loss from worthless securities or bad debt deduction.

Keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.

Keep records indefinitely if you do not file a return.

Keep records indefinitely if you file a fraudulent return.

Keep employment tax records for at least four years after the date that the tax becomes due or is paid, whichever is later.

There is no period of limitations to assess tax when a return is fraudulent or when no return is filed. If income that you should have reported is not reported, and it is more than 25% of the gross income shown on the return, the time to assess is six years from when the return is filed. If you have employees, you must keep all your employment tax records for at least four years after the tax becomes due or is paid, whichever is later.

Routing expenses review

As your organization grows, it becomes more important to have additional layers of approval. Expense context is key to ultimately understanding whether or not something is within policy, and the larger an organization becomes, the farther removed a single person is from understanding all context. Consider routing expenses through department or team managers for the first level of approval before being sent to finance.

Enforcing your expense policy

Accounting staff will need to be diligent to make sure employees are following the established policy, which includes correctly allocating expenses. At month-end, expenses should be reviewed to ensure proper coding of items such as meals (sales vs. travel-related vs. meals for employees and local dining), corresponding receipt inclusion (based on your minimum amount requirement), and that all other required information is properly logged. You can automate many of these steps by implementing expense tracking software.

You will also need to decide what consequences there are to violating your policy, whether it’s simply denying expenses or if there are first-time violations (perhaps for honest mistakes on overspending) that you let through. This will be completely discretionary, but getting buy-in from any approving manager will ensure that the company does not send mixed messages.

Managing corporate card expense

If your company has decided to use a corporate card program, be sure to set specific rules for card holders. Also, be sure that card holders understand the responsibility. Often times, employees feel that corporate cards are a main-line to the company bank account and that they don’t need to keep receipts or expense their transactions. The IRS has the same rules in place for corporate card expenses as they do for reimbursable expenses.However, you may decide that reimbursable expenses over $25 require a receipt, whereas expenses on a corporate card may use the IRS rule of expenses over $75 requiring a receipt. If you have different rules for corporate card holders than you do for reimbursable expenses, consider writing two separate expense policies and distributing only the applicable one to an employee.

Reporting on business spend

Most companies don’t utilize their employee expense data to create regular reports, often because this data is siloed inside of expense reports and bucketed under arbitrary submission dates or report names that often don’t have a lot to do with the actual expenses inside.

However, if you decide to use a real-time expense reporting system, you will be able to dig into your expense data to find some great insights that can help inform business decisions.

Real-time expense reporting

There are limitless reporting options that can be customized to your business by creating specific expense tags to track the information your company finds most important.

Real-time cash flow monitoring

Monitor spend on demand.

Spending trends for categories, vendors, and other tagged expenses

Optimize your spending by reviewing trends and identifying opportunities for savings against a number of data points.

Return on investment reporting

Get detailed spend by client, event, or project to understand the investment versus the company benefit.

Get started with Emburse Spend

If Emburse Spend sounds like the right solution for your company, schedule a personalized demo today.