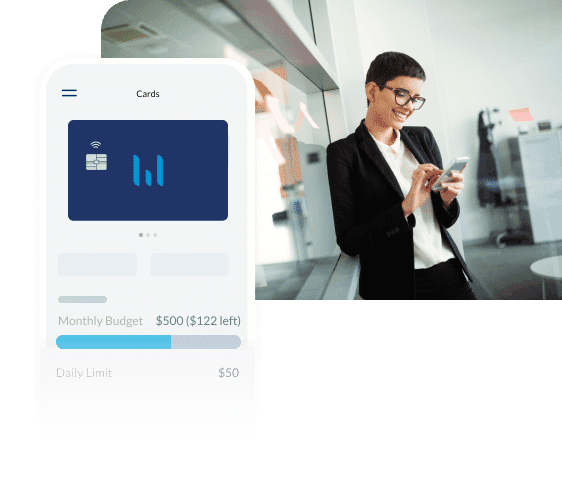

Virtual Emburse Cards

Streamline payments and increase your ROI

Issue virtual Emburse Cards to gain real-time, end-to-end control over employee expenses and vendor payments from the point of sale through reconciliation.

Turn purchasing into a strategic asset

Turn payments into potential

Switching to virtual card payments streamlines purchasing and offers incredible savings through cash-back rebates.

Easily pay suppliers

Flexible electronic payments, such as virtual cards, provide a fast, secure way to pay invoices, all while syncing with your accounting system.

Be confident in your decisions

Accurate, real-time information helps you make more confident decisions when approving expenses or analyzing company spending, budgets, and return on investment.

We are here to help

Your account team can provide a free vendor analysis and walk you through the vendor payments process.

Benefits

Make decisions based on real-time data insights

Gain better control over company spending

Manage vendor payments effectively. Simplify expense processes and ensure expenses are in-policy compliance.

Manage vendor payments effortlessly

Create a dedicated card for each vendor, set monthly spending limits, and ensure timely payments.

Real-time visibility into transactions

Gain instant visibility into every transaction, enabling you to track real-time spending.

Reduce the amount of waste and fraud

Minimize risk to your business by creating an unique card for each vendor and avoid overcharges.

Drive Efficiency and Security

Enhance your payment experience with virtual card and vendor payments

Safeguard your company's finances and prevent fraudulent activities.

Virtual cards provide secure transactions with spending limits, specific vendors, and transaction timeframes.

Simplify cash flow management and cut down on paper checks and errors.

Gain real-time tracking and reconciliation and use data insights for confident decision-making.

Virtual cards plus vendor payments

A streamlined resolution to the complex payments landscape

Seamlessly reconcile your card payments while simultaneously accruing a rebate that can be effortlessly allocated towards your account.

Features

Features designed to make vendor payments easier

A better payments experience

Boost your bottom line and streamline payables processing ensuring a hassle-free experience.

Save time on manual processes

Free up valuable time for your team instead of spending hours on manual data processing.

Real-time spend visibility

Stay informed and monitor your costs in real-time visibility including virtual card payments status by vendor.

Control vendor charges

Create vendor-specific virtual cards with unique limits, giving you greater control over your expenses.

Real-time data for strategic insights

Spend is visible the moment a card is swiped, allowing for real time budget visibility and adjustments.

Leverage insights to further analyze card spend by user, category, project, client, and more.

Meet with my account team

Your Emburse team can easily discuss your ROI potential and provide a free vendor analysis. They will let you know if vendor payments are a good option for your team.